3 Indian Exchange Stocks Estimated To Be Undervalued By 27.6% To 36.1%

The Indian market has shown robust performance, climbing 46% over the past year with earnings expected to grow by 16% annually. In such a thriving environment, identifying stocks that appear undervalued could present potential opportunities for investors looking for growth at a reasonable price.

Top 10 Undervalued Stocks Based On Cash Flows In India

Name | Current Price | Fair Value (Est) | Discount (Est) |

Updater Services (NSEI:UDS) | ₹290.05 | ₹477.16 | 39.2% |

Allied Digital Services (NSEI:ADSL) | ₹163.08 | ₹228.94 | 28.8% |

IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹410.20 | ₹574.52 | 28.6% |

Mahindra Logistics (NSEI:MAHLOG) | ₹486.55 | ₹801.12 | 39.3% |

Strides Pharma Science (NSEI:STAR) | ₹946.75 | ₹1520.38 | 37.7% |

TV18 Broadcast (NSEI:TV18BRDCST) | ₹42.66 | ₹70.66 | 39.6% |

PVR INOX (NSEI:PVRINOX) | ₹1421.10 | ₹2222.35 | 36.1% |

Delhivery (NSEI:DELHIVERY) | ₹392.45 | ₹611.60 | 35.8% |

Camlin Fine Sciences (BSE:532834) | ₹107.43 | ₹156.85 | 31.5% |

Godrej Properties (NSEI:GODREJPROP) | ₹3111.25 | ₹4553.24 | 31.7% |

We're going to check out a few of the best picks from our screener tool

Godrej Properties

Overview: Godrej Properties Limited operates primarily in real estate construction and development across India, with a market capitalization of approximately ₹836.20 billion.

Operations: The company generates revenue primarily from real estate construction and development, totaling approximately ₹29.95 billion, with a smaller segment in hospitality bringing in about ₹0.41 billion.

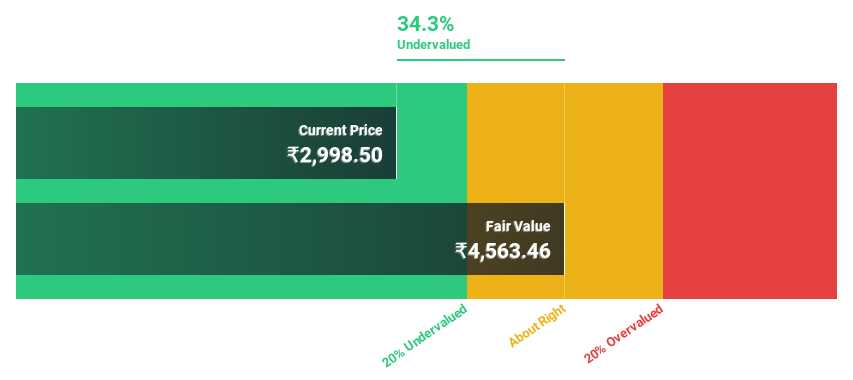

Estimated Discount To Fair Value: 31.7%

Godrej Properties, with a current price of ₹3111.25, appears undervalued based on DCF analysis, suggesting a fair value of ₹4553.24. Despite this potential underpricing, concerns persist as the company's debt is not well covered by operating cash flows. However, recent financial reports show robust growth with annual earnings increasing significantly and revenue growth outpacing the Indian market average. This trend is supported by strong sales results and an expanded booking value in FY 2024.

PVR INOX

Overview: PVR INOX Limited operates as a theatrical exhibition company involved in the exhibition, distribution, and production of movies across India and Sri Lanka, with a market capitalization of approximately ₹140.99 billion.

Operations: The company generates revenue primarily from movie exhibition, totaling ₹60.71 billion, and other related activities which contribute an additional ₹3.17 billion.

Estimated Discount To Fair Value: 36.1%

PVR INOX, priced at ₹1421.1, is significantly undervalued with a DCF-based fair value of ₹2222.35, reflecting a 36.1% discount. Expected to turn profitable within three years, its revenue growth rate at 11.3% annually outpaces the Indian market's 9.6%. However, its forecasted return on equity remains low at 9.8%. Recent expansions include launching multiplexes in Andhra Pradesh and Rajasthan, enhancing its premium offerings and nationwide presence.

Vedanta

Overview: Vedanta Limited is a diversified natural resources company that operates in the exploration, extraction, and processing of minerals and oil and gas across India, Europe, China, the United States, Mexico, and globally, with a market capitalization of approximately ₹1.74 trillion.

Operations: Vedanta's revenue is primarily derived from Aluminium (₹483.71 billion), Zinc - India (₹279.25 billion), Copper (₹197.30 billion), Oil and Gas (₹178.37 billion), Power (₹61.53 billion), Iron Ore (₅90.69 billion), and Zinc - International (₹35.56 billion).

Estimated Discount To Fair Value: 27.6%

Vedanta, priced at ₹463.35, is trading below its estimated fair value of ₹640.13, indicating a significant undervaluation. Despite a high debt level and lower profit margins year-over-year (3% down from 7.2%), the company's earnings are forecast to grow robustly at 42.8% annually over the next three years, outpacing the Indian market's growth rate. Recent strategic moves include plans to divest its steel business to reduce debt, aligning with financial restructuring efforts such as raising INR 10 billion through non-convertible debentures and potential further equity issuances up to INR 85 billion.

Make It Happen

Access the full spectrum of 16 Undervalued Indian Stocks Based On Cash Flows by clicking on this link.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:GODREJPROP NSEI:PVRINOX and NSEI:VEDL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance