2 Consumer Centric Stocks to Buy After Earnings

With investors eying retail earnings this week, it is noteworthy that a few consumer discretionary and consumer staples stocks are starting to stand out after their first-quarter results last Thursday.

Here are two of these stocks that investors may want to consider following their better-than-expected Q1 earnings.

Krispy Kreme (DNUT)

Consumers appeared to have a sweet tooth during Q1, with Krispy Kreme sporting a Zacks Rank #2 (Buy) after exceeding its top and bottom line expectations last Thursday.

The doughnut guru’s first-quarter earnings were up 12% YoY and also surpassed expectations by 12% at $0.09 per share compared to estimates of $0.08 a share. Along with the earnings beat Krispy Kreme topped Q1 sales estimates by 3% at $418.95 million which was up 12% from the prior-year quarter as well.

Image Source: Zacks Investment Research

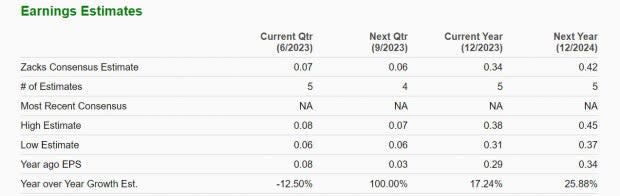

Furthermore, earnings estimate revisions have remained higher over the last quarter. Trading at $14 a share, Krispy Kreme’s earnings are now forecasted to climb 17% this year and leap another 26% in FY24 at $0.42 per share.

This lands Krispy Kreme a “B” Zacks Style Scores grade for Growth with its stock starting to look more attractive since going public again in 2021.

Image Source: Zacks Investment Research

YETI (YETI)

Also sporting a Zacks Rank #2 (Buy) Yeti Holdings is standing out among the consumer discretionary sector after strong Q1 results last Thursday.

Yeti is a supplier of products for the outdoor and recreation market such as fishing, camping, barbecue, and farm and ranch activities among others.

First-quarter earnings of $0.18 per share beat expectations by 20% with Q1 EPS estimates at $0.15. Although Q1 earnings declined -45% YoY after a tough-to-follow prior-year quarter, Yeti was also able to beat sales estimates by 4%. Sales also increased 3% from Q1 2022 at $302.80 million.

Image Source: Zacks Investment Research

Yeti also highlighted that its inventory decreased by $24.4 million marking a third consecutive quarter of sequential declines in inventory balance. This alludes to a more stable operating environment for Yeti as inflationary concerns continue to ease and we approach the peak outdoor recreation months.

Trading at $40 a share, Yeti’s earnings are now projected to dip -7% in FY23 but rebound and soar 24% in FY24 at $2.71 per share.

Image Source: Zacks Investment Research

Takeaway

The solid first-quarter results started to reconfirm that Krispy Kreme and Yeti’s outlooks are starting to brighten. At the moment, both stocks look worthy of investors’ consideration as there should be more upside if inflation keeps easing and consumers are more willing to spend.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

YETI Holdings, Inc. (YETI) : Free Stock Analysis Report

Krispy Kreme, Inc. (DNUT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance