3 Key Euronext Paris Dividend Stocks Offering Up To 7.2% Yield

Amid a backdrop of fluctuating European markets with France's CAC 40 Index recently experiencing a modest decline, investors are keenly observing opportunities for stable returns. In this context, dividend stocks on the Euronext Paris stand out as potential candidates for those seeking to generate income through investments that offer up to 7.2% yield.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Rubis (ENXTPA:RUI) | 6.11% | ★★★★★★ |

Samse (ENXTPA:SAMS) | 8.40% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.35% | ★★★★★★ |

Fleury Michon (ENXTPA:ALFLE) | 5.58% | ★★★★★☆ |

Métropole Télévision (ENXTPA:MMT) | 9.06% | ★★★★★☆ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 3.76% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.25% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 3.94% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 3.71% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 7.17% | ★★★★★☆ |

Click here to see the full list of 34 stocks from our Top Euronext Paris Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

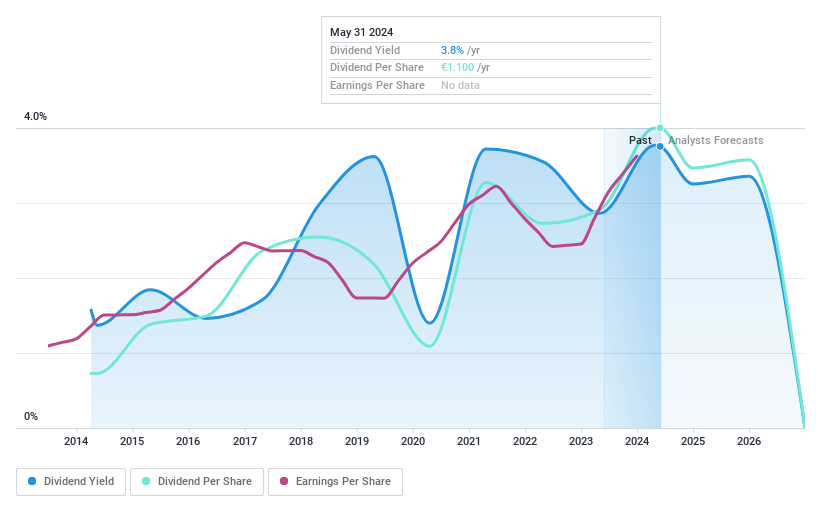

Groupe Guillin

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Groupe Guillin S.A. is a company based in France that manufactures and distributes food packaging products globally, with a market capitalization of approximately €0.54 billion.

Operations: Groupe Guillin S.A. generates its revenues primarily from the production and distribution of food packaging solutions across various international markets.

Dividend Yield: 3.8%

Groupe Guillin's recent earnings surged to €75.43 million, with a notable increase in EPS from €2.76 to €4.08 year-over-year, reflecting robust profitability. Despite this growth, its dividend yield at 3.75% remains below the French market's top quartile of 5.17%. The dividends are well-supported by earnings and cash flows, with payout ratios of 22.6% and 18.5%, respectively; however, the company has experienced volatility in its dividend payments over the past decade, indicating some instability despite recent financial improvements and trading significantly below estimated fair value.

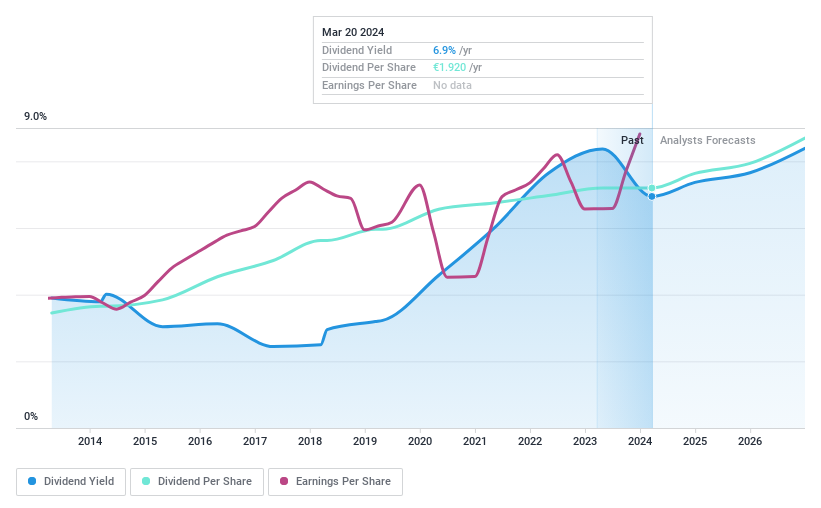

Groupe LDLC société anonyme

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Groupe LDLC société anonyme is an online retailer specializing in IT and high-tech equipment, with a market capitalization of approximately €99.94 million.

Operations: Groupe LDLC société anonyme generates €580.38 million from the distribution of computer equipment and related services.

Dividend Yield: 7.2%

Groupe LDLC offers a high dividend yield at 7.25%, ranking in the top 25% in the French market, yet its sustainability is questionable as dividends are not well supported by earnings or cash flows. Although the company's dividends have shown growth over the past decade, they have also been marked by significant volatility and unreliability. Despite these challenges, LDLC's shares trade at a 7.4% discount to estimated fair value and earnings are expected to grow significantly.

Rubis

Simply Wall St Dividend Rating: ★★★★★★

Overview: Rubis operates bulk liquid storage facilities for commercial and industrial customers across Europe, Africa, and the Caribbean, with a market capitalization of approximately €3.35 billion.

Operations: Rubis generates €6.58 billion from Energy Distribution and €48.64 million from Renewable Electricity Production.

Dividend Yield: 6.1%

Rubis offers a compelling 6.11% dividend yield, placing it among the top 25% of French dividend payers. The company's dividends have grown and remained stable over the last decade, supported by a reasonable payout ratio of 57.7% and cash payout ratio of 73.4%. Despite trading at a significant discount to fair value and recent earnings growth of 34.5%, Rubis faces challenges from high debt levels and potential impacts from new tax policies estimated to affect net income by €20-25 million.

Next Steps

Reveal the 34 hidden gems among our Top Euronext Paris Dividend Stocks screener with a single click here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:ALGIL ENXTPA:ALLDL and ENXTPA:RUI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance