$100 billion club shrinks to 12 members as slump in stocks knocks 3 people out

The $100 billion club lost three people last week as tumbling stocks dented their net worths.

Only 12 members remain after Jensen Huang, Michael Dell, and Gautam Adani shed their elite status.

Friday's sell-off cut the combined wealth of the world's 20 richest people by around $60 billion.

The $100 billion club has lost three members in four days, shrinking the elite group of the world's superwealthy to just 12 people.

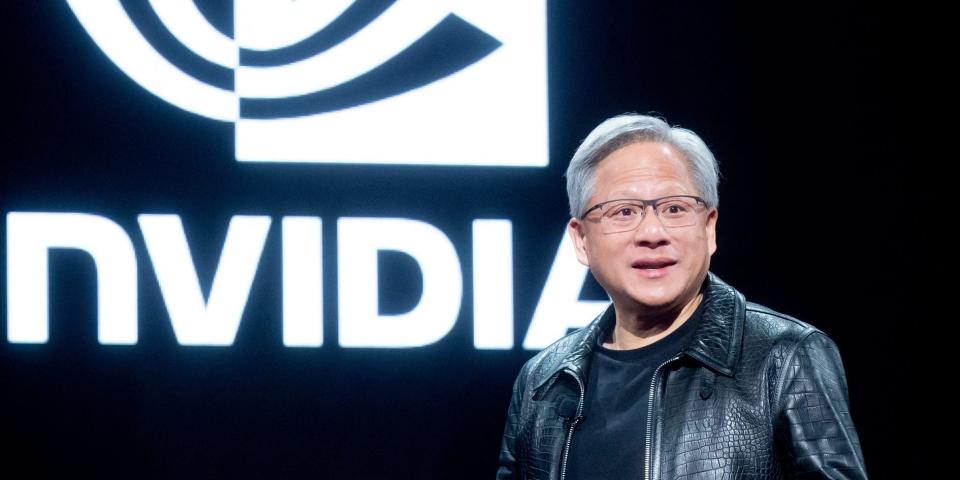

Nvidia CEO Jensen Huang, personal-computing pioneer Michael Dell, and Indian industrialist Gautam Adani saw their net worths tumble below $100 billion last week, per the Bloomberg Billionaire Index.

Huang's fortune sank from $105 billion to $90.5 billion in the four trading days following Labor Day, dropping him from 14th to 18th place on Bloomberg's list of the world's wealthiest people.

His wealth decline was fueled by a 14% plunge in Nvidia's stock last week, as investors pared their bets on the buzzy supplier of AI chips amid regulatory concerns and lackluster economic data.

The chipmaker's boss has still added a hefty $46 billion to his net worth this year, but he now trails Meta's Mark Zuckerberg (up $50 billion) as the biggest wealth gainer of 2024 so far.

Adani's net worth dipped from $102 billion on Wednesday to $99.6 billion by Friday's close, as Adani Enterprises shares fell amid a broader downturn in India's Nifty 50 index. The infrastructure magnate's wealth has also been hit by US short-seller Hindenburg Research targeting his company in recent months.

As for Dell — the founder and CEO of the eponymous PC maker — his net worth took a roughly $10 billion hit last week, dropping from $107 billion to $96.3 billion, per Bloomberg's rich list.

It tanked $5.5 billion on Friday alone as Dell Technologies shares slid 5% as part of a wider tech rout. The sell-off slashed the combined wealth of the world's 20 richest people by around $60 billion in a single day.

The hardest hit were Elon Musk (down $13.9 billion), Jeff Bezos (down $6.1 billion), Zuckerberg (down $5.8 billion), Dell (down $5.5 billion), and Google cofounder Larry Page (down $5.1 billion).

Musk, Bezos, Zuckerberg, and Page are all members of the $100 billion club, along with Bill Gates, Larry Ellison, Warren Buffett, Bernard Arnault, Sergey Brin, Steve Ballmer, Mukesh Ambani, and Amancio Ortega.

All but one of the top 18 people on the wealth index have grown richer this year. LVMH's Arnault has bucked the trend with a nearly $27 billion decline in net worth, but the luxury goods tycoon remains the world's third-richest person with a $181 billion fortune.

Just a few days ago, the $100 billion club appeared set to expand its ranks, with Walmart heir Jim Walton at $99.6 billion and his two siblings, Rob and Alice, not far behind. But the latest market downturn has pared his net worth to $98.8 billion, leaving him a little more ground to cover before he can join the elite group.

Read the original article on Business Insider

Yahoo Finance

Yahoo Finance