3 Leading German Dividend Stocks Offering Up To 6.8% Yield

Amid a backdrop of rising inflation and economic uncertainty across Europe, Germany's market has shown resilience, with investors increasingly focusing on stable returns. Dividend stocks, known for their potential to provide steady income, are becoming particularly attractive in these volatile times.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.23% | ★★★★★★ |

Edel SE KGaA (XTRA:EDL) | 6.70% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 4.66% | ★★★★★★ |

Südzucker (XTRA:SZU) | 6.35% | ★★★★★☆ |

MLP (XTRA:MLP) | 4.57% | ★★★★★☆ |

Deutsche Telekom (XTRA:DTE) | 3.40% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.13% | ★★★★★☆ |

SAF-Holland (XTRA:SFQ) | 4.89% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 8.06% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.11% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

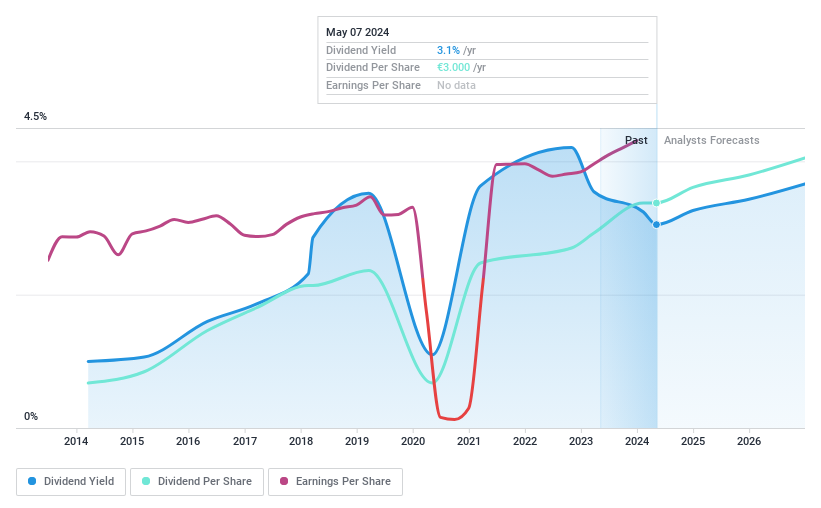

Heidelberg Materials

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Heidelberg Materials AG operates globally, producing and distributing cement, aggregates, ready-mixed concrete, and asphalt, with a market capitalization of approximately €17.29 billion.

Operations: Heidelberg Materials AG generates €11.21 billion from cement, €4.88 billion from aggregates, and €5.90 billion from ready-mixed concrete and asphalt.

Dividend Yield: 3.2%

Heidelberg Materials AG, a notable player in the construction materials sector, has demonstrated a commitment to returning value to shareholders through dividends and share repurchases. Recently, they increased their dividend by €0.40 to €3 per share, reflecting a 15% hike from the previous year. Concurrently, they've embarked on an aggressive share buyback program, committing up to €1.2 billion through 2026 with the first tranche of €400 million starting May 2023. Despite these positive shareholder returns, the company's dividend history shows volatility over the last decade with significant annual fluctuations exceeding 20%. Financially, both earnings and cash flow adequately cover current dividends with payout ratios at 27.3% and 29.1%, respectively; however, its dividend yield remains modest at 3.15%, trailing behind top German market payers averaging around 4.51%.

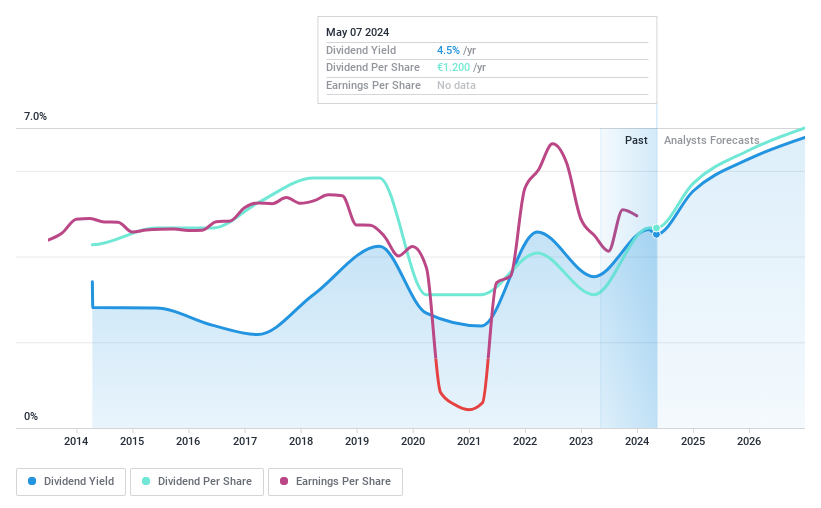

INDUS Holding

Simply Wall St Dividend Rating: ★★★★★☆

Overview: INDUS Holding AG is a private equity firm focused on mergers and acquisitions as well as corporate spin-offs, with a market capitalization of approximately €704.66 million.

Operations: INDUS Holding AG generates revenue through three primary segments: Materials (€601.79 million), Engineering (€588.82 million), and Infrastructure (€572.78 million).

Dividend Yield: 4.6%

INDUS Holding AG offers a dividend yield of 4.58%, ranking in the top 25% of German dividend payers, supported by a sustainable payout ratio of 47% from earnings and a low cash payout ratio of 21%. Despite trading at a significant discount to its estimated fair value, the company's dividends have shown volatility over the past decade. Recent financials indicate challenges, with Q1 earnings dropping to €10.16 million from €16.03 million year-over-year, reflecting potential pressure on future payouts.

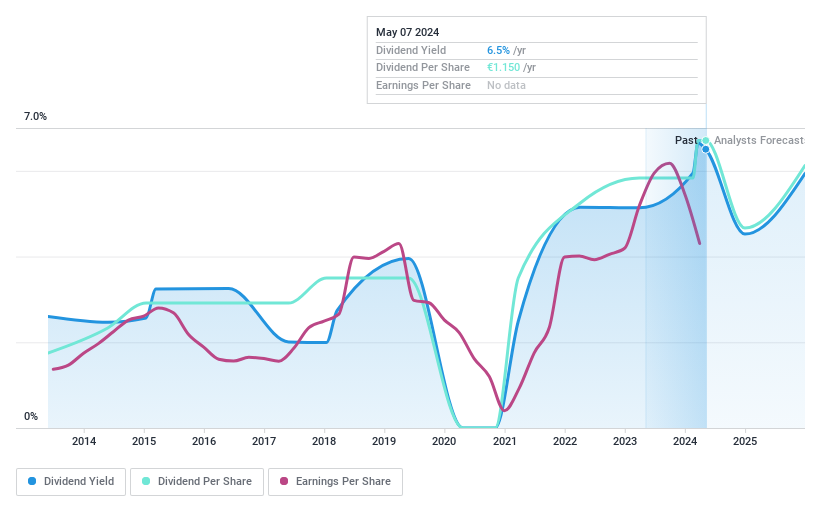

Wacker Neuson

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wacker Neuson SE, with a market capitalization of €1.13 billion, is a global manufacturer and distributor of light and compact equipment, operating primarily in Germany, Austria, the United States, and other international markets.

Operations: Wacker Neuson SE generates revenue through three main segments: Services (€490 million), Light Equipment (€500.70 million), and Compact Equipment (€1.61 billion).

Dividend Yield: 6.9%

Wacker Neuson SE's recent financials show a dip with Q1 sales at €593.1 million and net income at €23.3 million, down from last year. Despite this, the company maintains a high dividend yield of 6.89%, positioned in the top quartile of German dividend stocks. However, its dividends are not well supported by cash flows or earnings growth, indicating potential sustainability issues despite a reasonable payout ratio of 53.4%. The dividends have also been volatile over the past decade, raising concerns about their reliability moving forward.

Make It Happen

Embark on your investment journey to our 32 Top Dividend Stocks selection here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:HEIXTRA:INHXTRA:WAC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance