3 Growth Companies With High Insider Ownership And Up To 23% Revenue Growth

As global markets exhibit mixed signals with the S&P 500 reaching new highs and sectors like technology leading the charge, investors are navigating through a landscape shaped by fluctuating interest rates and economic indicators. In such a market, growth companies with high insider ownership can be particularly compelling, as this combination often signals strong confidence in the company’s future from those who know it best.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

Cettire (ASX:CTT) | 28.7% | 26.7% |

Gaming Innovation Group (OB:GIG) | 26.7% | 36.9% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Vow (OB:VOW) | 31.8% | 97.6% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

Adocia (ENXTPA:ADOC) | 11.9% | 59.8% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

Let's dive into some prime choices out of from the screener.

Pharma Mar

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pharma Mar, S.A. is a biopharmaceutical company focused on the research, development, production, and commercialization of bio-active principles for oncology use across various regions including Spain, Italy, Germany, Ireland, France, other parts of the European Union, and the United States with a market cap of approximately €0.67 billion.

Operations: The company generates €160.64 million from its oncology segment.

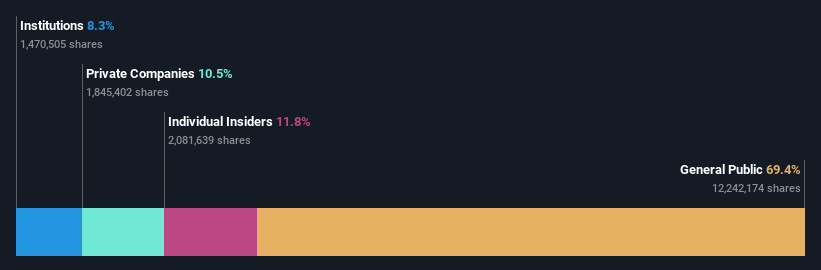

Insider Ownership: 11.8%

Revenue Growth Forecast: 17.8% p.a.

Pharma Mar, a company with significant insider ownership, is making strides in cancer treatment through its marine-derived drug Zepzelca® (lurbinectedin), particularly for Small Cell Lung Cancer. Recent Phase II trial results showcased promising response rates and manageable safety profiles, reinforcing its potential as a second-line treatment. Despite this innovation, revenue growth projections are modest at 17.8% annually, trailing behind the desired 20% mark but still outpacing the Spanish market's 4.7%. Earnings are expected to surge by 46.9% annually, significantly above Spain's average growth rate. However, profit margins have dipped from last year’s figures.

Click to explore a detailed breakdown of our findings in Pharma Mar's earnings growth report.

Upon reviewing our latest valuation report, Pharma Mar's share price might be too optimistic.

ShenZhen Woer Heat-Shrinkable MaterialLtd

Simply Wall St Growth Rating: ★★★★★★

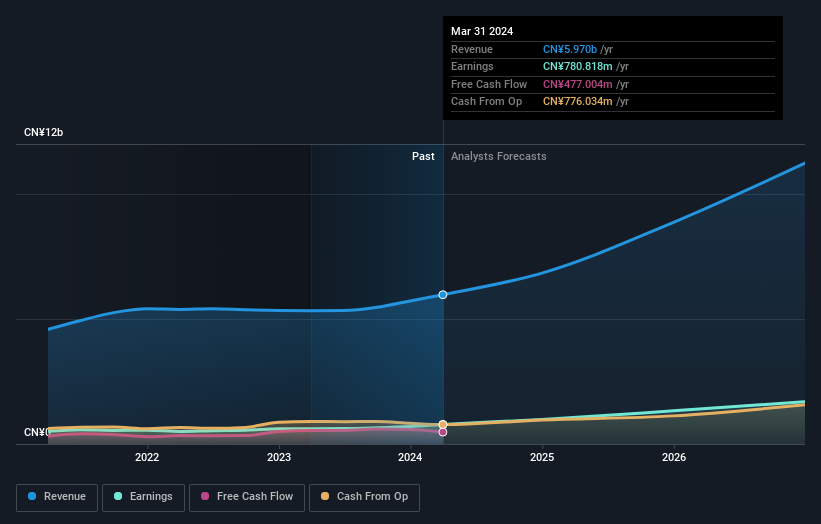

Overview: ShenZhen Woer Heat-Shrinkable Material Co., Ltd. specializes in the production of heat-shrinkable materials, with a market capitalization of approximately CN¥20.27 billion.

Operations: The company generates revenue from the production of heat-shrinkable materials.

Insider Ownership: 19%

Revenue Growth Forecast: 23.6% p.a.

ShenZhen Woer Heat-Shrinkable Material Co., Ltd. is poised for robust growth with earnings and revenue forecast to expand significantly, outpacing the broader Chinese market. Despite a volatile share price and an unstable dividend track record, the company's strong insider ownership aligns leadership interests with shareholders. Recent corporate actions include a modest buyback and consistent dividend payouts, underscoring its commitment to returning value while aggressively pursuing growth in its sector.

Dongguan Aohai Technology

Simply Wall St Growth Rating: ★★★★★☆

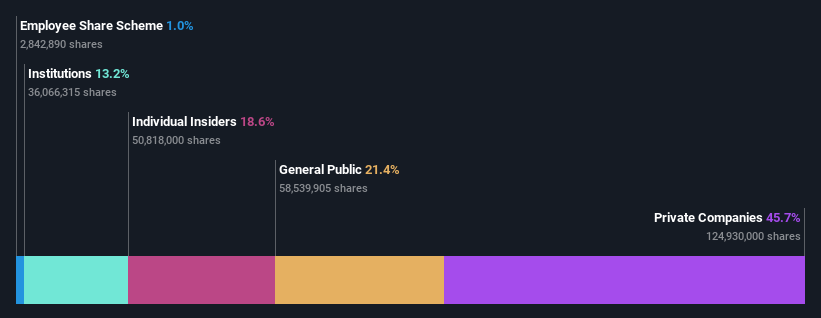

Overview: Dongguan Aohai Technology Co., Ltd. is a company that specializes in the research, development, production, and sale of consumer electronics products both domestically and internationally, with a market capitalization of approximately CN¥10.14 billion.

Operations: The company generates revenue primarily from the manufacturing of computer, communications, and other electronic equipment, totaling CN¥5.17 billion.

Insider Ownership: 18.6%

Revenue Growth Forecast: 23.6% p.a.

Dongguan Aohai Technology, with a lower Price-To-Earnings ratio than the market average, shows promise in value. The company's earnings are expected to grow by 24.18% annually, outstripping the Chinese market forecast. However, its dividend coverage by free cash flows raises sustainability concerns. Recent corporate actions include consistent dividend payments and amendments to its articles of association, reflecting active management involvement and commitment to shareholders' interests despite a forecast of low Return on Equity in three years.

Next Steps

Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1442 companies by clicking here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include BME:PHM SZSE:002130 and SZSE:002993.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance