Here’s How 3 Global Companies Are Embracing Disruption

A Germany energy giant, a Belgium-based beer titan, and a Singaporean tech heavyweight may make for strange bedfellows. But all three appear on the Global 500, Fortune’s annual ranking of the best in world business. This year’s list represents many examples of the disruption that is faced by many of the world’s biggest companies on many levels. All three of these corporations have embraced the art of reinvention as a means to combat increasing competition, low crude prices, or to keep up with the latest developments in technology. Here’s how these three companies are navigating the winds of change in global business.

E.ON (No. 32 on the Global 500)

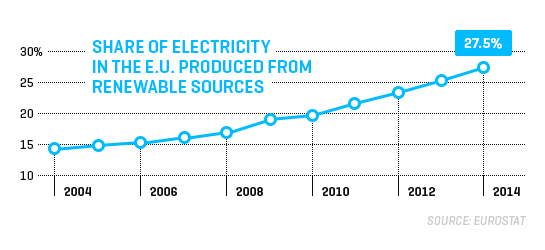

Germany's push to generate electricity from renewable sources rather than fossil fuels and nuclear reactors, combined with the global commodities crisis, helped spell bad news for German power giant E.ON last year. The company suffered a record $7.8 billion loss as it wrote down the value of its traditional power plants. Still, E.ON has reason to be optimistic. After spinning off its fossil and hydro assets into a new company called Uniper in January, E.ON is now more focused on energy networks, services, and renewables.

Check out “This Chart Shows the World’s 500 Largest Companies” for more on the Global 500.

Anheuser-Busch InBev (No. 211 on the Global 500)

Beer barrels outside an Sabmiller Brewery In Budapest.Akos Stiller--Bloomberg via Getty Images

Anheuser-Busch InBev indulged in an epic transatlantic shopping spree last year. Not only did the Leuven, Belgium-based beer behemoth strike a $107 billion deal to acquire SABMiller in November--the largest beer-company merger in history--but AB InBev then went on to swallow up craft breweries in Arizona, Colorado, and the U.K. town of Camden. (The company is also selling a number of brands, such as Grolsch and Peroni, to win antitrust approval.)

Flex (No. 441 on the Global 500)

Flex's "pulse center" helps clients manage their supply chains.Courtesy of Flex

Flextronics International renamed itself Flex in July 2015--and hopes that the trimmer moniker will reflect a change in its mission. The Singaporean giant built its business on manufacturing electronics for everyone from and to and . Now Flex is attempting to reinvent itself by developing its own web-connected technology. Its Customer Innovation Center in Milpitas, Calif., develops intellectual property for clients in addition to offering space and training to startups.

Check out the full Global 500 at fortune.com/global500 for more graphics, charts, company profiles, and much more.

A version of this article appears in the August 1, 2016 issue of Fortune with the headline “Global 500 List.”

Yahoo Finance

Yahoo Finance