2 Top-Rated Stocks to Watch as Earnings Approach

With the heart of the Q2 earnings season approaching several stocks are standing out ahead of their quarterly reports on Wednesday, June 26.

Sporting a Zacks Rank #2 (Buy), here’s a look at why now appears to be a good time to invest in these two top-rated Zacks stocks in particular.

Levi Strauss & Co LEVI

Along with its brand strength, casual apparel retailer Levi Strauss has experienced improved financial performance from its omnichannel initiatives which include e-commerce expansion such as same-day delivery along with mobile checkouts, and contactless returns among other direct-to-consumer strategies.

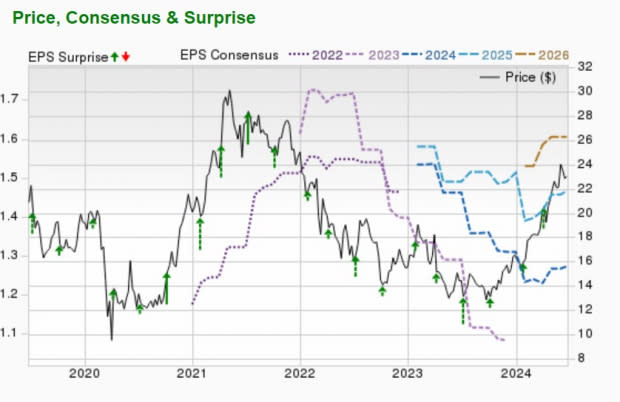

Trading at a reasonable 18.2X forward earnings multiple, Levi’s Q2 EPS is expected at $0.11 compared to $0.04 a share in the comparative quarter. Plus, Q2 sales are projected to rise 8% to $1.45 billion. Considerable expansion on the company’s top and bottom lines has led to Levi’s stock soaring +32% year to date and the rally could continue considering its valuation is still attractive. Furthermore, LEVI has a 2.07% annual dividend yield to attract and support longer-term investors.

Image Source: Zacks Investment Research

Micron Technology MU

Set to report its fiscal third quarter results on Wednesday, Micron Technology is a name that has started to buzz again among tech stocks. There has been increased demand for Micron’s semiconductor memory solutions thanks to the artificial intelligence frenzy along with easing inflation and lower supply chain constraints.

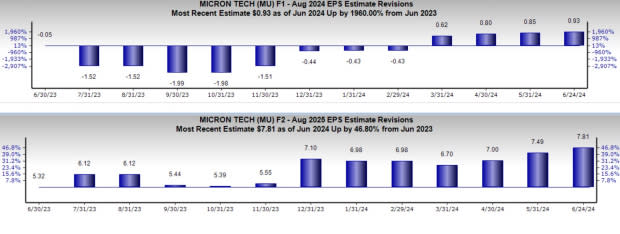

Correlating with such, Micron’s stock has ripped +66% YTD with its Q3 EPS expected at $0.50 compared to an adjusted loss of -$1.43 per share a year ago. More impressive, Q3 sales are expected to soar 78% to $6.7 billion versus $3.75 billion in the prior year quarter. The rebound in Micron’s top line certainly alludes to the company’s future earnings potential as indicated by the very compelling trend of positive earnings estimate revisions over the last year for both fiscal 2024 (F1) and FY25 (F2).

Image Source: Zacks Investment Research

Other Stocks to Watch

Two other stocks to watch tomorrow ahead of their quarterly reports are consumer foods leader General Mills GIS and payroll solutions provider Paychex PAYX with both landing a Zacks Rank #3 (Hold).

Reporting results for what is their fiscal fourth quarter, General Mills' valuation has become enticing despite a slight dip expected on its top and bottom lines for Q4 while Paychex’s steady expansion is thought to have continued.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

Levi Strauss & Co. (LEVI) : Free Stock Analysis Report

Paychex, Inc. (PAYX) : Free Stock Analysis Report

General Mills, Inc. (GIS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance