3 Things About Couche-Tard Stock Every Smart Investor Knows

Written by Brian Paradza, CFA at The Motley Fool Canada

Convenience stores giant Alimentation Couche-Tard (TSX:ATD) has steadily grown its global business footprint for decades and it is racking up profits year after year – making long-term oriented Couche-Tard stock investors wealthier. But what makes this $75 billion growth stock tick? ATD stock has generated a strong 16,490% capital gain over the past two decades. Savvy investors know that its acquisitions-led growth strategy remains intact. They also appreciate the tricks management successfully employ to augment long-term shareholder returns. However, some are increasingly skeptical about one rarely mentioned risk.

ATD stock: A growth machine with a strong track record

Since going public in 1999, Alimentation Couche-Tard has grown its annual revenue by 13,640% over the past two decades. Acquisitions propelled the company’s growth trajectory. Synergistic benefits accumulated, earnings margins held strong, and the business flourished beyond oceanic boundaries.

That said, organic growth has somewhat abated with changing consumer patterns lately. Consumers tightened their belts and cut back on some expenditures as inflation emptied pockets faster. This could perhaps explain the recent drop in ATD stock over the past month.

On a trailing 12-month basis, Couche-Tard’s revenue has seen a consistent decline over the past five consecutive quarters, despite a sequential increase in the number of its operating sites from 14,332 sites in January 2023 to 16,715 sites by February this year. Same-store sales growth has been negative in key markets lately and fuel sales margins shrank somewhat.

Looking ahead, gas stations are a significant revenue growth driver for Couche-Tard following its US$3.8 billion (C$5.2 billion) acquisition of 2,175 European vehicle fueling stations from TotalEnergies in December, and a US$470 million (C$645 million) splurge on 112 fueling sites from MAPCO in the United States.

Smart investors appreciate Alimentation Couche-Tard stock’s somewhat contrarian growth investment strategy. However, they also appreciate the associated risk.

Couche-Tard is a contrarian investor

Couche-Tard harvested good earnings and cash flow from sales of tobacco products, even as global society encouraged connoisseurs to quit smoking. Smart investors are familiar with the company’s somewhat contrarian business strategy, especially as it loads up on gasoline service stations today despite the world’s attempt to electrify green transport systems.

An increased dependency on fossil fuel sales in a world that’s actively promoting the adoption of electric vehicles could be risky if governments successfully ban new production and sales of gasoline and diesel-powered vehicles during the next decade. Revenue could shrink.

That said, the company may still transform its fueling stations into EV charging stations and remain relevant. However, conversions may require significant capital investments, and EV charging stations may still require more real estate to charge a fraction of the number of vehicles typically served by a gasoline station within an hour.

It’s too early to tell how ATD stock’s contrarian bets on thriving fossil fuel sales in the future will pay off. However, smart investors know that uncertainty is a given in any equity investment decision.

Meanwhile, the company’s other returns-boosting strategy may persist for longer.

Share repurchases to remain a significant return contributor

Alimentation Couche-Tard continues to actively repurchase its common stock every year. Its share repurchases are funded from internally generated cash flow, and they look sustainable. Share buybacks could have helped propel the value of remaining ATD stock units on the market.

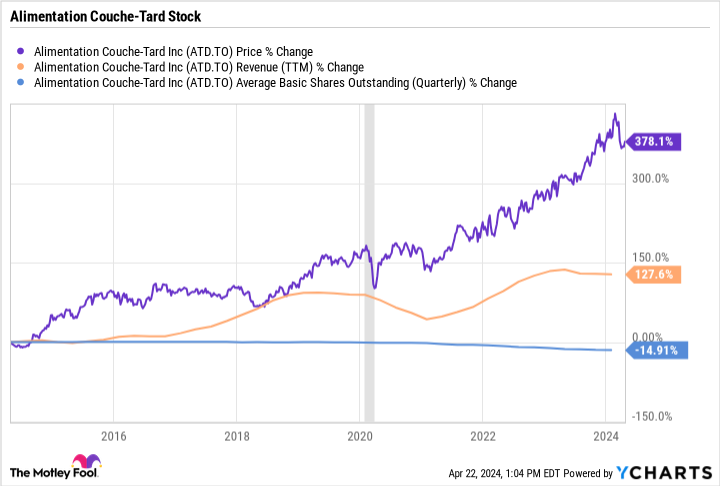

Over the past decade, ATD has reduced the number of issued shares outstanding on its books by 14.9%. There are fewer claims on the company’s future earnings and cash flow after each round of share repurchases. Repurchases may help explain the 376.9% gain on Couche-Tard stock over the past 10 years when the business increased revenue by less than 128%.

Stock repurchases may continue to support ATD stock’s price in the future – as long as the business remains profitable and continues to generate positive cash flow.

The post 3 Things About Couche-Tard Stock Every Smart Investor Knows appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Alimentation Couche-Tard?

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for a decade, Motley Fool Stock Advisor Canada, is beating the TSX by 32 percentage points.*

They just revealed what they believe are the 10 best Starter Stocks for investors to buy right now… and Alimentation Couche-Tard made the list -- but there are 9 other stocks you may be overlooking.

Get Our 10 Starter Stocks Today * Returns as of 3/20/24

More reading

Can You Guess the 10 Most Popular Canadian Stocks? (If You Own Them, You Might Be Losing Out.)

How to Build a Bulletproof Monthly Passive-Income Portfolio in 2024 With Just $25,000

Fool contributor Brian Paradza has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alimentation Couche-Tard. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance