3 Indian Exchange Growth Companies With High Insider Ownership And Up To 24% Revenue Growth

Despite a recent 5.3% drop over the last week, the Indian market has shown robust growth, up 34% over the past year with earnings expected to grow by 16% annually. In this context, companies with high insider ownership and significant revenue growth stand out as potentially strong performers, aligning closely with investor interests and market optimism.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.1% |

Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 28.6% |

Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 38% | 22.9% |

Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

Kirloskar Pneumatic (BSE:505283) | 30.6% | 27.7% |

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 33.1% |

Aether Industries (NSEI:AETHER) | 31.1% | 39.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

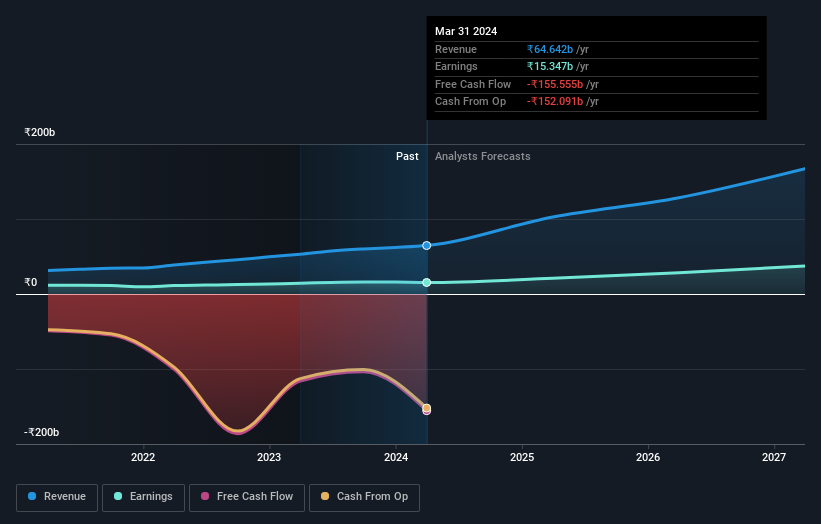

AU Small Finance Bank

Simply Wall St Growth Rating: ★★★★★☆

Overview: AU Small Finance Bank Limited operates in India, offering a range of banking and financial services, with a market capitalization of approximately ₹497.43 billion.

Operations: The bank's revenue is derived from Treasury (₹17.04 billion), Retail Banking (₹91.18 billion), and Wholesale Banking (₹11.61 billion).

Insider Ownership: 24.3%

Revenue Growth Forecast: 24.9% p.a.

AU Small Finance Bank, a growth-oriented entity with high insider ownership in India, has shown robust financial performance with earnings and revenue growth surpassing the Indian market average. The bank's revenue is expected to grow by 24.9% annually, while earnings are forecasted to increase by 24% per year. Despite recent regulatory penalties for minor infractions, the bank has proactively addressed these issues, demonstrating a commitment to regulatory compliance and operational improvement. This proactive approach is reflected in their consistent financial results and strategic executive appointments aimed at sustaining growth.

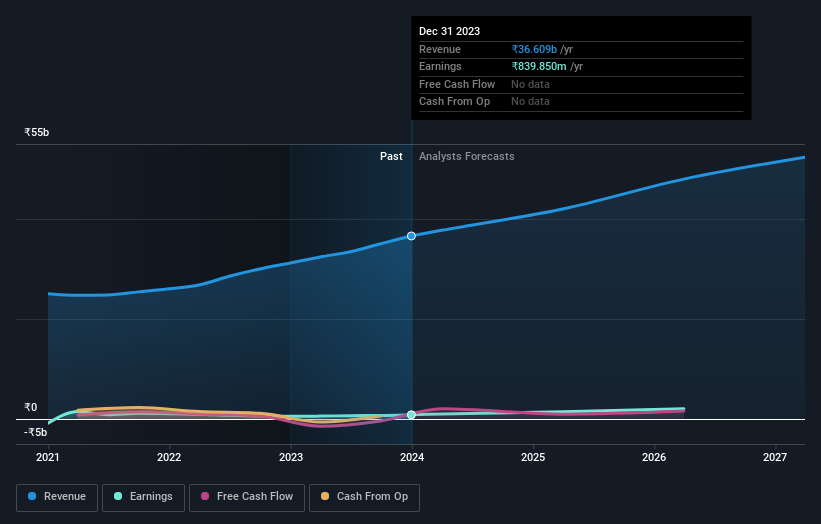

Heritage Foods

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Heritage Foods Limited operates in India, focusing on the procurement and processing of milk and milk products, with a market capitalization of approximately ₹50.71 billion.

Operations: The company generates revenue primarily through its Dairy segment at ₹36.06 billion, with additional income from Feed and Renewable Energy segments amounting to ₹1.48 billion and ₹0.09 billion respectively.

Insider Ownership: 37.2%

Revenue Growth Forecast: 11.1% p.a.

Heritage Foods, despite its volatile share price, has demonstrated strong growth with a 59.9% earnings increase over the past year and is expected to continue this trend with a forecasted annual profit growth of 31.06%. However, its revenue growth at 11.1% annually, though above the Indian market average, trails the high-growth benchmark of 20%. Additionally, its modest dividend coverage and recent board changes suggest potential challenges in maintaining steady leadership and financial stability.

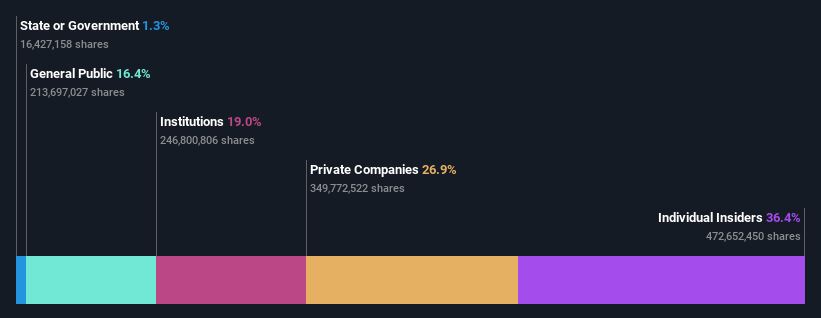

Varun Beverages

Simply Wall St Growth Rating: ★★★★★☆

Overview: Varun Beverages Limited operates as a franchisee of PepsiCo, producing and distributing carbonated soft drinks and non-carbonated beverages, with a market capitalization of approximately ₹1.94 trillion.

Operations: The company generates its revenue primarily from the manufacturing and sale of beverages, totaling approximately ₹16.47 billion.

Insider Ownership: 36.4%

Revenue Growth Forecast: 16.3% p.a.

Varun Beverages, a company with substantial insider ownership, is expanding its footprint by launching a new subsidiary in Zimbabwe and starting production of beverages in Uttar Pradesh. Despite having high debt levels, the firm reported significant earnings growth of 29.4% last year and forecasts suggest robust future earnings growth at 23% annually, outpacing the Indian market's average. Recent executive changes, including a new CFO appointment, indicate strategic shifts potentially impacting financial management and oversight.

Taking Advantage

Click this link to deep-dive into the 82 companies within our Fast Growing Indian Companies With High Insider Ownership screener.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:AUBANKNSEI:HERITGFOOD and NSEI:VBL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance