3 Remarkably Cheap TSX Stocks to Buy Right Now

Written by Kay Ng at The Motley Fool Canada

Here are three top TSX stocks that appear to be cheap. Investors shopping for value can investigate the ideas to see if they fit their diversified portfolios. These stocks have the potential to deliver solid total returns over the next three to five years while paying out decent dividend income.

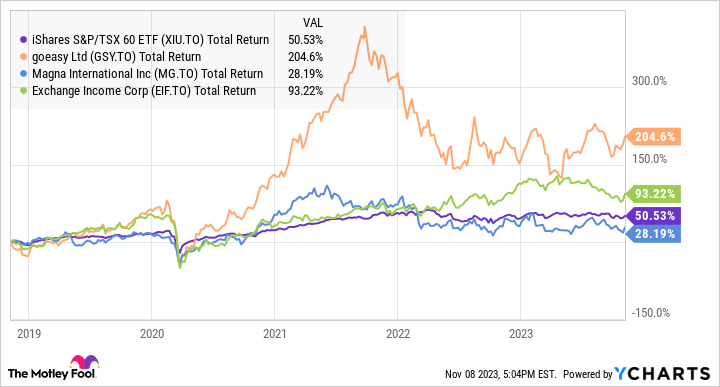

XIU, GSY, MG, and EIF 5-Year Total Return Level data by YCharts

goeasy

Leading non-prime Canadian lender goeasy (TSX:GSY) reported solid third-quarter results on Tuesday. Seemingly, a higher interest rate environment has not affected its business. For the quarter, goeasy’s loan originations climbed 13% year over year to $722 million. Its revenue climbed 23% to $322 million. Its loan portfolio rose 33% to $3.43 billion. Importantly, its net charge-off rate dropped 0.50% to 8.8%, which is within the company’s target of 8-10%. (As Investopedia explains, “net charge offs are the debt owed to a company unlikely to be recovered by that company.”) Ultimately, the adjusted earnings per share (EPS) jumped 29% to $3.81.

At about $124 per share at writing, the dividend stock trades at about nine times adjusted earnings, which is a discount of about 25% from its long-term normal valuation. This roughly aligns with the 12-month analyst consensus price target that represents a near-term upside potential of approximately 29%.

At the recent quotation, the stock also offers a dividend yield of 3.1%. goeasy is a Canadian Dividend Aristocrat with what it takes to maintain dividend growth. Its payout ratio is estimated to be about 27% of adjusted earnings this year.

Magna stock

Auto parts maker Magna International (TSX:MG) reported solid third-quarter results last week. For the quarter, sales growth was 15% to approximately US$10.7 billion and adjusted EPS rose 33% to US$1.46. The year-to-date picture shows similarly sturdy results — sales growth of 14% to US$32.3 billion and adjusted EPS growth of 26% to US$4.15.

Notably, Magna is experiencing a rebound from lowered results last year. Using 2021 as the base year for comparison instead, its adjusted EPS is expected to rise about 8-12%.

No matter what, Magna is used to periods of extensive growth when the macro environment is positive. It has the potential to deliver double-digit growth rates in its earnings over multiple years. If so, it’s an undervalued stock trading at $71.57 per share or about 9.9 times adjusted earnings. One could argue that its multiple wouldn’t normally be high because it’s a cyclical stock and, therefore, more unpredictable. Analysts believe it trades at a discount of about 21%.

Magna is a Canadian Dividend Aristocrat that maintains a low payout ratio that helps protect its dividend. At the recent quotation, it yields 3.5%.

Exchange Income

Exchange Income (TSX:EIF) is categorized under the airline industry and industrial sector. So, investors can imagine it to be a cyclical stock with ups and downs in its profits. On its website, Exchange Income describes itself as “a diversified, acquisition-oriented dividend company focused on opportunities in Aviation Services & Aerospace and Manufacturing.”

Interestingly, unlike most stocks in the airline industry, Exchange Income has a strong track record of dividend payments. Since its inception in 2004, the company has maintained or increased its monthly dividend every year. At writing, it provides a nice dividend yield of almost 5.4%.

The stock is still recovering from its recent dip from market volatility. At $46.73 per share at writing, analysts estimate it trades at a discount of approximately 30%.

The post 3 Remarkably Cheap TSX Stocks to Buy Right Now appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Exchange Income Corporation?

Before you consider Exchange Income Corporation, you'll want to hear this.

Our market-beating analyst team just revealed what they believe are the 5 best stocks for investors to buy in October 2023... and Exchange Income Corporation wasn't on the list.

The online investing service they've run for nearly a decade, Motley Fool Stock Advisor Canada, is beating the TSX by 25 percentage points. And right now, they think there are 5 stocks that are better buys.

See the 5 Stocks * Returns as of 10/10/23

More reading

Fool contributor Kay Ng has positions in Exchange Income and Goeasy. The Motley Fool recommends Magna International. The Motley Fool has a disclosure policy.

2023

Yahoo Finance

Yahoo Finance