3 Top Dividend Stocks In India With Yields Up To 3.6%

The Indian stock market has shown robust performance, rising 2.7% in the last week and an impressive 44% over the past 12 months, with earnings expected to grow by 16% annually. In this buoyant environment, dividend stocks can be particularly appealing for investors looking for steady income combined with potential capital appreciation.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Balmer Lawrie Investments (BSE:532485) | 4.27% | ★★★★★★ |

Bhansali Engineering Polymers (BSE:500052) | 4.15% | ★★★★★★ |

D. B (NSEI:DBCORP) | 4.24% | ★★★★★☆ |

Castrol India (BSE:500870) | 3.71% | ★★★★★☆ |

ITC (NSEI:ITC) | 3.15% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.66% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 8.47% | ★★★★★☆ |

PTC India (NSEI:PTC) | 3.83% | ★★★★★☆ |

VST Industries (BSE:509966) | 3.46% | ★★★★★☆ |

Redington (NSEI:REDINGTON) | 3.31% | ★★★★★☆ |

Click here to see the full list of 19 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

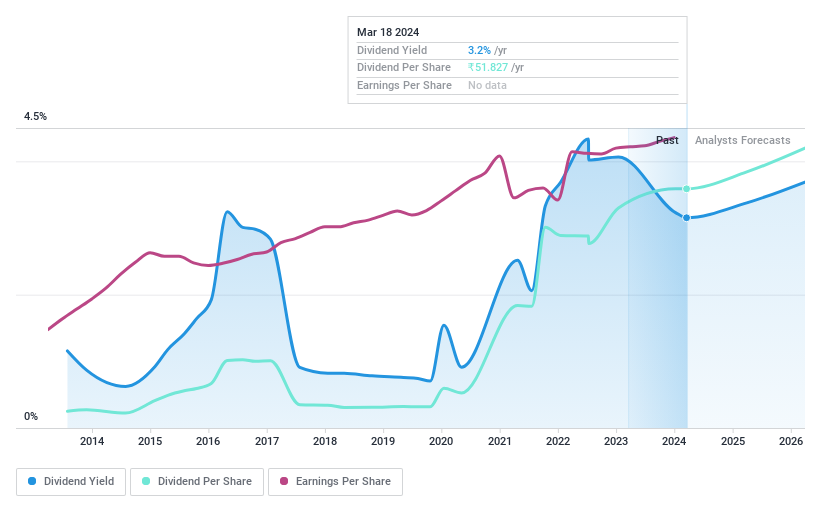

HCL Technologies

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HCL Technologies Limited, a global company, provides software development, business process outsourcing, and infrastructure management services with a market cap of approximately ₹3.88 trillion.

Operations: HCL Technologies generates revenue primarily through three segments: HCL Software at $1.41 billion, IT and Business Services at $9.80 billion, and Engineering and R&D Services at $2.12 billion.

Dividend Yield: 3.7%

HCL Technologies, a significant player in the IT services industry, declared an interim dividend of INR 18 per share for FY 2024-2025. This announcement followed a year where HCLTech reported a revenue increase to US$13.27 billion and net income growth to US$1.90 billion. Despite these positive figures, the company's dividend history has been marked by volatility over the last decade, raising questions about the reliability of its dividends despite reasonable coverage by earnings and cash flows (payout ratio at 89.1% and cash payout ratio at 65.1%). Additionally, HCLTech's recent integration with Google Cloud's Gemini models signals robust strategic positioning but does not directly influence immediate dividend stability or growth prospects.

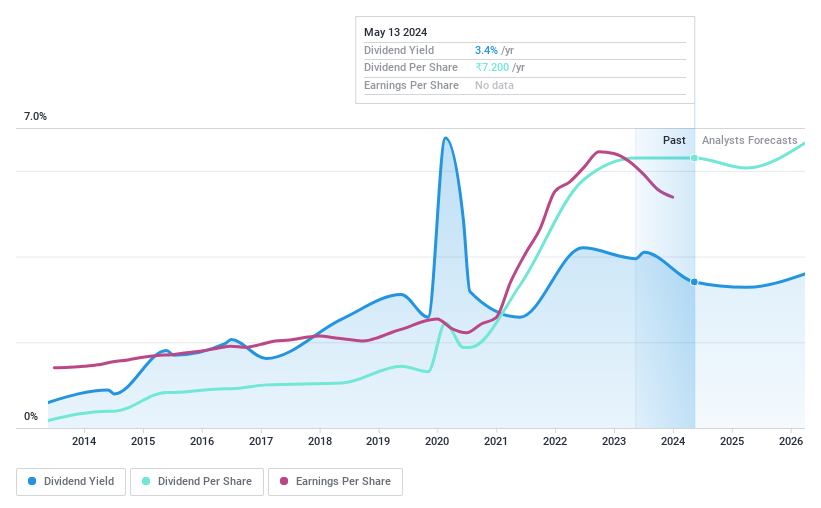

Redington

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Redington Limited operates as a provider of supply chain solutions both in India and internationally, with a market capitalization of approximately ₹163.23 billion.

Operations: Redington Limited generates its revenue from providing supply chain solutions across both domestic and international markets.

Dividend Yield: 3.3%

Redington, trading below the broader Indian market P/E at 14x, shows promising financial health with earnings expected to grow by 13.64% annually. Despite a top quartile dividend yield of 3.31%, its dividend track record over the past decade has been unstable and volatile, including a recent decrease to INR 6.20 per share for FY 2024. Dividends are well-covered by both earnings and cash flows, with payout ratios of 40.4% and 58.8%, respectively, suggesting cautious optimism for future sustainability amidst past inconsistencies.

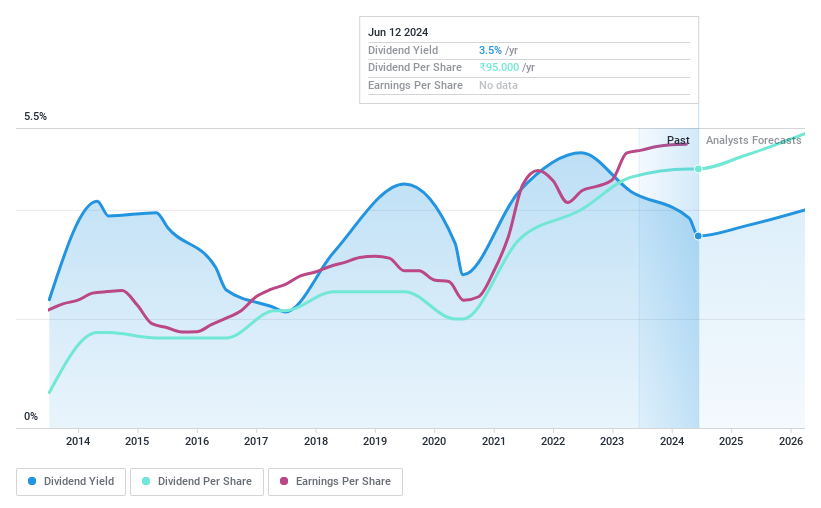

Swaraj Engines

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swaraj Engines Limited, based in India, specializes in manufacturing and selling diesel engines, diesel engine components, and spare parts for tractors, with a market capitalization of approximately ₹30.60 billion.

Operations: Swaraj Engines Limited generates its revenue primarily through the sale of diesel engines, components, and tractor spare parts, totaling ₹14.19 billion.

Dividend Yield: 3.7%

Swaraj Engines, with a price-to-earnings ratio of 22.9, trades below the broader Indian market average of 30.5, indicating relative value against peers. Despite a generous dividend recommendation of INR 95 per share for FY2024, its dividend sustainability is questionable due to a high payout ratio of 83.7% and cash payout ratio exceeding earnings at 122%. Earnings have shown an annual growth rate of 15.4% over the past five years, but dividend reliability remains compromised by historical volatility and inadequate coverage by free cash flow.

Where To Now?

Investigate our full lineup of 19 Top Dividend Stocks right here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:HCLTECHNSEI:REDINGTON NSEI:SWARAJENG

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance