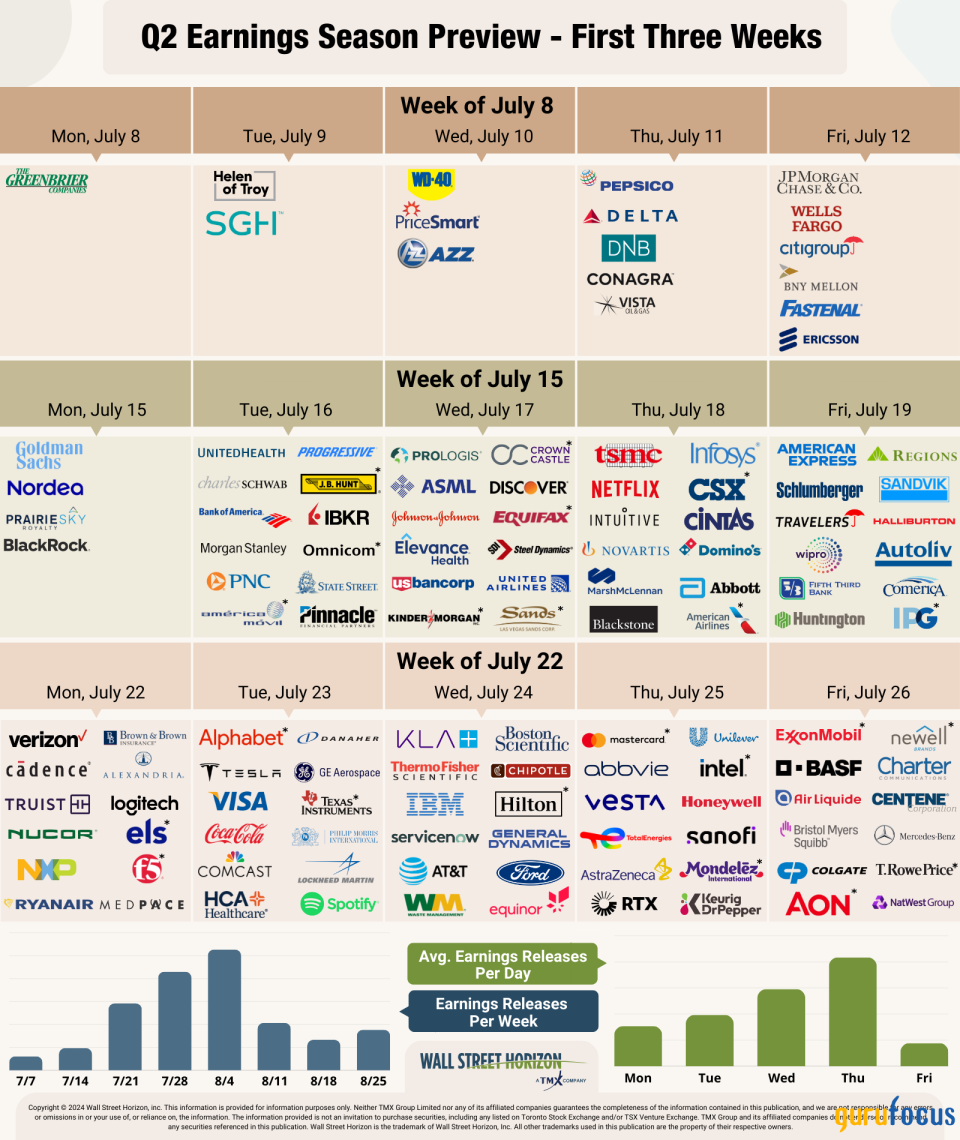

2nd-Quarter Earnings Season Preview

U.S. markets have been rising in anticipation of second-quarter earnings season, which unofficially kicks off Friday with results from the big banks.

The good news is earnings are expected to continue to be a bright spot through the second half of the year. What's especially bullish as we enter the second-quarter earnings season is the fact that Wall Street expectations have barely budged since the end of the first quarter. According to FactSet, S&P 500 earnings per share growth is anticipated to hit 8.80% for the second quarter. This is down just ever so slightly from the 9% expectation on March 31.[1] This is pretty atypical as far as estimate revisions go. In response to more conservative corporate guidance, analysts tend to pull their estimates down by 3% to 4% in the weeks ahead of an earnings season. The fact analysts mostly kept their estimates as is suggests corporations believe they can surpass these expectations. If growth comes in at 8.80%, it would be the highest growth rate in over two years, that's with eight of the 11 sectors anticipated to show year-over-year increases.

On the flipside, however, while earnings growth is expected to be a highlight of the second-quarter season, revenue estimates still remain a little light. Large corporations continue to cost cut their way to profit growth, which is a fine short-term solution, but soon investors will want to see a return to robust revenue growth driving earnings. Second-quarter revenue growth is expected to come in at 4.60%.[2] Analysts have also barely touched that estimate, down from 4.70% expected on March 31, but it is important to note that first-quarter 2024 saw a trend of more revenue misses than the historical average. In the first quarter, only 60% of S&P 500 names surpassed analyst expectations, well below the one-, five- and 10-year average beat rate.[3]

Up this week: Big banks

In its usual fashion, second-quarter earnings season will begin with the big banks, with JPMorgan Chase (NYSE:JPM), Citigroup (NYSE:C) and Wells Fargo (NYSE:WFC), reporting on Friday. While these banks struck a bit of a cautious note in their first-quarter reports, recent commentary has sounded a bit more upbeat.

While similar headwinds were still in play for the second quarter, investment banking showed signs of rebounding. Citigroup Chief Financial Officer Mark Mason recently spoke on the uptick of the investment banking business thanks to strong M&A activity,[4] while Goldman Sachs (NYSE:GS) President John Waldron noted that deal-making was making a comeback thanks to investments in AI.[5] Overall, we noted 84 initial public offering announcements in the second quarter, the strongest pace since third-quarter 2022 saw 112 such announcements. Merger and acquisition announcements for the quarter totaled 98, just about with the prior three quarters, but otherwise a little light in the context of the last four years.

Investors seem to like the banks as well, given that stock prices rose steadily throughout the quarter. Of the six big banks, JPMorgan Chase has seen the largest gains year to date of 35%, followed by Citigroup at 25% and Goldman Sachs, Bank of America and Wells Fargo all just above the 20% mark. This is in comparison to the S&P 500, which is up around 18% on the year.

Source: Wall Street Horizon

Second-quarter earnings wave

This season peak weeks will fall between July 22 and Aug. 16, with each week expected to see over 1,000 reports. Currently Aug. 8 is predicted to be the most active day with 1,445 companies anticipated to report. Thus far only 46% of companies have confirmed their earnings date (out of our universe of 10,000-plus global names), so this is subject to change. The remaining dates are estimated based on historical reporting data.

Source: Wall Street Horizon

1 FactSet Earnings Insight, FactSet, John Butters, July 3, 2024, https://advantage.factset.com2 FactSet Earnings Insight, FactSet, John Butters, July 3, 2024, https://advantage.factset.com3 FactSet Earnings Insight, FactSet, John Butters, July 3, 2024, https://advantage.factset.com4 Citigroup CFO: Second Quarter Investment Banking Revenue up 50%, Wall Street Journal, Justin Baer, June 18, 2024, https://www.wsj.com5 Our view is a soft landing is still the base case': Goldman Sachs exec, MarketWatch, Steven Gelsi, May 30, 2024, https://www.marketwatch.com?

Copyright 2024 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance