3 Intriguing Internet Stocks to Buy Now

Glancing at the Zacks Rank #1 (Strong Buy) list, there are a few intriguing tech stocks that were added this week.

Belonging to vibrant internet-related industries here are three of these highly ranked tech stocks to consider.

Bumble BMBL

As the parent company of two of the world’s largest dating apps, Bumble’s growth trajectory remains attractive but the company’s valuation is most enticing. Notably, Bumble’s Zacks Internet-Software Industry is currently in the top 38% of approximately 250 Zacks industries.

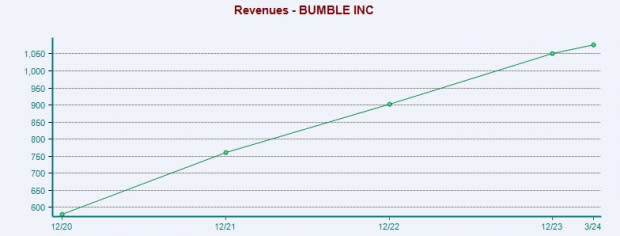

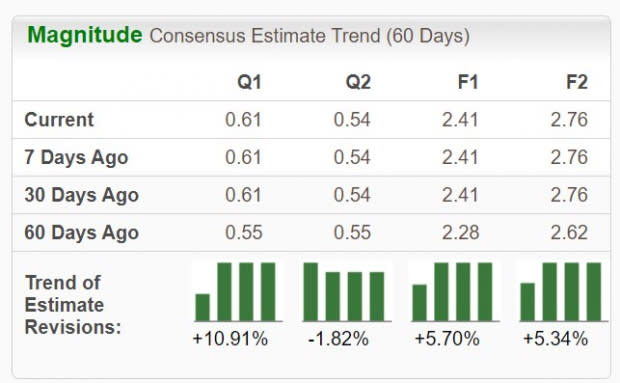

Bumble’s namesake dating app targets online consumers in the US, with the company’s Badoo platform having a large presence in Latin America and London. Between them, Bumble has millions of users worldwide and the trend of earnings estimate revisions has been positive over the last 60 days for both fiscal 2024 and FY25. Furthermore, Bumble’s stock is starting to look like a steal trading under $10.

To that point, BMBL trades at 10.5X forward earnings with EPS projected to soar to $0.90 in FY24 compared to an adjusted loss of -$0.03 a share last year. More reassuring is that FY25 EPS is projected to climb another 41% to $1.27. This is accompanied by steady top line growth with total sales projections continuing to climb north of $1 billion after eclipsing this mark in 2023, a respectable expansion from the $766 million Bumble brought in after going public in 2021.

Image Source: Zacks Investment Research

Carvana CVNA

Providing an e-commerce platform for buying and selling used cars, Carvana has been one of the best momentum stocks after setting up a bullish pattern back in April when CVNA retook and eclipsed its 50-day moving average as illustrated in the green line on the technical analysis price chart below.

The Zacks Internet-Commerce Industry is in the top 22% of all Zacks industries with Carvana certainly peaking the interest of technical traders as CVNA has now soared +132% year to date. Plus, Carvana’s top line growth has kept longer-term investors engaged as an indicator of its lucrative earnings potential with total sales expected to rise 15% this year and projected to jump another 16% in FY25 to $14.47 billion.

Image Source: Zacks Investment Research

Also correlating with its very bullish YTD performance, earnings estimate revisions have soared over the last quarter and are nicely up in the last 30 days with Carvana optimistically staying on the cusps of turning a profit after posting EPS of $0.75 last year.

Image Source: Zacks Investment Research

Okta OKTA)

Last but not least, the Zacks Internet-Software Services Industry is in the top 34 percentile, and Okta’s growth as an enterprise identity services provider is very appealing. Okta’s verification and provisions products include technologies such as single-sign-on and multi-factor authentication which streamline but also offer a secure process for managing and securing the digital identities of various entities within an organization from employees to customers.

Most compelling is that Okta’s EPS is expected to climb 50% in its current FY25 to $2.41 versus $1.60 a share in FY24. Even better, FY26 EPS is projected to pop another 14%. Okta’s total sales are expected to spike 11% in both FY25 and FY26 with projections edging toward $3 billion. Better still, EPS estimates for FY25 and FY26 have risen over 5% in the last two months.

Image Source: Zacks Investment Research

Takeaway

Rising earnings estimate revisions are starting to pinpoint the notion that Bumble, Carvana, and Okta are benefiting from their strong business industries. This makes now an ideal time to invest as the top line expansion of these internet-focused companies also suggests they should be viable long-term investments.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Okta, Inc. (OKTA) : Free Stock Analysis Report

Carvana Co. (CVNA) : Free Stock Analysis Report

Bumble Inc. (BMBL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance