3 Japanese Dividend Stocks Offering Up To 3.3% Yield

Despite a challenging economic backdrop marked by a contraction in GDP, Japanese equities have shown resilience, with the Nikkei 225 and TOPIX indices posting gains. This environment highlights the appeal of dividend stocks, which can offer investors potential income stability amidst market fluctuations. In selecting strong dividend stocks, investors might consider companies with consistent payout histories and solid financial health, particularly in markets experiencing economic uncertainties. Such attributes can provide a buffer against broader market volatility while offering attractive yields.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.64% | ★★★★★★ |

Mitsubishi Shokuhin (TSE:7451) | 3.49% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.63% | ★★★★★★ |

Globeride (TSE:7990) | 3.55% | ★★★★★★ |

Nihon Parkerizing (TSE:4095) | 3.35% | ★★★★★★ |

Ryoyu Systems (TSE:4685) | 3.43% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 3.50% | ★★★★★★ |

Mitsubishi Research Institute (TSE:3636) | 3.40% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.14% | ★★★★★★ |

Innotech (TSE:9880) | 4.02% | ★★★★★★ |

Click here to see the full list of 374 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Nitto Fuji Flour MillingLtd

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nitto Fuji Flour Milling Co., Ltd. is a Japanese company that manufactures and sells flour products, with a market capitalization of approximately ¥57.27 billion.

Operations: Nitto Fuji Flour Milling Co., Ltd. primarily generates its revenues from the production and sale of flour products within Japan.

Dividend Yield: 3%

Nitto Fuji Flour Milling Co., Ltd. has demonstrated a volatile dividend history over the past decade, making its reliability as a dividend stock questionable. However, both earnings and cash flows adequately cover current dividends with payout ratios of 59.8% and 53.6%, respectively. Despite a low yield of 3% compared to top Japanese dividend payers, the company's price-to-earnings ratio stands favorably at 13.5x against the market average of 14.1x, suggesting some valuation advantage.

Teikoku Tsushin Kogyo

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Teikoku Tsushin Kogyo Co., Ltd. specializes in the production and distribution of electronic components both domestically in Japan and internationally, with a market capitalization of approximately ¥18.65 billion.

Operations: Teikoku Tsushin Kogyo Co., Ltd. generates revenue primarily through the production and sales of electronic components across both domestic and international markets.

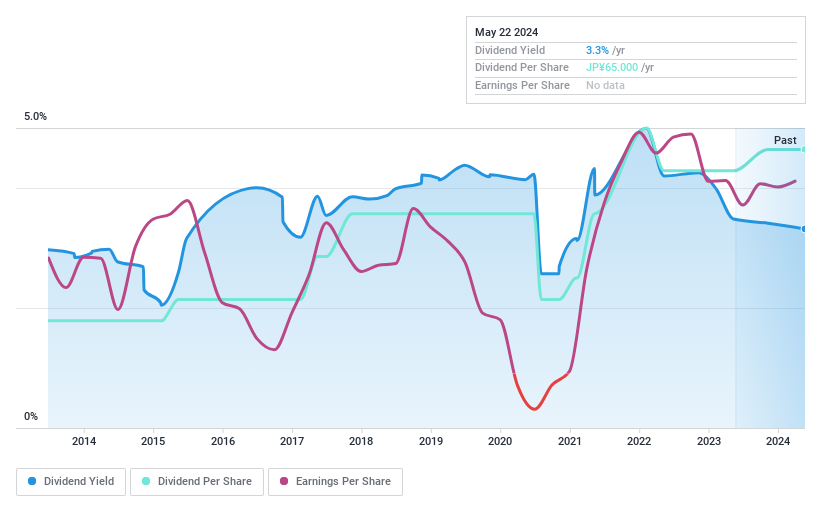

Dividend Yield: 3.3%

Teikoku Tsushin Kogyo has projected an increase in dividends to JPY 50.00 per share for the second quarter and full year ending March 31, 2025, up from JPY 35.00 the previous year. Despite a low dividend yield of 3.32%, slightly under the top quartile of Japanese dividend stocks at 3.33%, its dividend payments are sustainable with a payout ratio of 47.5% and a cash payout ratio of just 26.4%. However, historical data reveals inconsistency in dividend growth over the last decade, suggesting potential volatility in future payouts.

MS&AD Insurance Group Holdings

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MS&AD Insurance Group Holdings, Inc. is a global insurance holding company offering a range of insurance and financial services, with a market capitalization of approximately ¥4.98 trillion.

Operations: MS&AD Insurance Group Holdings, Inc. generates revenue through several key segments: ¥1.36 billion from Aioi Nissay Dowa Insurance Company, ¥1.62 billion from Mitsui Sumitomo Insurance Co., Ltd., ¥0.47 billion from Mitsui Sumitomo Aioi Life Insurance Company, ¥0.04 billion from Mitsui Direct General Insurance Co., Ltd., and ¥1.36 billion from Mitsui Sumitomo Primary Life Insurance Co., Ltd.; additionally, its international business contributes ¥1.26 billion through overseas insurance subsidiaries.

Dividend Yield: 3.2%

MS&AD Insurance Group Holdings has demonstrated a consistent dividend growth over the past decade with a current yield of 3.19%, slightly below the top quartile in Japan. The dividends are well-supported by both earnings and cash flows, with payout ratios of 38.8% and 34.2% respectively, indicating sustainability. Recently, the firm announced a significant share repurchase program valued at ¥190 billion to enhance shareholder returns, alongside an executive reshuffle set for approval in June 2024.

Turning Ideas Into Actions

Click this link to deep-dive into the 374 companies within our Top Dividend Stocks screener.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:2003TSE:6763 TSE:8725

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance