2 Dividend Stocks That Could Create $1,000 in Passive Income in 2024

Written by Brian Paradza, CFA at The Motley Fool Canada

Are you looking for passive-income sources for the second half of 2024 and beyond? Canadian dividend stocks can deliver regular payouts, but some may offer more cash flow certainty than others.

Labrador Iron Ore Royalty’s (TSX:LIF) indicative 14.8% dividend yield may look appealing, but Enbridge’s (TSX:ENB) quarterly payout, which yields 7.5%, could be more attractive as a source of recurring passive income for the second half of 2024 and beyond. Let’s see which high-yield dividend stock could be the best bet to make $1,000 in passive income during the second half of this year.

Labrador Iron Ore Royalty: High yield, variable payouts

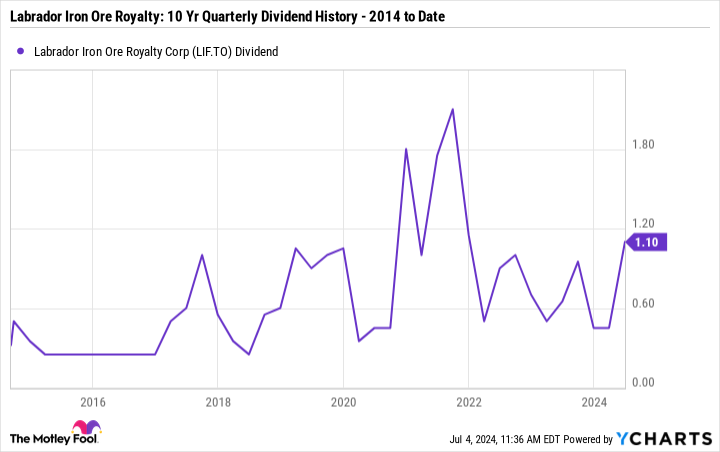

Labrador Iron Ore Royalty is a high-yield Canadian dividend stock that pays essentially all its distributable income to investors. Dividend yields can be quite huge annually. However, its payouts vary from quarter to quarter, depending on iron ore production and industry economics.

The company receives dividends on its equity stake in one of Canada’s largest iron exporters, it receives royalties on the miner’s production and some commissions on sales.

Labrador Iron Ore Royalty’s quarterly dividend of $1.10, payable in July, was the company’s highest quarterly payout in 10 consecutive quarters. It could yield 14.8% annually. However, if you wanted it, you’re too late — the cutoff date was June 28. That said, the company’s September dividends are historically the largest quarterly payouts each year since 2021.

LIF Dividend data by YCharts

That said, although the royalty stock’s quarterly dividend payouts can average yields above 10% annually, quarterly payouts vary widely depending on iron ore prices, mine productivity, and timing of payments. Given a highly volatile dividend, budgeting for recurring expense payments will be extremely challenging. However, investors can easily earn $1,000 in annual passive income if iron ore and steel prices comply.

Although China’s steel demand may weaken as its real estate market falters, its steel demand may have plateaued at decent levels. India is a powerhouse to watch, and the World Steel Association forecasts global steel demand to grow through 2025.

Enbridge stock: Reliable payouts, lower yield

Enbridge, a North American oil pipeline giant, offers a more predictable path to passive income and could make your goal to make $1,000 in passive income during the second half of 2024 relatively more certain. The company has a 72-year history of paying stable, regular quarterly dividends, with increases for the past 28 years. This consistency stems from its predictable cash flow from its contracted pipeline businesses. You simply know what to expect with Enbridge’s payouts.

Given consistent reinvestments, which are largely funded by internally generated cash flow, the business is growing and diversifying its earnings. Bloomberg reported in May that Enbridge is working to offer additional pipeline space to underserved exporters at the Corpus Christi port, which accounts for more than half the U.S.’s oil exports. The cash flow machine could grow some more.

While Enbridge’s dividend yield is lower than LIF’s potential, at around 7.5%, it comes with greater certainty. Investors seeking a reliable stream of passive income might prioritize Enbridge for its stability.

Choosing your path to $1,000 in passive income

To earn $1,000 in passive income from Enbridge stock, you’d need to buy approximately 274 shares at the current price. With Enbridge’s track record, you can be more confident in receiving consistent quarterly dividends that add up to $1,000 for the remainder of 2024.

As a second option, Labrador Iron Ore Royalty stock could declare handsome dividends in September and December, but there isn’t assurance as to how much each quarterly payout will be. If dividends average second-half 2023 levels, then investors could receive about $0.70 per share in quarterly dividends for the remainder of the year.

Company | Recent Price | Investment | Number of Shares | Dividend per Share | Payout | Frequency | Total H2 Dividend |

Labrador Iron Ore Royalty Corp (TSX:LIF) | $29.75 | $21,271.25 | 715 | $0.70 (average H2 2023) | $500.50 | Quarterly | $1,001.00 |

Enbridge (TSX:ENB) | $48.89 | $26,742.83 | 547 | $0.915 | $500.51 | Quarterly | $1,001.01 |

Investor takeaway: High yields or steady income streams?

The choice between Labrador Iron Ore Royalty stock and Enbridge stock depends on your risk tolerance and income goals. LIF stock offers the possibility of a higher yield but with variability in payouts. ENB stock provides a more reliable, consistent stream of income, even if the yield is lower, and it keeps increasing payouts every year.

The post 2 Dividend Stocks That Could Create $1,000 in Passive Income in 2024 appeared first on The Motley Fool Canada.

Should you invest $1,000 in Enbridge right now?

Before you buy stock in Enbridge, consider this:

The Motley Fool Stock Advisor Canada analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enbridge wasn’t one of them. The 10 stocks that made the cut could potentially produce monster returns in the coming years.

Consider MercadoLibre, which we first recommended on January 8, 2014 ... if you invested $1,000 in the “eBay of Latin America” at the time of our recommendation, you’d have $16,110.59!*

Stock Advisor Canada provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month – one from Canada and one from the U.S. The Stock Advisor Canada service has outperformed the return of S&P/TSX Composite Index by 29 percentage points since 2013*.

See the 10 stocks * Returns as of 6/20/24

More reading

Can You Guess the 10 Most Popular Canadian Stocks? (If You Own Them, You Might Be Losing Out.)

How to Build a Bulletproof Monthly Passive-Income Portfolio in 2024 With Just $25,000

Fool contributor Brian Paradza has no position in any of the stocks mentioned. The Motley Fool recommends Enbridge. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance