3 Non-Energy S&P 500 Stocks With Enough Energy to Boost Returns

The Oil/Energy industry has undoubtedly been the best-performing S&P 500 sector in 2022, making up for huge losses in other sectors of the index. The space has generated a total return of nearly 25.9% in 2022 against the S&P 500’s decline of around 18.8%.

Image Source: Zacks Investment Research

The rise in oil and gas prices has brought windfall profits to energy companies, pushing their stocks up this year. As global economies reopen, demand for oil and gas has risen but supply remains tight. Several western countries have imposed restrictions on imports from Russia, one of the world's largest producers of the commodity, in the backdrop of its war with Ukraine that has been hurting the supply of oil and gas. This demand supply gap has been pushing up oil and gas prices.

Major energy companies were among the best-performing stocks in the S&P 500 Index this year.

While energy stocks have been the top performers within S&P 500 this year, it is quite a volatile sector. So, it is not a bad idea to invest in some top-performing non-energy S&P 500 stocks. Here we discuss three such S&P 500 stocks, Merck MRK, Vertex Pharmaceuticals VRTX and McKesson Corporation MCK. All three companies are from the Medical sector, which is a defensive sector to invest in the present environment of rising interest rates and economic uncertainty.

Each of these S&P 500 stocks has returned more than 40% year to date and looks well poised for the upcoming year.

Merck

Based in Kenilworth, NJ, Merck boasts more than six blockbuster drugs in its portfolio, with PD-L1 inhibitor, Keytruda, approved for several types of cancer, alone accounting for around 40% of the company’s pharmaceutical sales. An ongoing recovery from the disruptions related to the pandemic and strong global underlying demand across its business, particularly for Keytruda and Gardasil vaccines to prevent HPV-related cancers, is improving Merck’s sales performance.

Merck’s blockbuster cancer medicine, Keytruda is gaining from continued strong momentum in metastatic indications, including in some types of NSCLC, renal cell carcinoma, head and neck squamous cell carcinoma, TNBC and MSI-H cancers. Keytruda is continuously growing and expanding into new indications and markets globally.

With continued label expansion into new indications & early-stage settings, Keytruda is expected to remain a key top-line driver. Merck’s Animal Health business has been a key contributor to its top-line growth, with the company recording above-market growth. The trend is expected to continue in 2023. Merck boasts a strong cancer pipeline, including Keytruda, which should help drive long-term growth.

Merck’s stock has risen 41.9% this year so far. The Zacks Consensus Estimate for 2022 has risen from $7.37 per share to $7.38 per share while that for 2023 has gone up from $7.18 per share to $7.34 per share over the past 60 days. Merck has a Zacks Rank #3 (Hold)

Image Source: Zacks Investment Research

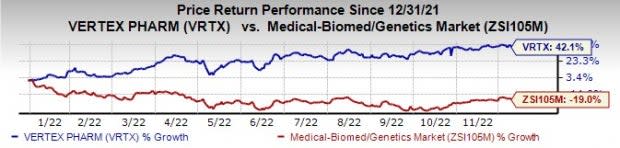

Vertex Pharmaceuticals

Vertex’s main area of focus is cystic fibrosis (CF). With its four CF medicines, Vertex is treating the majority of the 83,000 patients living with CF in the United States, Europe, Canada and Australia. Vertex’s CF sales continue to grow driven by its triple therapy, Trikafta/Kaftrio. New reimbursement agreements in ex-U.S. markets and label expansions to younger age groups in the United States are driving Trikafta/Kaftrio sales higher. Vertex faces only minimal competition in its core CF franchise.

While Vertex’s main focus is on the development and strengthening of its CF franchise, the company also has a rapidly advancing mid- to late-stage pipeline in seven additional diseases beyond CF like acute pain, sickle cell disease, beta-thalassemia, APOL1-mediated kidney diseases (AMKD), alpha-1 antitrypsin (AAT) deficiency and cell therapy for type I diabetes. Many of these candidates represent multibillion-dollar opportunities. Programs in five disease areas are now entering or progressing through late-stage clinical development. Multiple late-stage projects have established proof of concept.

Vertex Pharmaceuticals’ stock has risen 42.1% this year so far. Estimates for Vertex’s 2022 earnings have gone up from $14.21 to $14.65 per share, while that for 2023 have increased from $15.09 to $15.62 per share over the past 60 days. Vertex has a Zacks Rank of 2 (Buy).

Image Source: Zacks Investment Research

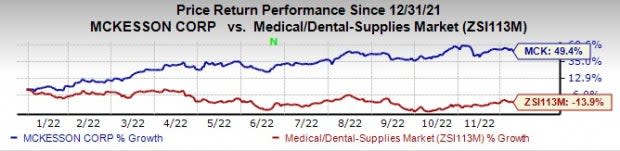

McKesson Corporation

McKesson is a major player in the pharmaceutical and medical supplies distribution market. The Distribution Solutions segment caters to a wide range of customers and businesses and stands to benefit from increased generic utilization, inflation in generics driven by several patent expirations in the next few years, and an aging population.

The company played a crucial role in the COVID-19 response efforts in the United States and abroad via the distribution of COVID-19 vaccines, ancillary supply kits, and COVID-19 tests. McKesson is well-poised for growth, backed by strategic collaborations and strength in the distribution solutions segment. The company has an encouraging outlook for 2023.

McKesson’s stock has risen 49.4% this year so far. Estimates for McKesson’s 2022 earnings have gone up from $24.26 to $24.75 per share, while that for 2023 have increased from $26.05 to $26.41 per share over the past 60 days. McKesson has a Zacks Rank #3.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance