2 TSX Canadian Stocks Set to Dominate the Global Market

Written by Kay Ng at The Motley Fool Canada

Both of these top TSX Canadian stocks are solid businesses to buy and hold. Particularly, one appears to be substantially undervalued for big cash distribution payouts and long-term total returns.

Alimentation Couche-Tard

Alimentation Couche-Tard (TSX:ATD) opened its first convenience store in Quebec in 1980. It has made strides in dominating the global market over the decades. It first set foot in the Midwest region of the United States in 2001 through the acquisition of Bigfoot stores. In 2012, it expanded into Europe by acquiring a leading Scandinavian fuel and convenience store retailer. In 2015, it launched its global Circle K brand.

Over the years, Alimentation Couche-Tard continued to expand in Canada, the United States, and Europe. In 2020, Couche-Tard even stretched its tentacles into Asia by acquiring Circle K franchise stores in Hong Kong and Macau. After having started experimenting with electric vehicle (EV) charging solutions for about four years in a Norway lab, Couche-Tard finally began rolling out EV fast chargers in North America. So, the roadside fuel and convenience store retailer will continue to dominate, as the world transitions to EVs.

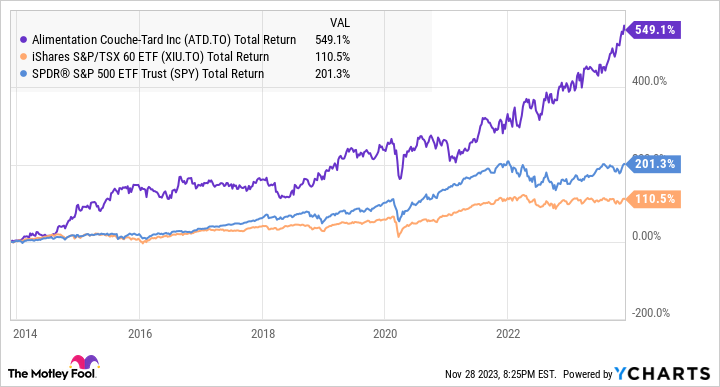

Over the last one, three, five, and 10 years, Couche-Tard stock has outperformed the Canadian and U.S. stock market benchmarks. The graph below illustrates the 10-year total returns.

ATD, XIU, and SPY Total Return Level data by YCharts

Given Couche-Tard’s track record of execution with high returns on equity north of 20% every year over the last decade or so, as well as increasing its dividend at a clip of north of 20% in the period, investors can consider buying and holding shares of the wonderful business. Analysts pretty much agree the shares are fairly valued at $78.75 per share at writing.

Brookfield Infrastructure Partners

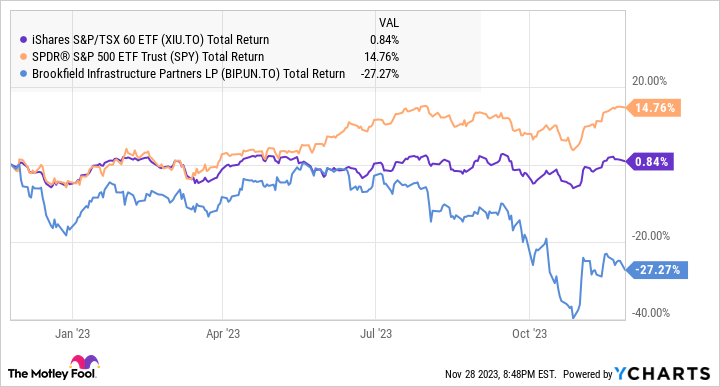

Brookfield Infrastructure Partners (TSX:BIP.UN) seems to be a better buying opportunity today. In a higher interest rate environment, the TSX stock has performed weakly to the stock market benchmarks even when cash distributions are accounted for. The chart below displays the total returns over the last 12 months.

BIP.UN, XIU, and SPY Total Return Level data by YCharts

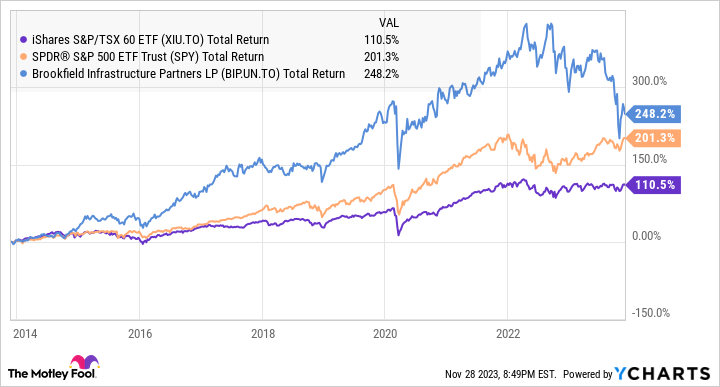

However, the top utility stock has outperformed the benchmarks over the last decade. So, the correction in the stock puts it at a substantial discount of close to a third, according to recent price targets set by analysts.

BIP.UN, XIU, and SPY Total Return Level data by YCharts

Over the years, Brookfield Infrastructure has been building a diversified portfolio of quality infrastructure assets as an owner and operator. About half of its funds from operations (FFO) are generated in North America, but it also has assets in South America, Europe, and the Asia Pacific region. Other than geographic diversification, its essential infrastructure assets are also diversified by asset class — utilities, transport, midstream, and data.

Since it was spun off from its parent company, the stock has increased its cash distribution every year. Its 10-year cash-distribution growth rate is approximately 9%, supported by healthy FFO growth. As a part of its growth strategy, it has sold optimized, mature assets to recycle capital into better risk-adjusted opportunities.

The stock is depressed partly due to higher interest rates, as it has high debt levels due to the nature of the business. However, it can manage its debt and maintain an investment-grade S&P credit rating of BBB+. It also has strong liquidity. For example, in the last reported quarter, it had liquidity of about US$2.4 billion at the corporate level. Brookfield Infrastructure Partners pays well to wait for a nice cash-distribution yield of about 5.8%.

The post 2 TSX Canadian Stocks Set to Dominate the Global Market appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Alimentation Couche-Tard?

Before you consider Alimentation Couche-Tard, you'll want to hear this.

Our market-beating analyst team just revealed what they believe are the 5 best stocks for investors to buy in November 2023... and Alimentation Couche-Tard wasn't on the list.

The online investing service they've run for nearly a decade, Motley Fool Stock Advisor Canada, is beating the TSX by 24 percentage points. And right now, they think there are 5 stocks that are better buys.

See the 5 Stocks * Returns as of 11/14/23

More reading

Fool contributor Kay Ng has positions in Alimentation Couche-Tard and Brookfield Infrastructure Partners. The Motley Fool has positions in and recommends Alimentation Couche-Tard. The Motley Fool recommends Brookfield Infrastructure Partners. The Motley Fool has a disclosure policy.

2023

Yahoo Finance

Yahoo Finance