3 Growth Companies On Euronext Amsterdam With High Insider Ownership And At Least 14% Revenue Growth

As global markets navigate through a period of cautious optimism and fluctuating bond yields, the Netherlands stock market remains a focal point for investors looking for growth opportunities. Amidst this backdrop, companies on Euronext Amsterdam with high insider ownership and robust revenue growth stand out as potentially resilient investment options in uncertain times.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

Name | Insider Ownership | Earnings Growth |

BenevolentAI (ENXTAM:BAI) | 27.8% | 62.8% |

Envipco Holding (ENXTAM:ENVI) | 16% | 68.9% |

Ebusco Holding (ENXTAM:EBUS) | 33.2% | 114.0% |

MotorK (ENXTAM:MTRK) | 35.8% | 105.8% |

Basic-Fit (ENXTAM:BFIT) | 12% | 66.1% |

PostNL (ENXTAM:PNL) | 30.8% | 24% |

We're going to check out a few of the best picks from our screener tool.

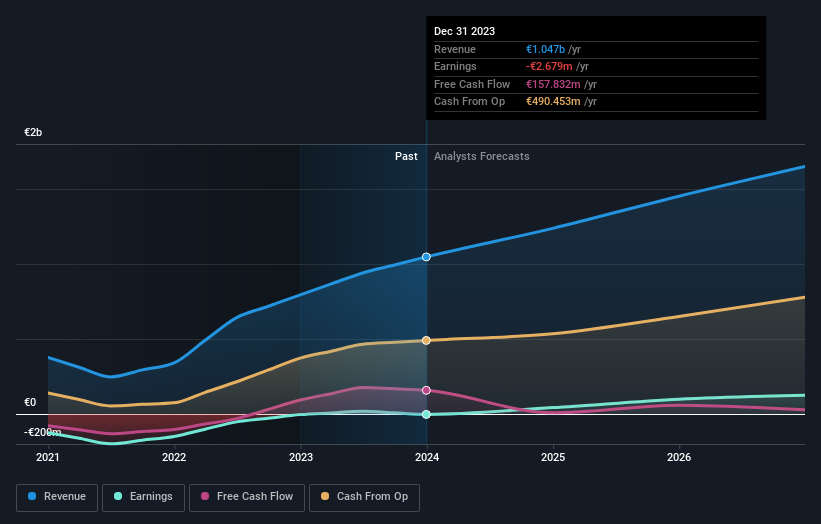

Basic-Fit

Simply Wall St Growth Rating: ★★★★★☆

Overview: Basic-Fit N.V. operates a chain of fitness clubs across Europe, with a market capitalization of approximately €1.34 billion.

Operations: The company generates revenue primarily from its fitness clubs in the Benelux region (€479.04 million) and in France, Spain, and Germany (€568.21 million).

Insider Ownership: 12%

Revenue Growth Forecast: 14.9% p.a.

Basic-Fit, a prominent fitness chain in the Netherlands, showcases promising growth with its revenue expected to increase by 14.9% annually, outpacing the Dutch market's 9.8%. Analysts predict a significant potential upside in its stock price, estimating a 62% increase. Insider activities reflect confidence as more shares have been purchased than sold recently, albeit not in large volumes. The company is also on track to achieve profitability within three years with an anticipated robust annual profit growth and high return on equity forecast at 26.7%.

Dive into the specifics of Basic-Fit here with our thorough growth forecast report.

Our expertly prepared valuation report Basic-Fit implies its share price may be too high.

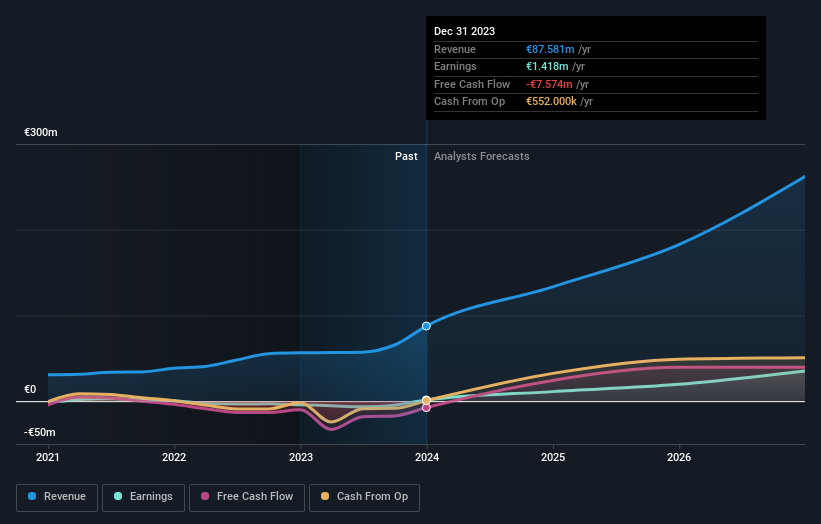

Envipco Holding

Simply Wall St Growth Rating: ★★★★★☆

Overview: Envipco Holding N.V. specializes in designing, developing, manufacturing, and selling or leasing reverse vending machines for recycling used beverage containers, operating mainly in the Netherlands, North America, and Europe with a market capitalization of approximately €337.49 million.

Operations: The company generates revenue primarily through the design, development, manufacture, and sale or lease of reverse vending machines in key markets including the Netherlands, North America, and Europe.

Insider Ownership: 16%

Revenue Growth Forecast: 33.3% p.a.

Envipco Holding N.V. has demonstrated a strong turnaround, transitioning from a net loss to reporting a net income of €0.147 million and tripling sales to €27.44 million in the first quarter of 2024. The company's revenue and earnings are expected to grow at 33.3% and 68.9% per year respectively, significantly outpacing the Dutch market averages of 9.8% and 18.1%. Despite high volatility in its share price recently, insider transactions have been more biased towards buying than selling, indicating positive sentiment among those closest to the company.

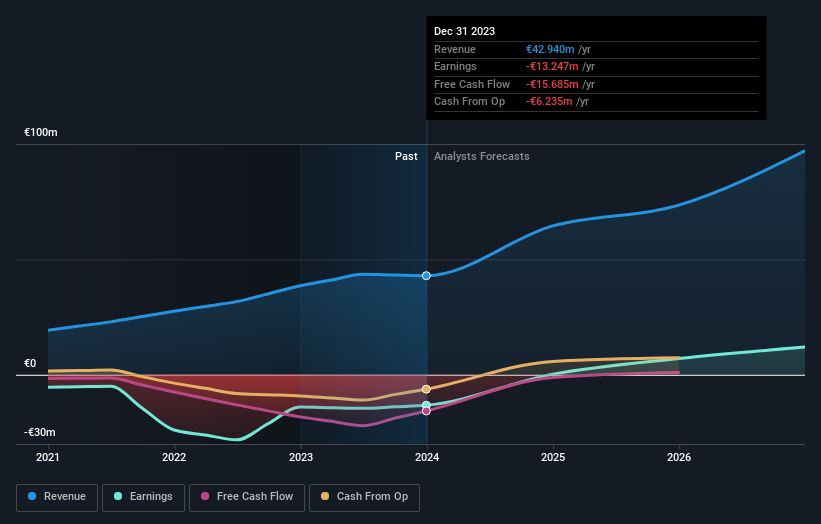

MotorK

Simply Wall St Growth Rating: ★★★★★☆

Overview: MotorK plc operates as a provider of software-as-a-service solutions for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union, with a market capitalization of approximately €273.01 million.

Operations: The company generates revenue primarily through its software and programming segment, amounting to €42.94 million.

Insider Ownership: 35.8%

Revenue Growth Forecast: 24% p.a.

MotorK, amidst leadership transitions with Helen Protopapas joining as a director, reported a slight dip in quarterly revenue to €11.25 million from €11.43 million year-over-year. Despite this, the company's revenue is expected to increase by 24% annually, outpacing the Dutch market's 9.8%. While currently unprofitable, MotorK is projected to achieve profitability within three years with an anticipated earnings growth of 105.85% per year, signaling robust potential ahead despite recent shareholder dilution.

Summing It All Up

Dive into all 6 of the Fast Growing Euronext Amsterdam Companies With High Insider Ownership we have identified here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTAM:BFITENXTAM:ENVI and ENXTAM:MTRK

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance