3 High Insider Ownership Indian Stocks With Up To 35% Earnings Growth

The Indian stock market has experienced a notable fluctuation recently, declining 2.5% over the last week but showing a robust increase of 40% over the past year with earnings expected to grow by 17% annually. In this context, stocks with high insider ownership can be particularly compelling as they often indicate that company leaders have significant confidence in their firm's future prospects.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 29.0% |

Pitti Engineering (BSE:513519) | 33.6% | 36.5% |

Triveni Turbine (BSE:533655) | 28.6% | 21.1% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Dixon Technologies (India) (NSEI:DIXON) | 25% | 26.7% |

Jupiter Wagons (NSEI:JWL) | 11.1% | 25.8% |

Paisalo Digital (BSE:532900) | 16.3% | 27.8% |

MTAR Technologies (NSEI:MTARTECH) | 38.4% | 41.7% |

Kirloskar Pneumatic (BSE:505283) | 30.7% | 27.7% |

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 35.5% |

Let's dive into some prime choices out of from the screener.

Heritage Foods

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Heritage Foods Limited, operating in India, engages in the procurement and processing of milk and milk products with a market capitalization of approximately ₹33.69 billion.

Operations: The primary revenue streams include ₹36.06 billion from dairy and ₹1.48 billion from feed, with a smaller contribution of ₹0.09 billion from renewable energy.

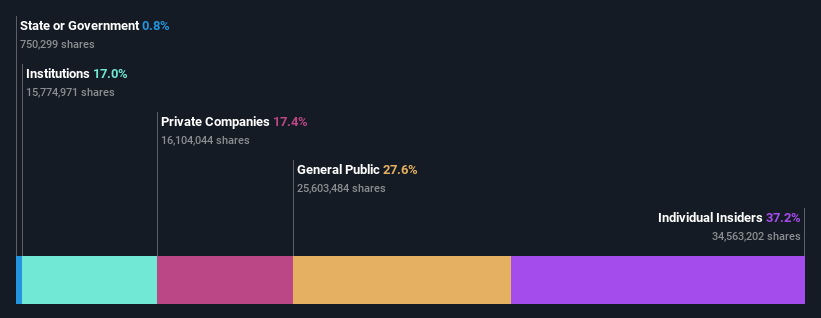

Insider Ownership: 37.2%

Earnings Growth Forecast: 36% p.a.

Heritage Foods, with its recent expansion into a new Ultra High Temperature (UHT) Milk plant, is poised for diverse market reach and product innovation in India. Despite trading slightly below its estimated fair value and having a low dividend coverage by cash flows, the company shows robust earnings growth projections at 36% annually over the next three years, outpacing the Indian market's 17% growth rate. However, it should be noted that its Return on Equity is expected to remain modest at 18.5%.

Metro Brands

Simply Wall St Growth Rating: ★★★★★☆

Overview: Metro Brands Limited is a specialty footwear retailer in India with a market capitalization of approximately ₹293.62 billion.

Operations: The company primarily generates revenue from the sale of fashion footwear, bags, and accessories, totaling ₹23.18 billion.

Insider Ownership: 18.3%

Earnings Growth Forecast: 23.5% p.a.

Metro Brands, known for its high insider ownership, is set to enhance its market position through a renewed partnership with Crocs India, gaining exclusive rights to operate Crocs stores in key Indian regions. This strategic move coincides with the company's inclusion in the FTSE All-World Index and the appointment of Roch D'Souza as Senior Vice President of Marketing, signaling a strong focus on brand expansion and innovative marketing strategies. Despite an unstable dividend track record, Metro Brands is forecasted to achieve significant earnings growth of 23.53% annually and revenue growth of 15.9% per year, outperforming broader Indian market expectations.

Metropolis Healthcare

Simply Wall St Growth Rating: ★★★★★☆

Overview: Metropolis Healthcare Limited operates as a provider of diagnostic services in India, with a market capitalization of approximately ₹93.80 billion.

Operations: The company generates approximately ₹11.59 billion from pathology services.

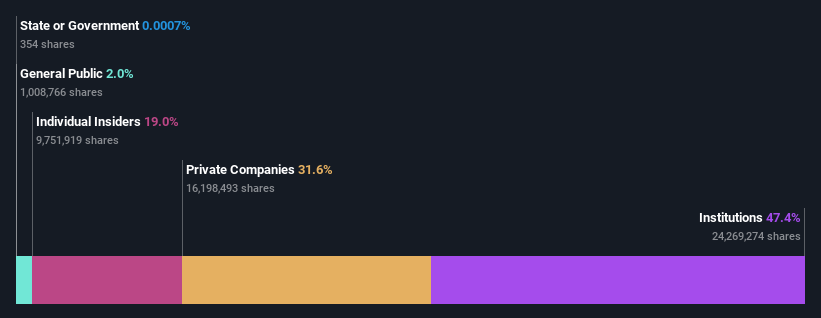

Insider Ownership: 19%

Earnings Growth Forecast: 24.8% p.a.

Metropolis Healthcare, despite a recent lack of insider buying and an unstable dividend track record, is poised for robust growth with forecasted earnings increasing by 24.84% annually. Revenue is also expected to rise by 11.6% per year, outpacing the broader Indian market's growth rate of 9.6%. Recent financial results underscore this trajectory, showing a significant year-on-year increase in core business and B2C revenues for the fourth quarter ended March 31, 2024.

Key Takeaways

Investigate our full lineup of 87 Fast Growing Indian Companies With High Insider Ownership right here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:HERITGFOOD NSEI:METROBRAND and NSEI:METROPOLIS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance