3 Quarterly Reports That Investors Shouldn't Ignore

As earnings season winds down, one thing is sure – it was a wild time, just like it always is. We received many positive quarterly prints, with an inspiring number of companies rebounding after a challenging Q1.

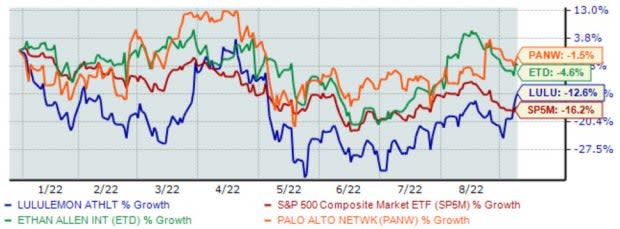

Looking back, several notable earnings reports stood out, such as those from Palo Alto Networks PANW, Ethan Allen Interiors ETD, and lululemon LULU. The chart below illustrates the year-to-date share performance of all three companies, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a closer look at each company’s quarterly report.

Palo Alto Networks

Palo Alto Networks PANW offers an enterprise cybersecurity platform that provides network and cloud security, endpoint protection, and several other cloud-delivered security services.

Palo Alto reported quarterly earnings of $2.39 per share, easily surpassing the Zacks Consensus EPS Estimate of $2.28 and reflecting a 5% bottom-line beat.

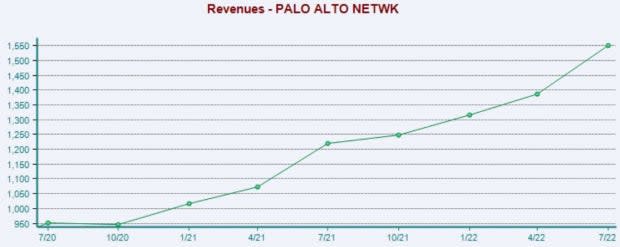

Quarterly revenue was reported at $1.5 billion, marginally above expectations and good enough for a substantial 27% Y/Y uptick. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Further, the cybersecurity titan noted its continued strength and momentum across many segments; Total Billings tallied $2.7 billion, penciling in a steep 44% Y/Y uptick. Product Revenue was $408 million, reflecting an inspiring 20% Y/Y uptick.

To ensure shares are accessible to all investors, PANW also announced its plans for a 3-for-1 stock split, undoubtedly a major highlight. Palo Alto shares start trading on their split-adjusted basis on September 14th, 2022.

Needless to say, the market was impressed by the quarterly results – shares tacked on 12% in value the following trading day.

Lululemon

Lululemon LULU designs, manufactures, and distributes athletic apparel and accessories for women, men, and female youth. The company targets the high-end consumer market.

LULU posted earnings of $2.20 per share, more than enough to exceed the Zacks Consensus Estimate of $1.86 by a sizable 18% and reflect a stellar Y/Y uptick of 33%.

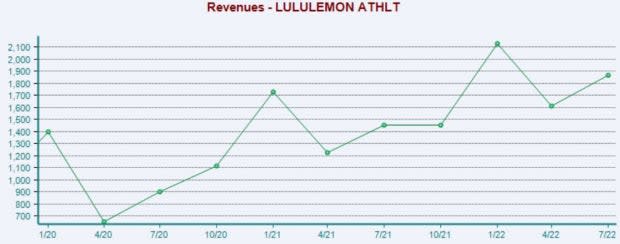

Quarterly revenue tallied $1.9 billion, exceeding the $1.8 billion estimate by roughly 6% and registering a substantial 30% Y/Y uptick.

Image Source: Zacks Investment Research

In addition, LULU’s gross profit improved by 25% Y/Y to $1.1 billion, and operating income jumped 38% to $401 million.

Further, the company opened 21 new company-operated stores throughout the quarter, bringing the total number of stores up to 600.

Perhaps the biggest highlight is the company’s uplifting guidance - management now expects net revenues of $1.8 - $1.81 billion for Q3 2022, representing a more than 20% Y/Y uptick.

It’s been the norm for lululemon to post strong quarterly results – the company has impressively exceeded earnings and revenue estimates in nine of its previous ten quarters.

Investors were thrilled with the results – shares tacked on nearly 7% in value the following trading day.

Ethan Allen Interiors

Ethan Allen Interiors ETD is a leader in interior design, selling a full range of home furnishings through a retail network of design centers and its online website.

ETD reported Q4 FY22 EPS of $1.25, crushing the Zacks Consensus EPS Estimate of $0.80 by a substantial 56%.

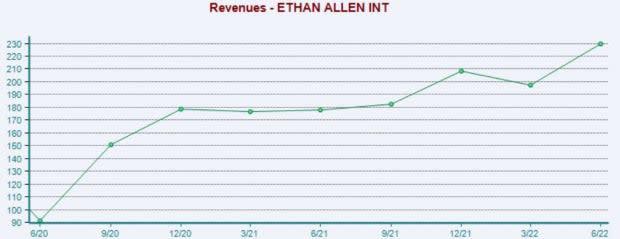

Top-line results were also spectacular; Q4 revenue of $229 million handily beat the $197 million Zacks Consensus Estimate by 16.3%.

Image Source: Zacks Investment Research

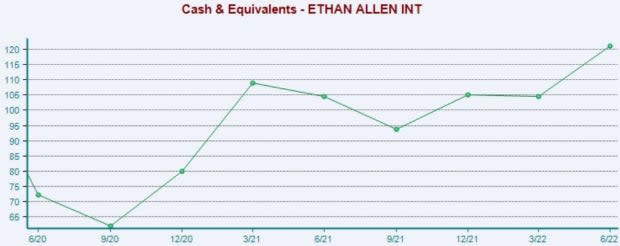

Undoubtedly another major positive, ETD ended the quarter with a strong balance sheet, including cash and investments of $121 million as of June 30th and zero debt. Further, ETD generated nearly $30 million in cash from operating activities.

Image Source: Zacks Investment Research

In addition, retail and wholesale net sales improved by 25% and 29%, respectively.

Farooq Kathwari, CEO, says, “In what was a dynamic and volatile fiscal year marked by rising costs and global supply chain challenges, we delivered strong sales growth and record earnings for the full fiscal year.”

Buyers came out to play following the quarterly print – ETD shares tacked on 8.3% in value the following trading day.

Bottom Line

Earnings season is always an exciting time. Companies finally pull the curtain back, unveiling quarterly results that investors have anxiously waited for.

Of course, not all companies post strong quarterly results.

However, all three companies above – Ethan Allen Interiors ETD, Palo Alto Networks PANW, and lululemon LULU – posted robust quarterly results worth a highlight.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

Ethan Allen Interiors Inc. (ETD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance