3 Chip Stocks Suited Nicely for Income Investors

After a rough showing in 2022, many semiconductor stocks are back in style in 2023, delivering outsized gains. SOXX, the iShares Semiconductor ETF, is up more than 25% year-to-date, widely outperforming the S&P 500.

For those with an interest in exposure to chips paired with a passive income stream, three stocks – Texas Instruments TXN, NXP Semiconductors NXPI, and Broadcom AVGO – could all be considerations.

Let’s take a closer look at each.

Broadcom

Broadcom is a premier designer, developer, and global supplier of a broad range of semiconductor devices. AVGO shares found plenty of attention following news of a new multiyear, multibillion-dollar deal with heavyweight Apple AAPL for components made in the USA.

The company has consistently grown its dividend payout, boasting an impressive 20% five-year annualized dividend growth rate. Shares currently yield 2.7% annually, more than triple the Zacks Computer and Technology sector average.

Image Source: Zacks Investment Research

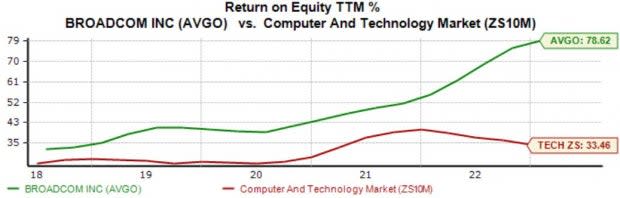

In addition, the company’s 78.6% TTM return on equity is worth highlighting, indicating a higher efficiency level in generating profit from existing assets relative to peers.

Image Source: Zacks Investment Research

Keep an eye open for Broadcom’s upcoming quarterly release on June 1st; the Zacks Consensus EPS Estimate of $10.13 suggests an 11% climb in earnings year-over-year. It’s worth noting that the quarterly estimate has remained unchanged over the last several months.

NXP Semiconductors

NXP Semiconductors is a global semiconductor company providing high-performance mixed signal and standard product solutions used in various applications. Analysts have raised their expectations across the board, helping land the stock into a favorable Zacks Rank #2 (Buy).

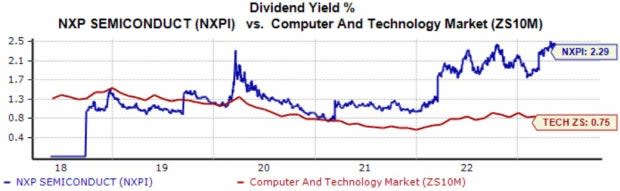

Image Source: Zacks Investment Research

Shares currently yield 2.3% annually, with the company’s payout growing by an impressive 40% over the last five years. Similar to AVGO, NXPI’s current yield easily crushes the Zacks sector average.

Image Source: Zacks Investment Research

NXPI shares could also entice value-focused investors, with the current 13.4X forward earnings multiple sitting nicely beneath the 16.9X five-year median and highs of 25.1X in 2022. The stock carries a Style Score of “B” for Value.

Image Source: Zacks Investment Research

Texas Instruments

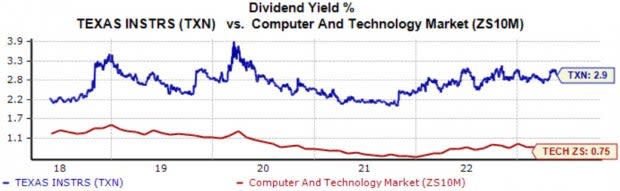

Texas Instruments is an original equipment manufacturer of analog, mixed-signal, and digital signal processing (DSP) integrated circuits. Like those above, TXN has had little issue increasingly rewarding its shareholders, sporting a 15% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

The company has a stellar earnings track record, exceeding earnings and revenue expectations in six consecutive quarters. Just in its latest release, TXN posted a 5% EPS surprise and reported revenue modestly above estimates.

Shares didn’t see a great reaction post-earnings but have since found buyers, as we can see illustrated in the chart below.

Image Source: Zacks Investment Research

Bottom Line

Semiconductors are back in style in 2023 after a harsh 2022, with many delivering positive returns year-to-date.

And for those with an appetite for exposure paired with an income stream, all three stocks above – Texas Instruments TXN, NXP Semiconductors NXPI, and Broadcom AVGO – fit the criteria nicely.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

NXP Semiconductors N.V. (NXPI) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance