15 Warning Signs of a Stock Market Meltdown

A bear market for investments can be a scary thing. The name alone makes it sound like you’re going to get mauled to death, and indeed a full-fledged bear market can be emotionally stressful and financially damaging.

Check Out: 3 Types of Investments Predicted To Plummet in Value in Summer 2024

Read Next: 7 Reasons You Should Consider a Financial Advisor — Even If You’re Not Wealthy

Although it’s impossible to predict the future, certain indications make it more likely that a bear market is around the corner.

If you see these warning signs flashing red, it’s a good time to look at your portfolio and reduce your risk.

To help you avoid falling victim to a bear market, be aware of some common precursors to a stock market meltdown and learn what steps you might take to avoid some of the damage.

Declining Corporate Earnings

Although stock prices are impacted on a second-to-second basis, earnings support stock prices over the long run.

Every quarter, companies report earnings, and the stock market reacts to them. When earnings start to decline across the board, it indicates that an economic recession lies around the corner.

Explore More: 10 Valuable Stocks That Could Be the Next Apple or Amazon

Be Aware: 5 Unusual Ways To Make Extra Money (That Actually Work)

In an environment of slowing or declining earnings, stock market valuations also shrink, triggering a market price reduction. When this contraction is severe and prolonged enough, it turns into a bear market. In the first quarter of 2023, S&P 500 companies experienced a 6.8% earnings decline. However, they started to rebound in December 2023, and are now at around a 2.4% increase in June 2024.

Wealthy people know the best money secrets. Learn how to copy them.

Rising Inflation

Everyone is more than familiar with inflation these days. While inflation, to some degree, can be good for the American economy, as it allows businesses to slowly raise prices and generate profits, as we’ve seen of late, it also hurts consumers’ wallets.

Sizable increases in the inflation rate can be a killer for the economy, and inflation scares can spook stock prices as well. When prices rise dramatically, the cost of operating a business rises as well.

Not all these increased costs can be passed to consumers, reducing business profits. Periods of rising inflation also tend to lead to higher Fed interest rates and tighter labor markets, further crimping corporate profits.

This brings us to the next warning sign…

Trending Now: In 5 Years, These 2 Stocks Will Be More Valuable Than Apple

Rising Interest Rates

One of the many stock market axioms is that you shouldn’t “fight the Fed.” This means that when the Fed is accommodating to the market by providing liquidity and low interest rates, you should invest expecting the market to gain, as has been the case historically.

On the contrary, when the Fed is tightening monetary policy, making money less available to the economy, you should prepare for some setbacks in the market.

This is extremely relevant in the current moment, as, after years of extremely low interest rates, the Fed has recently been consistently raising rates to combat inflation.

So far, the stock market has remained high in the face of rate hikes. Though the Fed has signaled an end to increases for the moment, it’s hard to predict what the economy will do next.

Declining Auto Sales

Auto sales are a leading economic indicator. When consumers slow the rate at which they’re purchasing cars, it’s an indication that they’re either tapped out financially or less confident about making major purchases.

As one of the two major purchases that customers make, auto sales can be a great snapshot of how the domestic economy is doing. When these major purchases slow, it reflects a slowing economy or even a recession, which can trigger a bear market. Auto sales have started to dip this year.

While 2024 started strong, Cox Automotive, a major car analyst, predicts the year’s second half will see less robust sales.

Declining Home Sales

Home sales are another leading economic indicator that can reflect the state of the consumer and the American economy overall. When consumers feel good about the economy and have money in their pockets, they’re more likely to make major purchases like a home.

If home sales decline over an extended period, it reflects a slowdown in overall American consumer spending, which is one of the major engines of the economy.

Thus, when home prices decline broadly, it’s often considered a precursor to a recession and a possible bear market. While sales were strong through 2023, they have begun to decline in 2024, due to high mortgage interest rates and low home inventory, according to the National Association of Realtors.

Discover More: 10 Things You Should Do When Your Child’s 529 Account Reaches $20,000

Declining Consumer Confidence

Confident consumers are more likely to purchase big-ticket items like homes and autos, but these two indicators alone aren’t enough to get the whole picture of the American consumer.

Since Americans only purchase homes and cars once every decade or longer, on average, more immediate indicators are also important. The Conference Board’s Consumer Confidence Index reflects how the American consumer feels about current business and labor market conditions.

A slowdown in the consumer confidence figures may indicate that an economic slowdown lies ahead. This index dipped slightly from May 2024 to June 2024.

However, according to the Board’s chief economist, Dana M. Peterson, “[S]trength in current labor market views continued to outweigh concerns about the future.” If the labor market does not remain strong, Peterson predicted that confidence could weaken as the year finishes out.

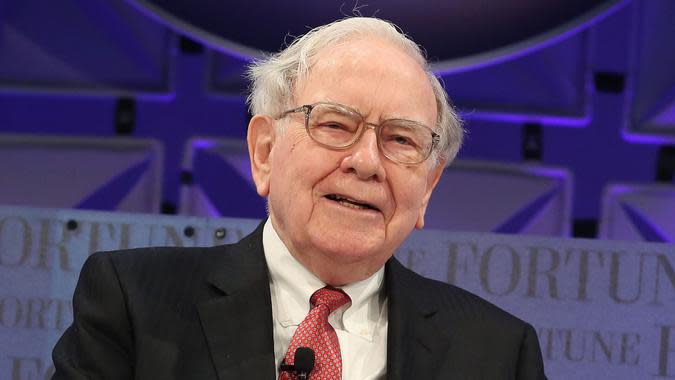

The Buffett Indicator

Warren Buffett is one of the most famous investors in the world. The billionaire CEO of Berkshire Hathaway has been dubbed the “Oracle of Omaha” for his legendary stock market prescience (and, you guessed it, for living in Omaha).

One of Buffett’s favorite market indicators is the ratio of total U.S. stock market capitalization to gross domestic product. When this ratio is too high, Buffett deems stocks overvalued, as he did before the dot-com bubble of 2000 and the Great Recession of 2008.

Currently, this indicator is at 192.2%, suggesting that the market is significantly overvalued. Buffett’s company, Berkshire Hathaway, is itself sitting on a pile of almost $189 billion in cash.

Stocks Declining on Good News

In a bull market, seemingly nothing will stop the upward surge in stock prices. Even companies that report bad news can see their stock prices rise, as investors look for optimistic signs for the future. In a bear market, however, stock prices often fall even in the midst of good news.

For example, if a company’s stock sells off after it reports blowout earnings and raises future earnings estimates, it can indicate that investors are fatigued or fearful that the future won’t pan out as predicted.

This turn in sentiment can lead to investors sitting on their cash instead of investing it, turning broader stock market prices lower.

Explore More: What Is the Median Household Income for the Upper Middle Class in 2024?

Euphoric Market Sentiment

This may seem counterintuitive, but when market sentiment is high, look out below. This is often the time when markets are about to sell off. The reasoning behind this indicator is simple. When investors are pessimistic, they are hoarding cash and not buying stocks.

As their confidence grows, money tumbles into the market, driving share prices higher. When investors are euphoric, they’ve generally put all the money they can into the stock market already, meaning there’s not much money sitting in cash to push share prices still higher.

As famed investor John Templeton once said, “Bull markets are born on pessimism, grown on skepticism, mature on optimism and die on euphoria.”

Domestic Political Instability

It’s possible that over the last decade, the influence of this indicator has started to wane. Even casual observers would have to admit that instability seems to be the new normal.

Having said that, it remains true that the market hates uncertainty, and as the U.S. heads into a new election cycle this year, uncertainty abounds.

While it’s generally true that if it looks like a candidate deemed to be anti-business could be the ultimate victor the market will react negatively, that reaction may or may not lead to a true bear market. Whether this will be a relevant factor in 2024 very much remains to be seen.

International Political Instability

Just like the stock market hates domestic uncertainty, it also hates global instability. Geopolitical events, such as the war between Russia and Ukraine, can have a profound effect on U.S. stock markets, for good or ill (while energy markets have gone crazy, defense manufacturers are raking in the dough).

Even if the U.S. isn’t directly involved politically with a global mix-up, fear of how those events could affect America economically can lead to investor caution.

If these fears grow or become reality, it can lead to a significant market pullback, such as in 1973 when the Yom Kippur War and subsequent Arab oil embargo resulted in a 48% market sell-off.

Learn More: I’m an Economist: Here Are My Predictions for Inflation If Biden Wins Again

Black Swan Event

A “black swan” is an unexpected event that has extreme consequences, either good or bad. Coined by Nassim Nicholas Taleb, this moniker has come to represent unexpected market events that wreak havoc on stock prices.

By definition, a black swan event is unpredictable, so there’s no point in trying to position your portfolio to defend against one.

However, when a negative one occurs, you should recognize that it can often be the starting point of a bear market.

Inverted Yield Curve

An inverted yield curve is one in which long-term interest rates are lower than short-term interest rates. This situation is considered “inverted” because typically longer-term loans involve higher risk and therefore carry higher yields.

When long-term rates are lower, this indicates that investors feel the economy will be slower in the future and that rates will fall even lower. Thus, this is one of the indicators economists look at when they’re predicting recessions.

Historically, an inverted yield curve occurred before each recession of the last 50 years, with only one false signal. In March, the yield curve reached the deepest inversion seen since 1981.

Leading Economic Indicators Weakening

The Conference Board Leading Economic Index is designed to identify peaks and troughs in the American economy. When these indicators fall, it’s an indication that the economy will slow its expansion in the future or even fall into recession. Here are the 10 indicators that comprise the index:

Average weekly hours, manufacturing

Average weekly initial claims for unemployment insurance

Manufacturers’ new orders, consumer goods and materials

ISM Index of New Orders

Manufacturers’ new orders, nondefense capital goods excluding aircraft orders

Building permits, new private housing units

Stock prices, 500 common stocks

Leading Credit Index

Interest rate spread, 10-year Treasury bonds less federal funds

The LEI is updated monthly. The most recent report showed a decline of 0.5% over the last six months (November 2023 – May 2024), a smaller decline than the 3.4% decline over the six months prior.

Be Aware: Here’s the Living Wage a Single Person Needs To Live Comfortably in Arizona

Weakening Advance/Decline Line

The advance/decline line is a tool used by market technicians to gauge the level of buying interest in the market. Although it may sound like something for financial geeks only, the concept is quite simple.

The index simply plots the number of advancing stocks daily against the number of daily decliners. Each following day, the net advancers or decliners are added to or subtracted from the index, respectively.

For example, if the index sits at 48 on a given day, and the following day 10 more stocks advance than decline, the index will jump to 58. If this index starts sloping downward, it indicates the market may be turning direction.

Over the last month, the A/D line for the S&P 500 has been sloping upward.

What To Do if a Bear Market Is Coming

Now that you’ve seen some of the possible indicators of an upcoming bear market, what can you do if you notice some of them occurring?

Here’s a look at some defensive strategies you can use to avoid losing a big chunk of your portfolio if and when the next bear market hits.

Review Your Asset Allocation

When you first established your portfolio, you hopefully created an asset allocation based on your investment objectives and your risk tolerance. If enough bear market indicators are flashing red, perhaps you might consider reducing the risk level in your asset allocation.

For example, if you have a long time horizon and took an aggressive growth allocation, you might want to downshift that risk profile into just plain old “growth.”

You’ll still have market exposure in case the market continues to surge higher, but you’ll be a bit better protected on the downside if things turn around.

Read More: 5 Changes That Could Be Coming for the Middle Class If Biden Is Reelected in 2024

Rebalance Your Portfolio

Even if you don’t want to change your asset allocation, there’s a good chance that your portfolio is out of balance. If you’ve been invested, it’s likely that the equity portion of your portfolio is now outsized compared to where it should be.

For example, if your original portfolio plan allocated 50% to stocks, your current allocation may sit at 60% or 65% stocks. In that case, your portfolio is out of balance and exposed to more risk than you originally intended.

Take Profits

If a bear market is around the corner, there’s no better way to protect yourself than to take profits. Remember, any unrealized gains in your portfolio are currently on paper only. If a bear market unleashes its wrath on stock prices, you may end up with no gains at all, or even losses.

There’s an old market expression that “no one ever went broke taking profits,” and even if you miss out on some future gains, at least you will have locked in those profits by the time the next bear market hits.

It’s important to keep in mind that this will create a taxable event – make sure you are considering the tax implications of any sale, or talk to your tax advisor if you’re unsure.

Continue Regular Contributions

Even if you were 100% certain a bear market was coming, it’s still in your long-term interest to keep making regular contributions to your savings and investment accounts.

Since no one can predict the market’s near-term future accurately, there’s no telling when a bear market will end or how severe it may be.

By continuing to make regular weekly or monthly contributions, you’ll be picking up shares in the midst of a downturn, when prices are low. When the bear market inevitably ends and prices make new highs, those shares you picked up at lower prices will look cheap by comparison.

Find Out: What the Upper Middle Class Makes in Different US Cities

Stop Watching Too Closely

Watching how the market moves every hour of every day is a bad idea at any time, but especially during a market downturn.

The stress you’ll endure while watching prices fall is simply not worth it, and may even drive you to panic and sell out of your investments at the worst possible time. The key in times like these is sticking with an appropriate asset allocation and continuing to add to your investments throughout the sell-off.

Eventually, the bear market will end, as every bear market before it has, and it may not even register as anything but a blip on a long-term chart. There’s no point in stressing yourself out over the day-to-day movements when prices will recover over the long run.

If Close to Retirement, Trim Down Risk

A caveat to all of these options is that things are different for those who are about to retire or who otherwise might need their invested funds over the short term.

Yes, the market has always recovered after a bear market, but it may take years for the market to gain back what it has lost. While younger investors can take advantage of these sell-offs by continuing to buy shares, if you’re about to retire, the market may not recover in time to gain back your losses.

Remember that a 50% drop in the market takes a 100% gain to get back to breaking even, and even a 20% drop requires a 25% gain to reach break even. These types of recoveries can simply take too long for an investor nearing retirement, so a more conservative asset allocation may be appropriate.

Consider Alternative, Noncorrelated Assets

The good news about a bear market in stocks is that not every investment goes down along with it. In fact, some investments actually rise when the stock market falls.

Bonds, particularly Treasuries, traditionally gain when the stock market sells off, as they are seen as a “safe haven” asset amid uncertainty. Other investments, like gold, can also gain during market sell-offs, as investors search for hard assets.

As bear markets can often occur during periods of inflation, investments like commodities, which tend to go up in price during times of rising inflation, can also be good diversification tools for a stock-heavy portfolio. If you’re not sure how to invest in these assets, exchange-traded funds are a simple option (remember to look for low fees).

Check Out: Here’s How Much the Definition of Middle Class Has Changed in Every State

For More Advanced Investors: Hedge Your Portfolio

Hedging is an advanced strategy investors use to protect their portfolios against risk. You can hedge your portfolio by owning put options, which are bets that the market (or an individual stock) will go down in value.

If you buy put options, you can maintain all of your existing positions rather than having to sell out of them. When the bear market strikes, those stock values will likely go down, but the value of your put hedge will go up, offsetting your losses.

Hedging strategies using put options can get quite complex, so you’ll likely want to work with a fiduciary financial advisor if you’re not an experienced trader.

Even relatively simple hedging strategies, like purchasing put options on the S&P 500 index, can be beyond the reach of some investors, so be sure to do your research and consult with an expert before you proceed.

Jordan Rosenfeld and John Csiszar contributed to the reporting for this article.

More From GOBankingRates

8 Rare Coins Worth Millions That Are Highly Coveted by Coin Collectors

Housing Market 2024: Home Prices Are Plummeting in 10 Formerly Overpriced Housing Markets

This is The Single Most Overlooked Tool for Becoming Debt-Free

This article originally appeared on GOBankingRates.com: 15 Warning Signs of a Stock Market Meltdown

Yahoo Finance

Yahoo Finance