3 High-Potential US Growth Stocks With Up To 26% Insider Ownership

The United States stock market has shown robust growth, rising 1.7% over the last week and achieving a 26% increase over the past year, with earnings expected to grow by 15% annually. In this context, stocks with high insider ownership can be particularly compelling, as they often indicate that those who know the company best are confident in its future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 26% | 21% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 22.4% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 28.2% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

EHang Holdings (NasdaqGM:EH) | 33% | 98.1% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

ZKH Group (NYSE:ZKH) | 17.7% | 91.8% |

BBB Foods (NYSE:TBBB) | 23.6% | 77.5% |

Capital Bancorp (NasdaqGS:CBNK) | 34.9% | 27.2% |

Neonode (NasdaqCM:NEON) | 24.7% | 158% |

We're going to check out a few of the best picks from our screener tool.

Bowman Consulting Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bowman Consulting Group Ltd. operates in the United States, offering a variety of solutions including real estate, energy, infrastructure, and environmental management with a market capitalization of approximately $576.99 million.

Operations: The primary revenue stream, generating $365.06 million, comes from providing engineering and related professional services.

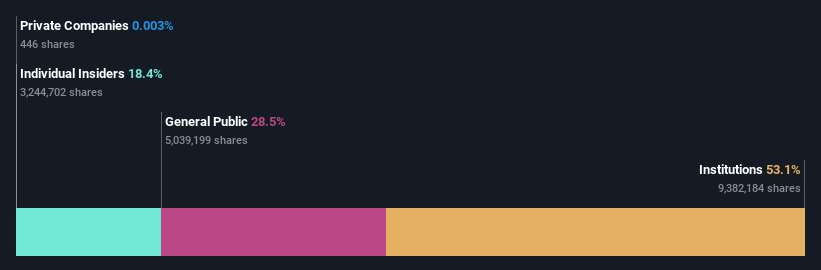

Insider Ownership: 18.4%

Bowman Consulting Group Ltd. recently secured a major contract with the Arizona Department of Transportation, marking its strategic expansion into Western U.S. public works and transportation markets. This aligns with Bowman's appointment of Vijay Agrawal to lead its national ports and harbors practice, leveraging technology-driven solutions for efficiency and safety improvements in maritime infrastructure. Despite these advancements, the company reported a net loss in Q1 2024 but has updated its full-year earnings guidance positively, reflecting potential growth from ongoing and future projects.

PDF Solutions

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PDF Solutions, Inc. offers software and intellectual property products for integrated circuit designs, along with electrical measurement hardware tools and professional services globally, with a market cap of approximately $1.32 billion.

Operations: The company generates revenue primarily through its Software & Programming segment, which accounted for $166.39 million.

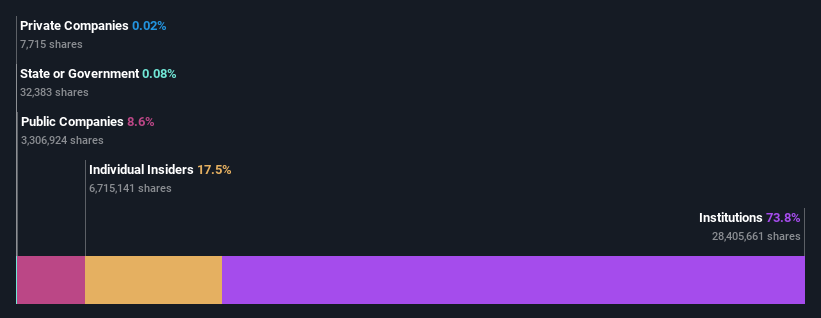

Insider Ownership: 17.5%

PDF Solutions, a company with high insider ownership, recently reported a slight revenue increase to US$41.31 million in Q1 2024 but shifted from a net profit last year to a net loss of US$0.393 million. Despite this setback, the company is optimistic, projecting a 20% revenue growth in the second half of 2024. Additionally, PDF Solutions has actively repurchased shares, spending US$24.29 million to buy back 2.48% of its stock since May 2022, underlining confidence by insiders in the company's value proposition and future prospects.

Dive into the specifics of PDF Solutions here with our thorough growth forecast report.

The valuation report we've compiled suggests that PDF Solutions' current price could be inflated.

Similarweb

Simply Wall St Growth Rating: ★★★★★☆

Overview: Similarweb Ltd. offers cloud-based digital intelligence solutions across various global regions, with a market capitalization of approximately $628.04 million.

Operations: The company generates revenue primarily through its segment focusing on online financial information providers, totaling $224.25 million.

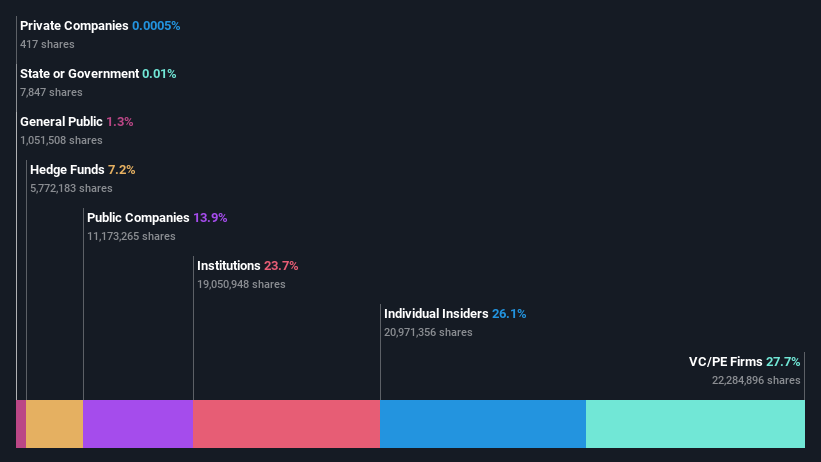

Insider Ownership: 26.1%

Similarweb, a growth company with high insider ownership, reported a significant reduction in its net loss to US$2.73 million in Q1 2024 from US$11.83 million the previous year, alongside a revenue increase to US$58.98 million. The firm has forecasted steady revenue growth and is set to become profitable within three years. Recent strategic moves include filing a substantial Shelf Registration and launching innovative AI-driven products like SAM, enhancing its digital data capabilities and market position.

Taking Advantage

Click through to start exploring the rest of the 173 Fast Growing US Companies With High Insider Ownership now.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGM:BWMN NasdaqGS:PDFS and NYSE:SMWB.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance