2 Plus 2 Still Equals 4

We are contrarians and oddly crave the moments when history, psychology and mathematics get defied in the U.S. stock market. We believe this is one of those points in time.

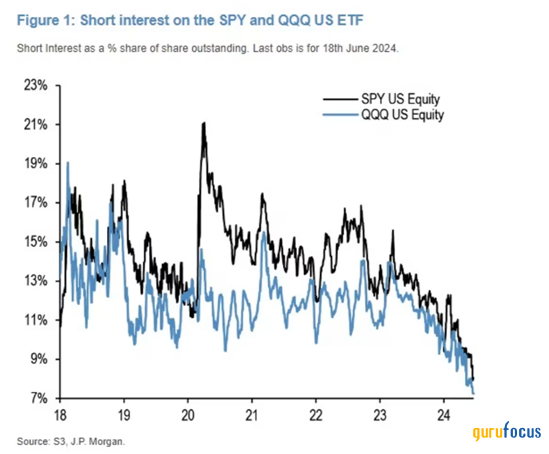

Short sellers have been obliterated, and the level of short selling is so low that it runs the risk of dropping off the charts:

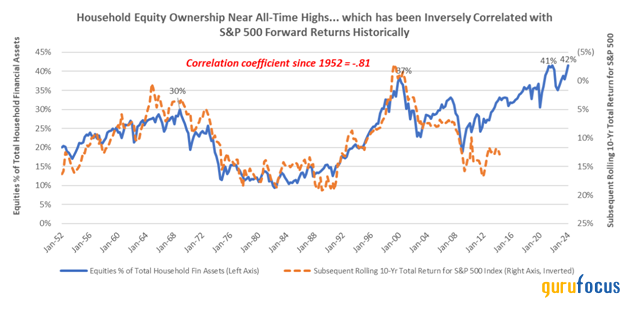

Simultaneously, U.S. household ownership of common stock has broken the all-time records:

Source: Federal Reserve Economic Data, Bloomberg

As you can see, high levels of ownership have been a precursor of poor index performance!

Lastly, Bank of America reports that money managers are holding their lowest cash levels (4%) since the last bear market started in November of 2021:

According to BofA's Global Fund Manager Survey for June, investors have been eager to put their money to work in riskier assets like stocks. In fact, cash made up just 4% of their portfolios, on averagethe lowest level since June 2021, BofA said. These managers are largely turning to equities: About 32% of their allocation out of money-market funds went into U.S. stocks, while 19% went to global stocks, the survey said.

Therefore, we are in this business to be fearful of this kind of enthusiasm and must avoid the exceptionally popular stocks that have driven these circumstances. However, this move in stocks has been very narrow like the tech bubble in 1999. There has been only enough money to go into the glamour tech stocks. When investors flooded out of tech in 2000, the non-tech stocks received about 30% of the cash, which didn't evaporate in the dotcom crash.

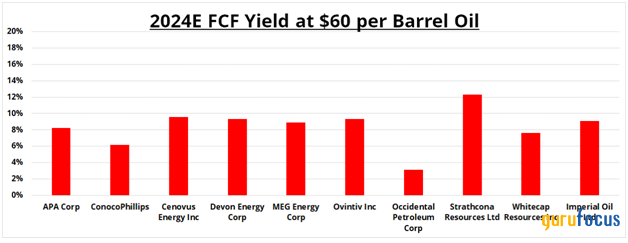

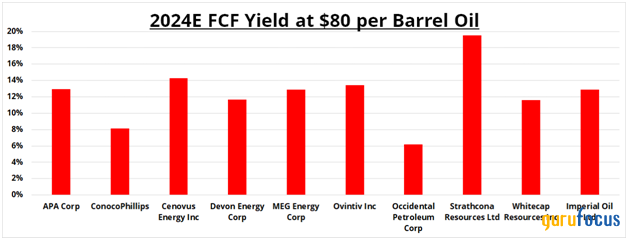

Which industries are investors afraid to invest in and provide copious operating profits and free cash flow? Look no further than oil and gas stocks and the shares of homebuilders. Oil has rallied above $80 per barrel, and gas has pulled back from the $3.07 level to around $2.55. This was a correction of a move from $1.80 to the $3.07 price. Sustained $80 oil prices mean analyst estimates for earnings are too low, and the industry is practicing shareholder-friendly use of those profits.

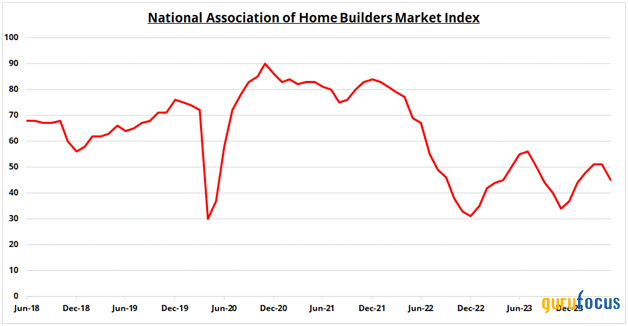

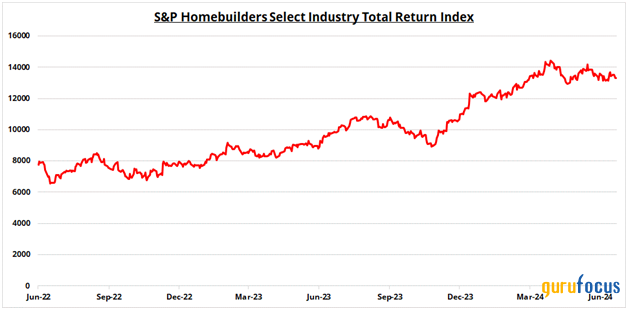

Homebuilder stocks have pulled back as the Fed has maintained very high short-term interest rates and left the yield curve inverted. This scares investors away from homebuilders and always causes homebuilder company executives to lose some of their optimism.

As you can see, buying homebuilders when their executives are skittish has led to major gains. Oil stocks and home builders sell for a 50% discount to the market with superior free cash flow. When you add two plus two in this market, it's time to fear stock market failure!

The information contained in this missive represents Smead Capital Management's opinions and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

2024 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance