2 TSX Stocks to Buy With Dividends Yielding More Than 3%

Written by Brian Paradza, CFA at The Motley Fool Canada

Inflation fears, recession paranoia, risks from a potentially weakening housing market, and increased geopolitical uncertainties top the list in daily conversations in 2022. However, such risks shouldn’t detract individual investors from committing to long-term retirement plans. Boosting one’s regular income with dividend investing may, at times, be one tactical change in an investment portfolio’s allocations that enables one to ride short-term stock market volatility with psychological confidence.

Investing in defensive TSX dividend stocks with reasonably safe payouts and yields well above 3% (or better than the yield on a 10-year treasury bond) could be a winning strategy right now.

Although rising interest rates increase the risk of the Canadian economy falling into a recession, nothing is obvious. Even if a recession comes, such economic downturns are historically short-lived, and bear markets usually give way to powerful bull runs.

However, recession or no recession, some TSX dividend stocks look well placed to keep churning out well-covered dividend paycheques yielding more than 3%. They generate growing cash flows from largely contracted regular revenues, and their management teams remain committed to raising dividends.

Two TSX dividend stocks to consider buying today pay dividends every month. They pay yields as high as 6.2% to help weather any stock market storms, and they could form part of core holdings in a long-term retirement portfolio. Let’s have a look.

Buy Pembina Pipeline stock for reliable monthly dividends

Pembina Pipeline (TSX:PPL)(NYSE:PBA) stock pays one of the most reliable, juicy, and well-covered monthly dividends on the TSX today. The 65-year-old business provides energy transportation and midstream services to a burgeoning oil and gas industry.

Investors who want to receive monthly cash dividends may buy Pembina Pipeline common stock at today’s prices and expect to receive $0.2175 per share in dividends yielding a simple 5.53% annually.

For cash flow-planning purposes, PPL usually pays monthly cash dividends around the 15th of every calendar month. $10,000 invested in PPL stock at Friday’s closing share price of $46.28 could earn you a $45.90 cash dividend monthly, or $550.70 annually — or even more if the company keeps increasing its dividend, as it has done historically.

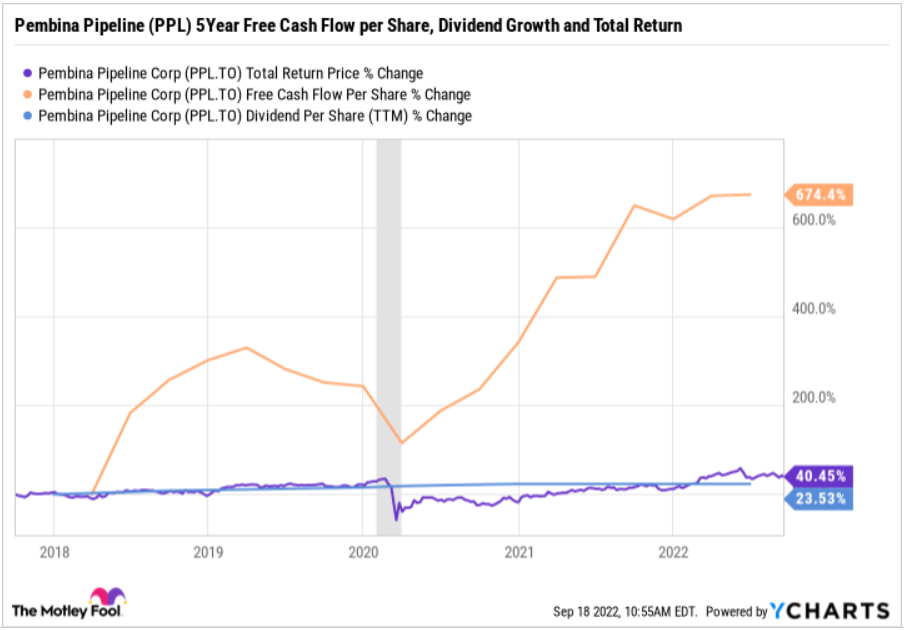

Pembina’s dividend has grown by more than 23% over the past five years, and the most recent dividend raises have averaged 5.5% over the half-decade. Dividend growth is well supported by growing free cash flows. PPL’s free cash flow per share has increased by 674% over the past five years.

The company has paid dividends for nearly 26 years and counting. Its highly contracted growing cash flows have supported safe annual dividend increases for a decade so far. The payout looks safe with a payout rate of 53% of distributable cash flows for 2021.

Keyera’s juicy 6.2%-yielding dividend could grow further

Keyera (TSX:KEY) stock pays a monthly dividend that has increased at a compound annual growth rate (CAGR) of 7% between 2008 and 2021. Investors buying KEY stock today may expect to receive a $0.16-per-share dividend every month yielding a juicy 6.2% annually.

The integrated energy firm operates oil and gas liquids processing infrastructure, pipelines, and midstream services and runs a fast-growing marketing segment that’s expanding margins and growing its cash flows. Keyera’s base business is in high demand, and the company has highly visible long-term growth opportunities as it expands its infrastructure in Canada.

Keyera’s management expects an adjusted earnings before interest, taxes, depreciation, and amortization (adjusted EBITDA) CAGR of 6-7% from 2022 to 2025. The expected growth in Keyera’s value chain is mainly self-funded. The company will grow revenue, earnings, and cash flow while improving its balance sheet quality, too.

KEY is an income investor’s dream stock to buy for monthly dividends as its payouts are well covered by growing cash flows. The company paid out just 63% of distributable cash flows in 2021, and it has room to sustain good dividend-growth rates into the foreseeable future — more so as its nearly complete Key Access Pipeline System comes online.

The post 2 TSX Stocks to Buy With Dividends Yielding More Than 3% appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Keyera?

Before you consider Keyera, you'll want to hear this.

Our market-beating analyst team just revealed what they believe are the 5 best stocks for investors to buy in September 2022 ... and Keyera wasn't on the list.

The online investing service they've run for nearly a decade, Motley Fool Stock Advisor Canada, is beating the TSX by 21 percentage points. And right now, they think there are 5 stocks that are better buys.

See the 5 Stocks * Returns as of 9/14/22

More reading

Fool contributor Brian Paradza has no position in any stocks mentioned. The Motley Fool recommends KEYERA CORP and PEMBINA PIPELINE CORPORATION. The Motley Fool has a disclosure policy.

2022

Yahoo Finance

Yahoo Finance