3 Energy Stocks With Strong Dividend Yields & Safe Payouts

The Energy sector is infamous for being notoriously volatile, with sudden positive surprises and crashes. While wild price moves have always been integral to investment in oil and natural gas, the quantum of uncertainty has increased manifold in recent years, especially post-COVID.

In an erratic energy market setting, you might consider high-quality dividend stocks like HF Sinclair DINO, ExxonMobil XOM and Diamondback Energy FANG to fetch a promising income stream.

Use Dividend to Shield From Unpredictable Energy Prices

From the depths of minus $38 a barrel during the height of the pandemic in April 2020 to a 14-year high surge of above $130 per barrel in March 2022, crude has been on a roller-coaster ride over the past few years.

Of late, the going has been particularly tricky for “black gold.” With investors dumping risky assets in the wake of the biggest U.S. bank collapse since 2008 and the Credit Suisse blowup, oil slumped below $70 for the first time since December 2021. But prices have since recovered to $80 after a surprise production cut from OPEC.

It’s not any different for natural gas. The fuel slumped to a 25-year low in June 2020 but hit $10 per MMBtu for the first time since 2008 in August last year. Now, it is trading at just above $2, on adverse weather predictions and plentiful supplies.

As evident from the energy market story, stocks can take a sudden turn for the good (or bad), making stock picking a risky game. Every good stock also has its bad day, which adds to the risk. With uncertainty ruling Wall Street, it is not surprising that dividend investing has emerged as one of the most popular stock market themes.

Dividend stocks are always investors’ preferred choices as they provide steady income and cushion against market risks. These stocks are generally less volatile in nature and hence, dependable when it comes to long-term investment planning. They not only offer a higher income but also protect against equity market risks.

Moreover, dividend stocks are safe bets to create wealth, as the payouts generally act as a hedge against economic uncertainty and simultaneously provide downside protection by offering sizable yields on a regular basis. Finally, dividend growth can also help investors to offset some of the value destruction of the prevailing high inflationary environment.

How to Pick the Best Dividend Stocks?

Although the benefits of dividend investing cannot be stressed enough, one should keep in mind that not every company can keep up with its dividend-paying momentum. Hence, a cautious strategy needs to be followed to select the best dividend stocks with the potential for steady returns.

To guide investors to the right picks, we are recommending stocks with a payout ratio less than 60 and a dividend yield of at least 2%. Moreover, these companies have hiked their dividends over the past five years.

Calculated by dividing dividend per share by earnings per share, the payout ratio indicates how comfortably a firm can pay the dividend from its earnings. It is one of the key metrics that dividend growth investors consider when looking for potential investments. A payout ratio below 60 looks quite sustainable and leaves enough scope for future dividend hikes.

With our objective to build a dividend income portfolio, we look for companies that have at least better yields than the S&P 500. A representative of the broader market, the index currently yields 1.55%. While our yield criterion isn't very high, it’s at a level where the company can weather all kinds of commodity price environments and provide a reliable income stream to investors.

Finally, we only consider stocks that have a consistent dividend, i.e., paying and increasing offerings over the past five years. It also acts as an indicator of what to expect from the company in the next few years on the payout front.

Our Choices

We have used the above criteria to narrow down three dividend-paying energy stocks.

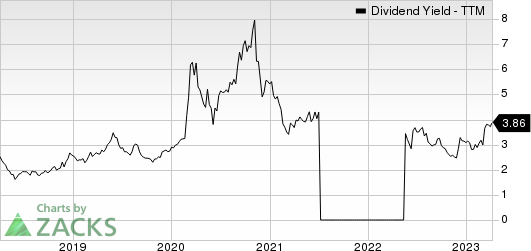

HF Sinclair Corporation: A producer and marketer of gasoline, diesel fuel and other specialty products, HF Sinclair pays out a quarterly dividend of 45 cents ($1.80 annualized) per share that gives it a 4.02% yield at the current stock price. The Zacks Rank #3 (Hold) company’s payout ratio is 11, with a five-year dividend growth rate of 5.90%. (Check HF Sinclair’s dividend history here)

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DINO is valued at some $8.8 billion. The Zacks Consensus Estimate for HF Sinclair’s 2023 earnings has been revised 7% upward over the past 30 days. The downstream operator has a trailing four-quarter earnings surprise of roughly 804%, on average. DINO shares have gained 19.6% in a year.

HF Sinclair Corporation Dividend Yield (TTM)

HF Sinclair Corporation dividend-yield-ttm | HF Sinclair Corporation Quote

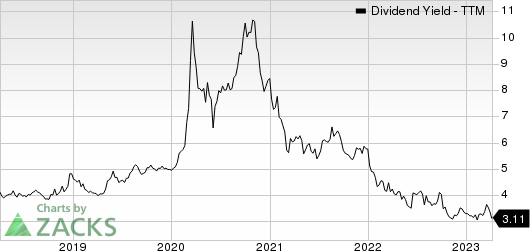

ExxonMobil: ExxonMobil is one of the largest publicly traded oil and gas companies in the world, which participates in every aspect related to energy — from oil production to refining and marketing. XOM’s dividend of 91 cents per share ($3.64 annualized) represents a 3.16% yield. ExxonMobil’s payout ratio is 26, with a five-year dividend growth rate of 1.81%. (Check ExxonMobil’s dividend history here)

ExxonMobil is valued at some $468.2 billion. XOM’s expected EPS growth rate for three to five years is currently 23.1%, which compares favorably with the industry's growth rate of 12.5%. ExxonMobil, headquartered in Irving, TX, has a trailing four-quarter earnings surprise of roughly 4.5%, on average. XOM shares have gained 39.8% in a year.

Exxon Mobil Corporation Dividend Yield (TTM)

Exxon Mobil Corporation dividend-yield-ttm | Exxon Mobil Corporation Quote

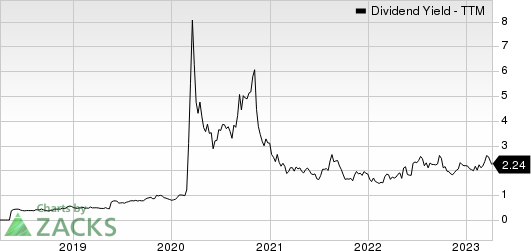

Diamondback Energy: Diamondback Energy is an independent oil and gas exploration & production company with its primary focus on the Permian Basin. FANG’s dividend of $2.95 per share comprises 80 cents ($3.20 annualized) in regular payout plus a variable cash component of $2.15 apiece. The regular component represents a 2.26% yield. Diamondback’s payout ratio is 12, with a five-year dividend growth rate of 53.86%. (Check Diamondback Energy’s dividend history here)

Diamondback is valued at some $26 billion. Diamondback, headquartered in Midland, TX, has a trailing four-quarter earnings surprise of roughly 4.3%, on average. FANG shares have gained 5.9% in a year.

Diamondback Energy, Inc. Dividend Yield (TTM)

Diamondback Energy, Inc. dividend-yield-ttm | Diamondback Energy, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Diamondback Energy, Inc. (FANG) : Free Stock Analysis Report

HF Sinclair Corporation (DINO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance