3 Secrets of RRSP Millionaires

Written by Tony Dong, MSc, CETF® at The Motley Fool Canada

Despite the increasing attention on the Tax-Free Savings Accounts (TFSA) and the newly introduced First Home Savings Account (FHSA), I maintain that the Registered Retirement Savings Plan (RRSP) remains an underrated cornerstone of Canadian retirement planning.

Its key benefits are compelling: you can contribute up to 18% of your income, up to a cap of $31,560 for 2024, which not only helps in building your retirement nest egg but also reduces your taxable income. Moreover, any dividends, capital gains, or income earned within the RRSP grows tax-deferred until you decide to retire and begin withdrawals.

The RRSP’s structure offers unique opportunities for savvy investors to optimize their accounts for maximum growth potential. With the right strategies, it’s possible to significantly enhance the value of your RRSP over time.

To illustrate these strategies, I’ll use Vanguard Total Stock Market ETF (NYSEMKT:VTI) as an example, showcasing how integrating this kind of investment into your RRSP can play a pivotal role in achieving long-term financial success.

Tip #1: Hold U.S. securities

One strategic move for maximizing the growth potential of your RRSP is to prioritize holding U.S. stocks and exchange-traded funds (ETFs) within it. This approach leverages a unique advantage of the RRSP when it comes to the treatment of foreign withholding taxes.

For most Canadian investors, a 15% foreign withholding tax is levied on dividends from U.S. stocks, even when held in a TFSA. For instance, if you hold XYZ, a hypothetical U.S. stock with a 4% yield, in a TFSA, this yield effectively gets reduced to 3.4% after the withholding tax is applied.

However, this withholding tax doesn’t apply to U.S. stocks or ETFs held in an RRSP, thanks to the tax treaty between Canada and the United States. This makes the RRSP an optimal account for investing in U.S. securities, allowing you to fully benefit from the original yield.

Tip #2: Prioritize low-fee ETFs

It’s equally crucial to prioritize low fees when investing, particularly in ETFs. The impact of fees on your investment returns compounds over time, making it a key factor in optimizing your RRSP’s growth.

Using VTI as an example, we see an annual expense ratio of merely 0.03%. This means that a $10,000 investment in VTI incurs just $3 in annual fees. However, VTI’s Canadian dollar counterpart, Vanguard Total U.S. Stock Market Index ETF (TSX:VUN), comes with a higher expense ratio of 0.16%, translating to $16 in fees for a $10,000 investment.

While the difference might seem minimal at first glance, the impact becomes significantly more pronounced as your portfolio grows. For a $100,000 investment, the fees would amount to $160 for VUN compared to just $30 for VTI. Over the span of several decades, this difference in fees can compound, leading to a substantial variance in your investment’s net growth.

Therefore, if you have a cost-effective method of converting CAD to USD—such as through a brokerage like Interactive Brokers—opting for a USD-denominated ETF with lower fees, like VTI, can lead to considerable savings.

Tip #3: Reinvest dividends consistently

Given the long-term nature of the RRSP, it makes little sense to cash out dividends only to face a withdrawal tax. Instead, reinvesting those dividends back into your portfolio is far better.

Why does this matter? Well, each reinvested dividend buys more shares, increasing the number of shares that will generate dividends in the future. This snowball effect continues to grow, accelerating the increase in the value of your investment.

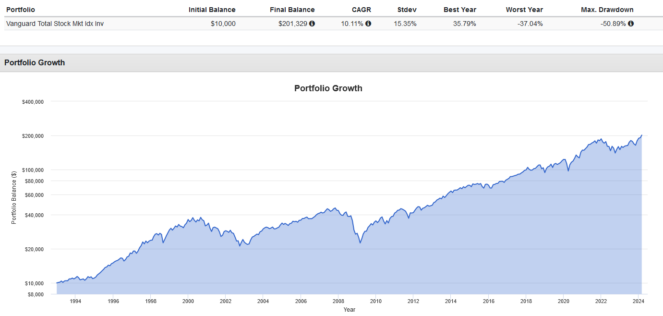

Here’s a real-life example: if you invested $10,000 in 1993 in the older mutual fund of VTI and didn’t reinvest dividends, you would have earned an 8.11% annualized return and ended up with $113,515.

But if you reinvested dividends consistently when they were paid out, you would have earned an even better annualized rate of return at 10.11%, resulting in a final value of $201,329.

By consistently reinvesting dividends, you’re not just saving on taxes you would have incurred from withdrawing; you’re also ensuring that every dollar earned is put to work, contributing to the exponential growth of your retirement savings over the decades.

The post 3 Secrets of RRSP Millionaires appeared first on The Motley Fool Canada.

Should you invest $1,000 in Vanguard Index Funds - Vanguard Total Stock Market Etf right now?

Before you buy stock in Vanguard Index Funds - Vanguard Total Stock Market Etf, consider this:

The Motley Fool Stock Advisor Canada analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Index Funds - Vanguard Total Stock Market Etf wasn’t one of them. The 10 stocks that made the cut could potentially produce monster returns in the coming years.

Consider MercadoLibre, which we first recommended on January 8, 2014 ... if you invested $1,000 in the “eBay of Latin America” at the time of our recommendation, you’d have $15,578.55!*

Stock Advisor Canada provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month – one from Canada and one from the U.S. The Stock Advisor Canada service has outperformed the return of S&P/TSX Composite Index by 32 percentage points since 2013*.

See the 10 stocks * Returns as of 3/20/24

More reading

Can You Guess the 10 Most Popular Canadian Stocks? (If You Own Them, You Might Be Losing Out.)

How to Build a Bulletproof Monthly Passive-Income Portfolio in 2024 With Just $25,000

Fool contributor Tony Dong has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance