3 Embarrassingly Low Dividend Stocks

As if the S&P 500's dividend yield of 1.8% weren't low enough, there are some established companies that pay even less despite earning consistently strong profits and cash flows. In fact, you'd be surprised to know how miserly well-known names like Sherwin-Williams (NYSE: SHW), Waste Connections (NYSE: WCN), and Visa (NYSE: V) are with their dividend payouts and yields.

Income investors must know why the three stocks have such embarrassingly low dividends, more so because each company also looks poised to become a better dividend payer in the near future. Here's why.

When dividend yield does not match up to growth

As a Dividend Aristocrat, Sherwin-Williams boasts an incredible dividend track record, having raised its dividends for 39 consecutive years now. But the paint maker is a bummer when it comes to yields -- it's a tiny 0.9%, placing Sherwin-Williams at the bottom three among the 54-odd Dividend Aristocrats in terms of yield. Blame a low dividend payout.

Sherwin-Williams' dividend payout has remained below 30% in each of the past years. Comparatively, closest competitor PPG Industries (NYSE: PPG) has paid out more than 30% of its net profits to shareholders in four out of the past five years, including nearly 48% in 2016. PPG currently yields 1.6%.

Image source: Getty Images.

It's not that Sherwin-Williams has plowed back most of its profits into its business. Instead, it has consistently spent the bulk of its free cash flows (FCF) on share buybacks.

SHW stock buyback (annual). Data by YCharts.

That's worked in Sherwin-Williams' favor as the stock price has risen manifold over the years. But for income investors, the stock has been a disappointment despite securing a firm place in the elite Dividend Aristocrat group.

This stock could be great for income investors, if only...

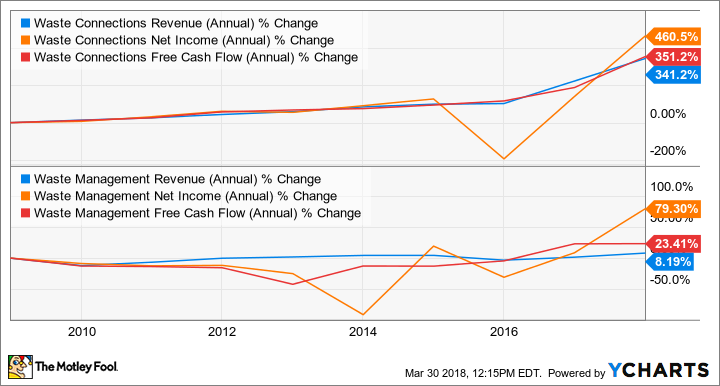

Talking about waste, you've probably heard more about the industry's largest player, Waste Management (NYSE: WM), than Waste Connections. But you may not know that Waste Connections has consistently delivered superior operational numbers and is growing at a much faster clip than its larger rival.

In fact, the pace of growth in Waste Connections' profits and cash flows could put Waste Management to shame.

WCN revenue (annual). Data by YCharts.

Looking at the above chart, you'd expect solid shareholder returns. Sadly, Waste Connections has been really stingy with dividends, paying out only 26% of its net income and 14% of its FCF in dividends last year and yielding a minuscule 0.7%. Waste Management, with a yield of 2.2%, scores higher on all fronts.

Waste Connections hasn't been too aggressive with share repurchases either, but has largely reinvested profits back into the business and has been an aggressive acquirer. The company's bottom line growth tells us the strategy has paid off. To be fair, Waste Connections has also increased its dividends by double-digit percentages in each of the past seven years, but management could certainly bump up its payout to boost the stock's appeal.

Why this top-class stock isn't a great dividend stock

Visa operates in one of the highest-margin businesses -- it raked up 60%-plus operating margins in four of the past five years. The payments processing giant has been terrific in growing its FCF as well, thanks to rising profits. Visa's is also a low-capital intensive business as makes money in two ways: a fee every time someone swipes its co-branded credit, debit, and other cards anywhere in the world, and a percentage of the total global transaction volumes. As more merchants accept plastic money, more banks issue cards, thereby expanding Visa's customer base without the company having to spend much.

Image source: Getty Images.

Going by its operational performance, Visa could be one of the best dividend stocks, but it isn't. Visa paid out less than 25% of its net income and just about 19% of its FCF in dividends last year. The stock's yield of 0.7% is nothing to write home about.

As you might've already guessed, Visa is a fan of share repurchases. Between 2011 and 2016, Visa bought back shares worth $25.6 billion but paid only $5.4 billion in dividends.

Two stocks could pay you a lot more

The low yields of each of the three stocks discussed above could put you off, but Sherwin-Williams and Visa possess strong dividend growth potential.

Sherwin-Williams, for instance, intends to keep its dividend payout at 30%in FY 2018 and 2019, but its per share dividend amount could jump nearly 65% at the midpoint between 2017 and 2020, thanks to the company's recently completed acquisition of Valspar that has pushed Sherwin-Williams to the top position in the global paints and coatings industry.

Visa's payout ratio, meanwhile, has come a long way from 12% in 2011 to 25% in 2017. Clearly, Visa is keen to share a greater chunk of its profits with shareholders -- a trend that I strongly expect to continue given Visa's massive growth catalysts ahead, especially the paradigm global shift from cash to plastic and virtual money.

As for Waste Connections, management still considers growth to be its "best use of capital," so don't expect any dividend surprises. That, however, doesn't mean the stock will stop rewarding shareholders with double-digit annual dividend increases in the future.

More From The Motley Fool

Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Visa. The Motley Fool recommends Sherwin-Williams. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance