13F: 3 of Buffett's Latest Moves

“The Oracle of Omaha”

Warren Buffett is arguably the most consistent and successful investor on the planet. Since 1965, Buffett’s Berkshire Hathaway (BRKA) has achieved compound annual returns of roughly 20% per year – double that of the most common benchmark, the S&P 500 Index. While 20% returns may not seem like a lot to amateur investors, 20% compounded over such a long period is unprecedented. “The Oracle of Omaha” is the fifth wealthiest person in the world, with a net worth North of $100 billion.

What is Behind Buffett’s Success?

Warren Buffett was a student of Benjamin Graham, who is often thought of as the “father of Value investing”. If one were to compare the beginning of Buffett’s investment journey to today, little has changed with his philosophy. Buffett, an avid reader, reads balance sheets, articles, and newspaper clippings in search of value stocks with a “margin of safety”. The margin of safety means the intrinsic value of a company’s assets is vastly undervalued, providing investment protection and peace of mind should there be any bumps in the road.

Why Long-Term Investors Can Benefit from Watching Buffett

Berkshire Hathaway’s 13F is one of the most watched on Wall Street. A 13F is a disclosure of positions required (by the SEC) to be filled out by large institutions like Berkshire Hathaway. Unlike many quant traders, short-term investors, or high-frequency firms of today, Buffett has an extremely long holding period with little turnover (his favorite holding period is “forever”). In other words, investors generally do not have to worry about Buffett changing his mind in a hurry. Buffett also heavily relies on a fundamentally based system that takes advantage of shareholder rewards like stock buybacks and dividends.

Though Buffett’s investment system is not the flashiest, it has proven effective. Betting on solid, undervalued companies and the U.S. stock market and holding for the long term has been a recipe for success and is likely to continue to be in the future. As legendary trader Jesse Livermore once said, “Those who can both be right and sit tight are uncommon.”

Sizing Up Buffett’s Latest Investment Moves

Taking another bite of Apple

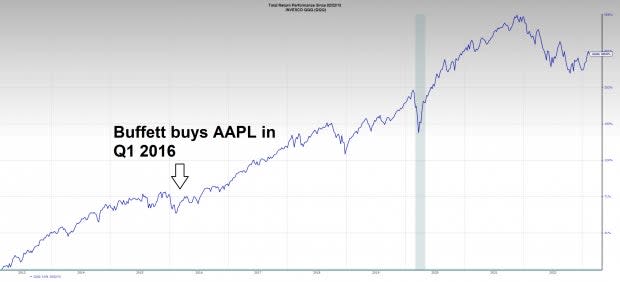

Another reason for Buffett’s success is his ability to be highly concentrated in his winning investments. Unsurprisingly, Buffett used the recent market pullback as an opportunity to add shares of his biggest position, Apple AAPL. Berkshire Hathaway now owns roughly 5% of the company, and its massive position is worth $112 billion. Since entering the stock in 2016, BRKA is up 290%. Apple shares make up an eye-popping 42% of the portfolio.

Image Source: Zacks Investment Research

Though Apple is not the most groundbreaking investment, it is a Buffett classic. Firstly, the company is consistent. Because of the ecosystem, it is tough for consumers to break away from Apple’s products. Secondly, Apple generates a ton of cash which it returns to shareholders through dividends and stock buybacks.

A Rare 360 on Taiwan Semi

The biggest surprise of this quarter’s 13F was that Buffett sold 86% of his massive position in Taiwan Semiconductor TSM. Berkshire’s last 13F revealed that it had purchased more than $4 billion worth of stock. Is Buffett concerned about possible Chinese aggression toward Taiwan?

Betting on a Turnaround in Hollywood

Another notable add for Buffett was entertainment and motion picture juggernaut Paramount Global PARA. Berkshire’s position is now more than $1.5 billion and accounts for a 15% stake. Buffett is showing conviction in this particular position. Initially, shares were accumulated last May and show a loss.

Image Source: Zacks Investment Research

Paramount’s stock was at the center of the blow-up of billionaire hedge fund manager Bill Hwang and has not been the same since. However, in recent months the stock has been trying to turn around. Another notable add was Louisiana Pacific LPX, which Buffett owns nearly 10% of.

Top Holdings

Beyond Apple, Berkshire’s top holdings have seen little change. Berkshire did not make any changes to its $25 billion Coca-Cola KO position or its $33.5 billion Bank of America BAC position.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

CocaCola Company (The) (KO) : Free Stock Analysis Report

Louisiana-Pacific Corporation (LPX) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

Paramount Global (PARA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance