3 High Yield Dividend Stocks On KRX With Returns Up To 9.7%

The South Korean market has shown resilience, maintaining a flat performance over the past week and achieving a 6.0% increase over the last year, with expectations of earnings growing by 30% annually. In this environment, high-yield dividend stocks can be particularly appealing for investors looking for steady income streams combined with potential capital appreciation.

Top 10 Dividend Stocks In South Korea

Name | Dividend Yield | Dividend Rating |

Kia (KOSE:A000270) | 4.46% | ★★★★★★ |

LOTTE Fine Chemical (KOSE:A004000) | 4.31% | ★★★★★☆ |

NH Investment & Securities (KOSE:A005940) | 6.15% | ★★★★★☆ |

Shinhan Financial Group (KOSE:A055550) | 4.00% | ★★★★★☆ |

Industrial Bank of Korea (KOSE:A024110) | 6.91% | ★★★★★☆ |

KT (KOSE:A030200) | 5.47% | ★★★★★☆ |

KB Financial Group (KOSE:A105560) | 3.56% | ★★★★★☆ |

Kyung Nong (KOSE:A002100) | 4.93% | ★★★★★☆ |

HANYANG ENGLtd (KOSDAQ:A045100) | 3.12% | ★★★★★☆ |

Cheil Worldwide (KOSE:A030000) | 5.98% | ★★★★☆☆ |

Click here to see the full list of 72 stocks from our Top KRX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

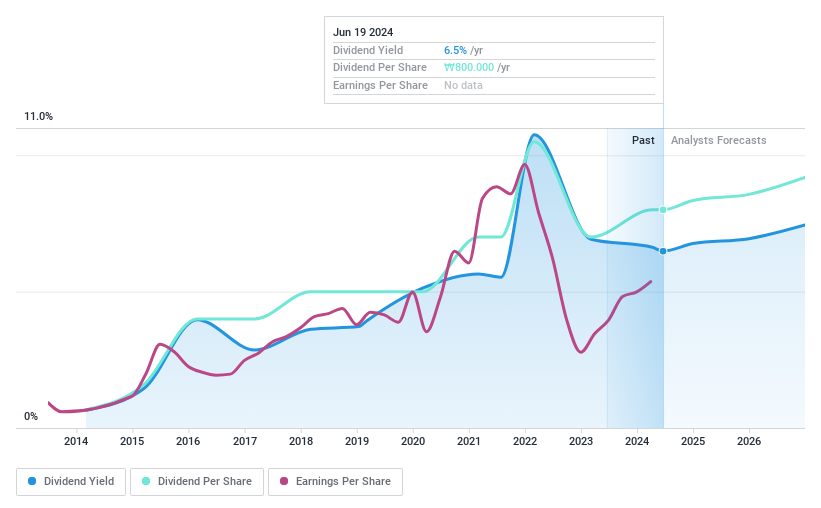

NH Investment & Securities

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NH Investment & Securities Co., Ltd. operates in wealth management, investment banking, trading, and equity sales both domestically in South Korea and internationally, with a market capitalization of approximately ₩4.47 trillion.

Operations: NH Investment & Securities Co., Ltd. generates revenue primarily through sales (₩2.83 billion), trading (₩3.26 billion), and investment banking (₩0.87 billion).

Dividend Yield: 6.1%

NH Investment & Securities has shown a mix of stability and volatility in its dividend performance. Despite a volatile 10-year history, recent earnings growth (55% year-over-year) and forecasts (6.07% annual growth) suggest improving fundamentals. The dividends, yielding 6.31%, are well-covered by both earnings (46.9% payout ratio) and cash flows (31.1% cash payout ratio), positioning it above many peers in the Korean market. However, past instability and significant one-off items impacting financial results may raise concerns about future reliability.

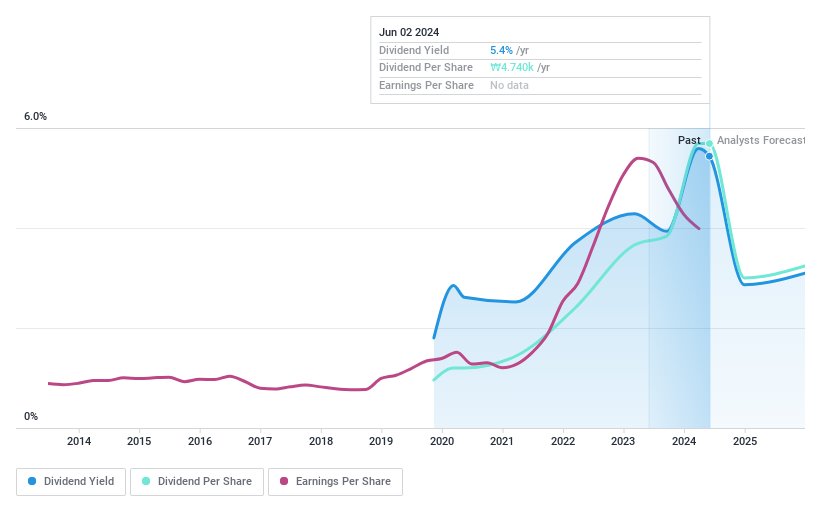

Youngone Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Youngone Holdings Co., Ltd. is a South Korean company that manufactures and sells apparel, footwear, gear, sportswear, and jackets globally, with a market capitalization of approximately ₩994.54 billion.

Operations: Youngone Holdings Co., Ltd. generates its revenue from the global sales of apparel, footwear, gear, sportswear, and jackets.

Dividend Yield: 5.5%

Youngone Holdings offers a solid dividend yield at 5.87%, ranking in the top 25% in the South Korean market. Despite a less established dividend history of under 10 years, its dividends are well-supported by both earnings and cash flows, with low payout ratios of 13.3% and 9.9%, respectively. The stock trades at a significant discount, valued at 78.7% below estimated fair value, enhancing its appeal relative to industry peers. However, its short dividend history and modest annual earnings growth projection of 3.07% may temper expectations for future dividend growth stability.

Take a closer look at Youngone Holdings' potential here in our dividend report.

Upon reviewing our latest valuation report, Youngone Holdings' share price might be too pessimistic.

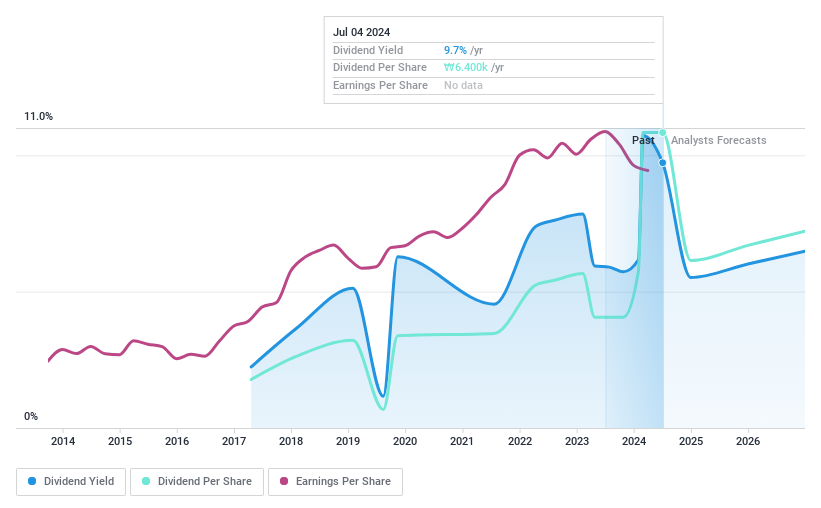

Hana Financial Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hana Financial Group Inc., a major South Korean financial services provider operating through its subsidiaries, has a market capitalization of approximately ₩18.67 trillion.

Operations: Hana Financial Group Inc. generates revenue primarily through three segments: Banking (₩8.98 billion), Capital (₩1.01 billion), and Credit Card (₩0.52 billion).

Dividend Yield: 9.7%

Hana Financial Group maintains a high dividend yield of 9.91%, placing it among the top quartile in the South Korean market. Despite its attractive yield, the company's dividend history is relatively short and marked by volatility, with dividends being paid for just 7 years and experiencing fluctuations. The dividends are currently well-covered by earnings with a payout ratio of 30.5%, and projections indicate continued coverage at 28.6% in three years. However, recent financials show a slight decline in net income from KRW 1,102 billion to KRW 1,034 billion year-over-year as of Q1 2024.

Taking Advantage

Unlock our comprehensive list of 72 Top KRX Dividend Stocks by clicking here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSE:A005940 KOSE:A009970 and KOSE:A086790.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance