10 CEOs’ Best Money Advice

Good CEOs grow profits, expand operations, cut costs and keep shareholders happy. The very best chief executives, however, go above and beyond the job description of a corporate boss by inspiring their employees, investors, customers and anyone else who might be listening with insightful advice.

Explore: GOBankingRates' Best Credit Cards for 2023

Related: With a Recession Looming, Make These 3 Retirement Moves To Stay On Track

Take Our Poll: How Do You Think the Economy Will Perform in 2023?

For giants like Warren Buffett and Mary Barra, their words are as much a part of their legacies as their innovations and successes in boosting corporate bottom lines. Their quotes adorn the walls of small-business break rooms and the dry-erase boards of aspiring entrepreneurs. Their words of wisdom are mentioned in college business classes and passed down from mentors to mentees.

When the most successful people in the world talk about money, investing, careers and wealth, it makes sense to listen. Even if you don't aspire to lead a company like Berkshire Hathaway or GM, you might learn a lesson or two you could apply to your own 401(k), your own household budget and your own life.

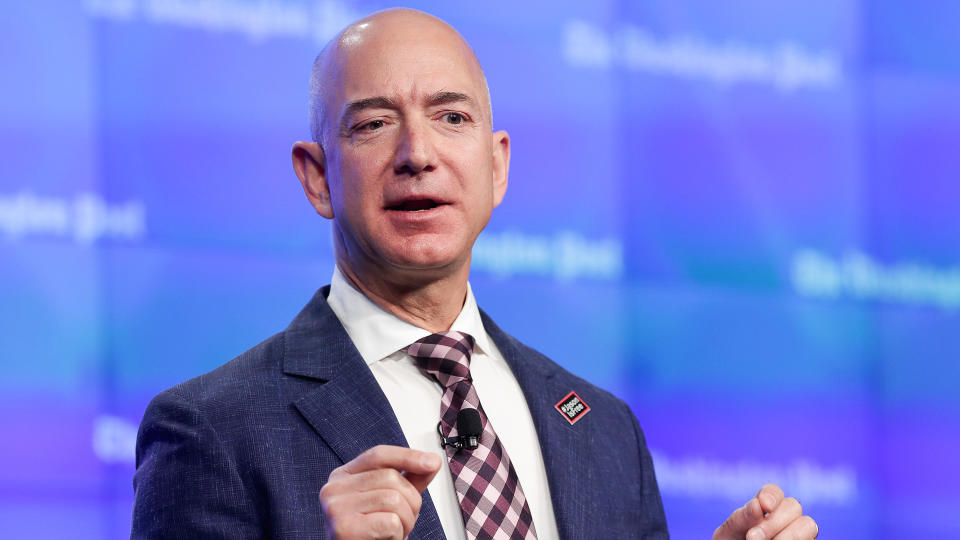

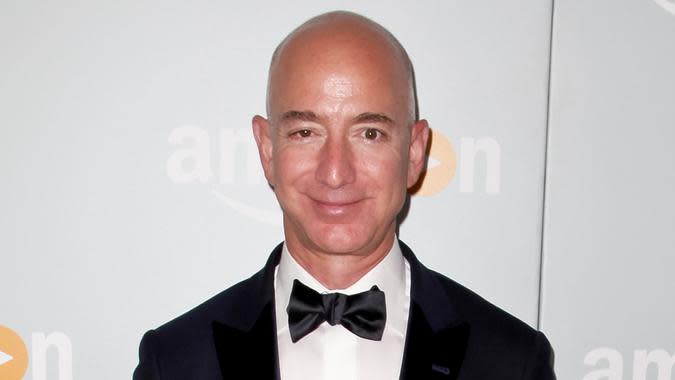

Jeff Bezos: Amazon

Jeff Bezos' best lesson came not from his words, but from his actions. Much is written about saving money by brewing your own coffee and cooking your own food, but big-ticket items tip the scales a whole lot more than Starbucks -- you'd be wise to buy less car than you can afford.

Bezos drove the same '87 Chevy Blazer he was driving when Amazon had 10 employees until he was a billionaire 12 times over. Even then, he only traded up to a Honda Accord. His then-wife MacKenzie Scott dropped Bezos off at work and their kids off at school in a Honda minivan until 2013.

Take Our Poll: Are You In Favor of More Inflation Relief in 2023?

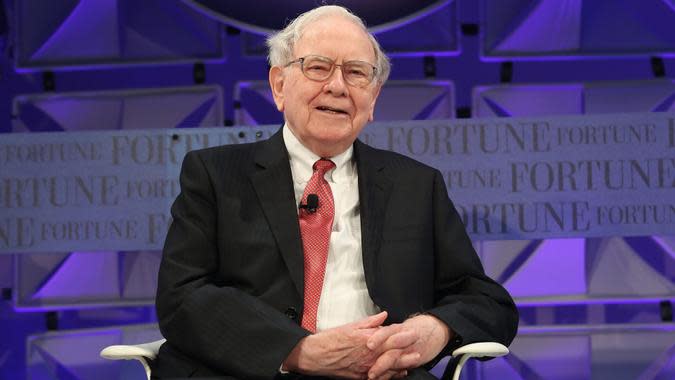

Warren Buffett: Berkshire Hathaway

Warren Buffett was doling out Yoda-like money wisdom since the 1980s, when Bezos was working in executive positions at hedge funds and investment banks like any regular 20-something.

There was the time when Buffett advised never to invest in something you don't understand. Then there was the stuff about living within your means, buying index funds instead of picking stocks and buying into companies you believe in and holding them forever. The best advice of all, however, was to pay yourself first. But as he is so inclined to do, Buffett said it better: "Don't save what is left after spending. Spend what is left after saving."

Mary Barra: General Motors

Mary Barra is more than the first woman CEO of a major automaker. She's up there with Warren Buffett as one of the most consummately quotable execs in corporate America. She said at a 2012 convention: "If you have a problem, you've got to solve it. Because that problem is going to get bigger in six months. It could get bigger in two years. But it's not going to get smaller with time."

She was referring to the auto bailout, but as is so often the case with Barra's famously artful statements, her words could be applied to all kinds of everyday situations. For you, it could be an analogy for finally facing up to credit-card debt, leaving a dead-end job or ending a toxic financial relationship.

Tim Cook: Apple

During a 2017 commencement speech at the University of Glasgow in Scotland, Apple CEO Tim Cook advised the newly minted grads in the audience never to work for a paycheck. He said: "My advice to all of you is, don't work for money -- it will wear out fast, or you'll never make enough and you will never be happy, one or the other."

CNBC reported that people were quick to point out that Cook's advice, while philosophically lofty, is easier said than done when diapers need buying and bills need paying. Also, they pointed out that Cook sells iPhones as opposed to making them as a passion project and giving them away out of kindness.

Richard Branson: Virgin

Along with Elon Musk, Richard Branson is as close to Tony Stark as the planet has in real life. Branson is famous for his sticktoitiveness -- but you don't have to be a billionaire adventurer or even a knight to benefit from a healthy dose of dogged perseverance. Whether you're struggling to sock money away every month, watching your investments lose value, or even just having a hard time learning the basics of money management, be like Branson and stick with it.

He once wrote: "On every adventure I have been on -- whether setting up a business, flying around the world in a balloon or racing across the ocean in a boat -- there have been moments when the easy thing to do would be to give up."

Elon Musk: Tesla, SpaceX

Like Richard Branson, Elon Musk has skin in the game both on Earth and in space -- although in the ultimate act of one-upmanship, Branson, like Bezos, has actually been there. One of the greatest innovators and risk-takers in corporate history, Musk advises both earthlings and E.T.s to choose a finish line that's worth reaching.

The Chicago Tribune quotes him as saying: "Don't just make your goal to 'make a lot of money' or 'get promoted to X.' Have a goal that's both compelling and meaningful. Figure out how to make things better, or to do something significant."

Corie Barry: Best Buy

Corie Barry took over Best Buy as the company's first woman CEO in 2019. Her advice to girls and women who want to mirror her success is to get comfortable outside of their comfort zones.

She told CNBC: "It's why I start with making yourself uncomfortable, because somewhere in here, you're going to have to be willing to put yourself in a space that you don't quite feel ready to fill, and then leverage all the resources around you to help you be successful."

Although her advice is gender-specific, it could be applied to anyone who's trapped in a financial rut or stuck in a dead-end job.

Satya Nadella: Microsoft

According to Business Today, Satya Nadella is a big believer in crafting new strategies for each new venture instead of repackaging whatever worked yesterday and hoping for a repeat of the original results.

He said: "You have to have that learning mindset going forward. It's not deterministic."

There are two lessons here. The first is a warning against resting on your laurels -- if you're staring at your trophies in the rearview mirror, you're going to crash the car. The second is not to make the mistake of applying the lessons learned from yesterday's battles to the wars of tomorrow. That might mean taking a second look at a stale resume, a dusty 401(k), a car insurance policy that's probably more expensive than it needs to be or anything in between.

Sundar Pichai: Alphabet

Alphabet boss Sundar Pichai isn't recommending you drop out of school the way he dropped out of Stanford. But he does recommend basing your education, career and money decisions on what's good for you and you alone.

According to Inc., he said: "Had I stayed the course in graduate school, I'd probably have a Ph.D. today, which would have made my parents really proud. But I might have missed the opportunity to bring the benefits of technology to so many others. And I certainly wouldn't be standing here speaking to you as Google CEO."

Indra Nooyi: PepsiCo (Retired)

Many financial experts don't believe it's possible to save your way to wealth and that earning more money is the only true path to financial freedom.

Whether you're just entering the workforce, starting a new job, or changing careers to start at the bottom of the totem pole later in life, it's natural to make a conservative entry, keep your head down, and avoid being noticed until you're up to speed.

Indra Nooyi, the longtime chair and CEO of Pepsi who retired in 2019, wants you to do the exact opposite.

She told Forbes: "Volunteer for the most difficult projects early in your career. Don't settle for a cushy, 9-to-5 existence. When you first enter a company, people should know you've arrived."

More From GOBankingRates

Andrew Lisa contributed to the reporting for this article.

This article originally appeared on GOBankingRates.com: 10 CEOs’ Best Money Advice

Yahoo Finance

Yahoo Finance