Here's the Best Industrial Stock to Buy for Passive Income

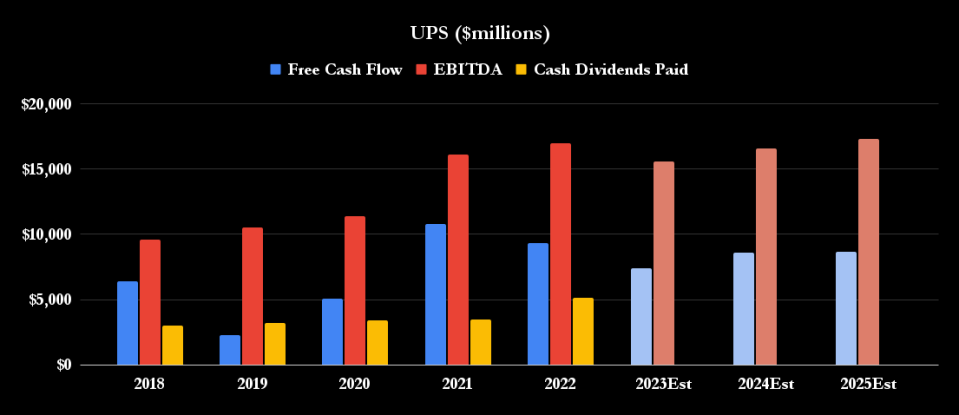

The chart below shows how well UPS's cash dividends have been covered by earnings before interest, taxes, depreciation, and amortization (EBITDA), and free cash flow (FCF). First, this year will likely prove a trough year (more on that in a moment), but EBITDA and FCF will easily cover UPS' cash dividends in 2023-2025. It's also due to a drop in capital expenditures (another point I'll get to in a moment) from an average of $6.3 billion in 2018 and 2019 compared to $4.8 billion, which boosts FCF generation.

Yahoo Finance

Yahoo Finance