3 Food Stocks Ready to Dish Out an Earnings Beat This Season

The earnings cycle is back and food players look fairly placed. While input cost inflation remains a hurdle, favorable demand, efficient productivity and saving measures are likely to have aided companies’ performances.

Companies have been benefiting from continued recovery in the foodservice channel. Traffic has been picking up at restaurants, cafes and other foodservice joints, which is favoring companies catering to them. Demand from retailers has also been above the pre-pandemic levels, thanks to increased at-home consumption.

Notably, the pandemic has made society even more aware of the importance of consuming healthy and nutritious food by cooking at home. As a result, the demand for organic and fresh food products has been high, acting as an upside for players in the natural food products industry. Increased at-home consumption has also been working well for companies offering packaged food and snacks, ready-to-cook meals, meat-based food offerings as well as confectionery and bakery items.

Companies have been making the most of the favorable demand trends through constant innovation, product upgrades and portfolio refinement via meaningful acquisitions and divestitures. Companies are also focused on making capacity expansions and technology investments to enhance efficiency in their operations. Apart from this, companies have been coming up with organic and nutrient-rich food options as health and wellness have gained further importance amid the pandemic. A number of companies have been developing their digital capabilities as well, with online shopping gaining prominence.

That being said, escalated input costs remain a concern. Increased raw material costs have been putting pressure on companies’ margins. Supply-chain hiccups across some markets have also led to higher warehouse, packaging and other logistics expenses. Nonetheless, companies have been undertaking prudent pricing and saving measures to combat the cost headwinds. On that note, let’s take a look at a few companies from the food space, which are likely to post an earnings beat this earnings season.

How to Make the Right Choice?

Our research shows that for stocks with the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), the chance of an earnings surprise is as high as 70%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Per the latest Zacks Earnings Outlook, the Consumer Staples sector (which houses food stocks) is likely to witness a top-line decline of 5.1%, whereas the bottom line is expected to increase 4.7% this earnings season.

3 Prominent Picks

Benson Hill, Inc. BHIL, with an Earnings ESP of +9.09% and a Zacks Rank #2, is worth a look. The Zacks Consensus Estimate for its fourth-quarter 2022 earnings is pegged at a loss of 17 cents. The consensus mark for Benson Hill’s bottom line has improved by a penny in the past 30 days. This food technology company has a trailing four-quarter earnings surprise of about 18%, on average.

The company’s Ingredients segment has been performing well. On its third-quarter 2022 earnings call, Benson Hill raised its Ingredients segment full-year guidance on the back of robust demand for non-proprietary ingredient soy and yellow pea products. BHIL also pulled up its gross profit view owing to accelerated top-line growth and expectations of enhanced operating efficiencies. Focus on innovation also keeps the company well-placed for growth. You can see the complete list of today’s Zacks #1 Rank stocks here.

Benson Hill, Inc. Price, Consensus and EPS Surprise

Benson Hill, Inc. price-consensus-eps-surprise-chart | Benson Hill, Inc. Quote

Corteva, Inc. CTVA also deserves a mention. The stock has an Earnings ESP of +33.33% and a Zacks Rank #2. The Zacks Consensus Estimate for Corteva’s fourth-quarter 2022 earnings per share has remained unchanged over the past 30 days at 6 cents. This agriculture business operator has a trailing four-quarter earnings surprise of 19.8%, on average.

The company continues to gain on its efficient global execution and strong customer demand. Solid pricing has also been an upside. Apart from this, portfolio reshaping actions have been working well for Corteva, which is battling cost inflation. CTVA is scheduled to release results on Feb 1.

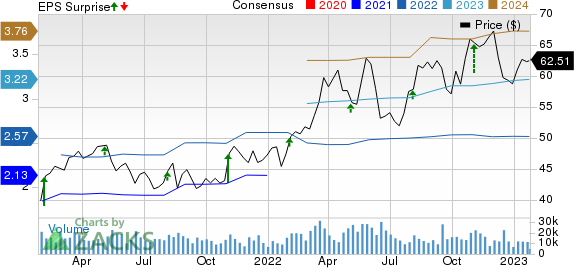

Corteva, Inc. Price, Consensus and EPS Surprise

Corteva, Inc. price-consensus-eps-surprise-chart | Corteva, Inc. Quote

Freshpet, Inc. FRPT is likely to register top- and bottom-line growth when it reports fourth-quarter 2022 results. This manufacturer and marketer of natural fresh meals and treats for dogs and cats an Earnings ESP of +2.04% and a Zacks Rank #3. The Zacks Consensus Estimate for Freshpet’s bottom line has remained unchanged at a loss of 8 cents in the past 30 days.

FRPT has a trailing four-quarter negative earnings surprise of roughly 88%, on average. The company has been benefiting from its robust pricing actions. Focus on innovation and favorable distribution gains are also working well for Freshpet.

Freshpet, Inc. Price, Consensus and EPS Surprise

Freshpet, Inc. price-consensus-eps-surprise-chart | Freshpet, Inc. Quote

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Freshpet, Inc. (FRPT) : Free Stock Analysis Report

Corteva, Inc. (CTVA) : Free Stock Analysis Report

Benson Hill, Inc. (BHIL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance