3 Affordable REITs to Buy While Others Are Fearful

There are nice opportunities among REITs despite these equities being fairly dependent on the proponents of rate cuts. However, the concern of inflationary pressures impacting REITs may be overdone and many offer sizable dividends to support long-term investors.

To that point, earnings estimate revisions have risen for several REITs that have made their way onto the coveted Zacks Rank #1 (Strong Buy) list.

Even better, their affordability and reasonable valuations may also be appealing and more reassuring to investors. Furthermore, REITs can give investors valuable exposure to real estate assets without having to manage them directly or deal with overhead costs.

Keeping this scenario in mind, here are three of these highly-ranked REITs that investors will want to consider.

Gladstone Commercial GOOD

Focused on owning or investing in triple-net leased industrial and commercial real estate properties, Gladstone Commercial is a viable REIT with a 9% annual dividend at the moment. This blasts the S&P 500’s 1.31% average and even towers over the Zacks REIT and Equity Trust-Other Industry average of 4.4%. Furthermore, Gladstone makes its dividend payout monthly which has been the company’s goal to further appease shareholders.

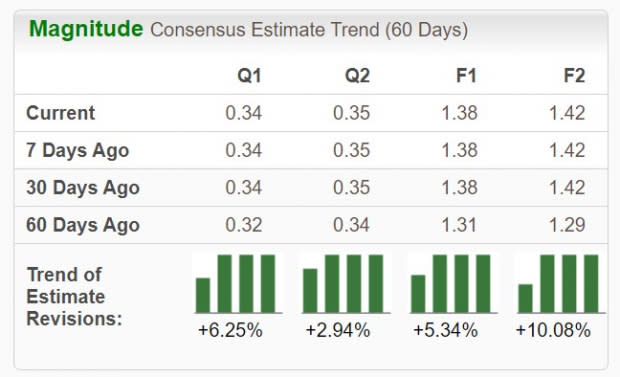

Image Source: Zacks Investment Research

More appealing, Gladstone’s stock is up a respectable +8% over the last year and has a low volatile 52-week range with lows of $10.84 a share last May to highs of $14.14 in August. Currently trading at $13 a share and 9.6X forward earnings, Gladstone’s stock trades pleasantly below the industry average of 14.6X. Plus, over the last 60 days, earnings estimate revisions are nicely up for FY24 and FY25 which suggests more upside ahead.

Image Source: Zacks Investment Research

CTO Reality Growth CTO

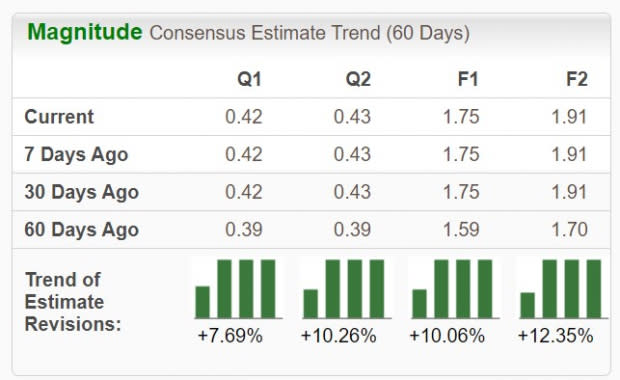

Rising earnings estimates are very compelling for CTO Reality Growth which operates a portfolio of retail-based properties primarily in Florida. Operating in high-growth markets, CTO’s fiscal 2024 earnings estimates have risen 10% in the last two months while FY25 EPS estimates have spiked 12%.

Image Source: Zacks Investment Research

More importantly, CTO’s stock trades just under $17 and at a 9.5X forward earnings multiple which is a nice discount to the Zacks REIT and Equity Trust-Other Industry average. However, most appealing is that CTO has a beta ratio of 0.77 which is below the optimum level of 1.0 and suggests its stock should be less volatile than the broader market.

Notably, CTO has a low volatile 52-week range as well with lows of $15.63 in October to highs of $18.03 last August. Making CTO’s low volatility more enticing is a 9.1% annual dividend that impressively tops the industry average. It’s also noteworthy that CTO has increased its payout eight times in the last five years with an eye-popping annualized dividend growth rate of 64.81% during this period.

Image Source: Zacks Investment Research

Host Hotels & Resorts HST

Rounding out the list is Host Hotels & Resorts, one of the leading lodging real estate investment trusts that engages in the ownership, acquisition, and redevelopment of luxury or upper-scale hotels in the United States and abroad.

Offering a 3.97% annual dividend yield, Host Hotels’ stock is up 5% YTD and has now soared +24% over the last year. Trading at $20 a share and not far from its 52-week peak it hit last month, Host Hotels’ stock still trades below the Zacks REIT and Equity Trust-Other industry’s P/E average at 10.5X forward earnings.

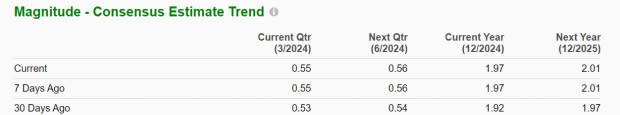

Image Source: Zacks Investment Research

Better still, FY24 and FY25 EPS estimates have risen 2% over the last 30 days respectively with Host Hotels’ annual earnings now forecasted to rise 2% this year and projected to edge up another 2% next year to $2.01 per share.

Image Source: Zacks Investment Research

Bottom Line

Rising earnings estimates make these highly-ranked REITs very attractive and are starting to confirm their stocks are cheap outside of their affordable price tags. Considering their generous dividends now looks like an ideal time to buy.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Host Hotels & Resorts, Inc. (HST) : Free Stock Analysis Report

Gladstone Commercial Corporation (GOOD) : Free Stock Analysis Report

CTO Realty Growth, Inc. (CTO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance