3 High Yielding Japanese Dividend Stocks With Up To 3.4% Yield

Amid a backdrop of global market fluctuations, Japan's stock markets have shown resilience, with significant gains in major indices such as the Nikkei 225 and TOPIX. This positive momentum, driven by a historically weak yen benefiting export-heavy industries, sets an intriguing stage for investors looking at high-yielding dividend stocks. In this context, selecting strong dividend-yielding stocks involves not just looking at the yield itself but also considering the overall stability and growth prospects of the company within these buoyant market conditions.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.83% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.47% | ★★★★★★ |

Globeride (TSE:7990) | 3.74% | ★★★★★★ |

Koei Tecmo Holdings (TSE:3635) | 3.60% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.47% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 6.72% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 5.12% | ★★★★★★ |

Japan Pulp and Paper (TSE:8032) | 4.11% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.07% | ★★★★★★ |

Innotech (TSE:9880) | 3.95% | ★★★★★★ |

Click here to see the full list of 378 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Riken Technos

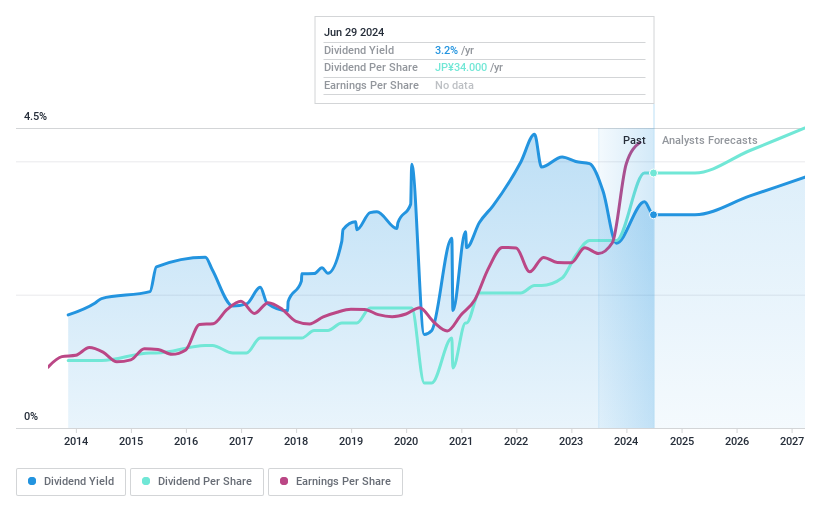

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Riken Technos Corporation operates in the compound, film, and food wrapping film sectors both domestically and internationally, with a market capitalization of approximately ¥58.46 billion.

Operations: Riken Technos Corporation generates revenue from its activities in compounding, film production, and the manufacture of food wrapping films.

Dividend Yield: 3.2%

Riken Technos offers a dividend yield of 3.2%, which is slightly below the top quartile for Japanese dividend stocks. Despite this, its dividends are well-supported by earnings and cash flows, with payout ratios of 26.5% and 28.7% respectively, indicating sustainability. However, the company's dividend history has been marked by volatility over the past decade, suggesting potential uncertainty for future payouts. Additionally, earnings are projected to decline by an average of 2.9% annually over the next three years.

Mizuho Financial Group

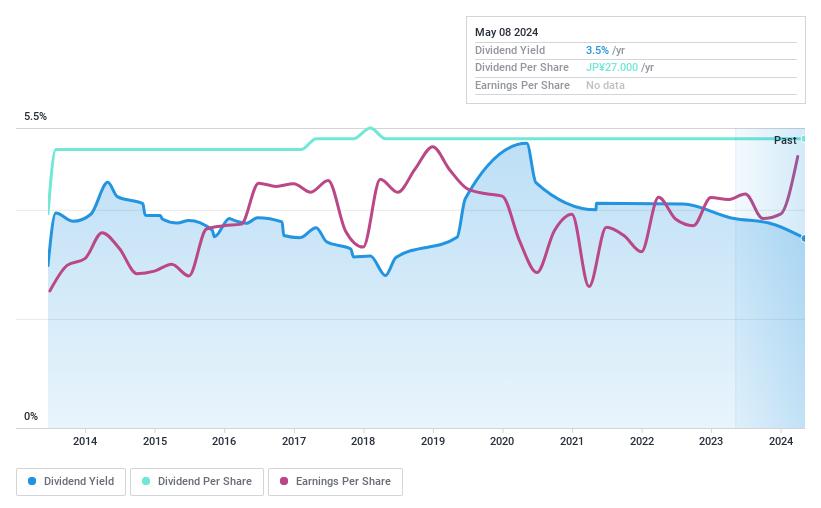

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mizuho Financial Group, Inc. operates a diversified financial services business including banking, trust, securities, and other financial activities across Japan and globally, with a market capitalization of approximately ¥8.51 trillion.

Operations: Mizuho Financial Group, Inc. generates revenue through several key segments: The Retail & Business Banking Company (RBC) at ¥749.22 billion, The Corporate & Investment Banking Company (CIBC) at ¥556.31 billion, The Global Corporate & Investment Banking Company (GCIBC) at ¥670.22 billion, The Global Markets Company (GMC) at ¥432.46 billion, and The Asset Management Company (AMC) at ¥57.22 billion.

Dividend Yield: 3.4%

Mizuho Financial Group has shown a robust dividend increase, with recent dividends rising from ¥42.5 to ¥55.0 per share, and further expected to grow to ¥57.5 in the upcoming fiscal year. This growth aligns with the company’s stable dividend track record over the past decade and a solid payout ratio of 39.2%, indicating that earnings sufficiently cover the payouts. However, it's crucial to note that while Mizuho maintains a high dividend yield at 3.42%, there is insufficient data on long-term sustainability beyond three years due to unpredictable earnings coverage and cash flows, coupled with an ongoing strategic investment in InCred Financial Services which may influence future financial flexibility.

Fuji

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fuji Corporation Limited, primarily engaged in the design, construction, and sale of detached houses and condominiums in Japan, has a market capitalization of approximately ¥29.36 billion.

Operations: Fuji Corporation Limited generates its revenue from the design, construction, and sales of residential properties in Japan.

Dividend Yield: 3.3%

Fuji Corporation maintains a dividend yield of 3.32%, slightly below the top quartile for Japanese dividend stocks. Despite a low payout ratio of 27.1% suggesting earnings sufficiently cover dividends, both earnings and cash flows raise concerns about long-term sustainability. Over the past decade, dividends have shown stability and growth, yet recent financial strain is evident as debt is poorly covered by operating cash flow, and there are no free cash flows to support future payouts. Additionally, Fuji's price-to-earnings ratio at 6.4x remains attractively below the market average.

Seize The Opportunity

Explore the 378 names from our Top Dividend Stocks screener here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:4220 TSE:8411 and TSE:8860.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance