How Did Schlumberger React to Crude Oil’s Price Last Week?

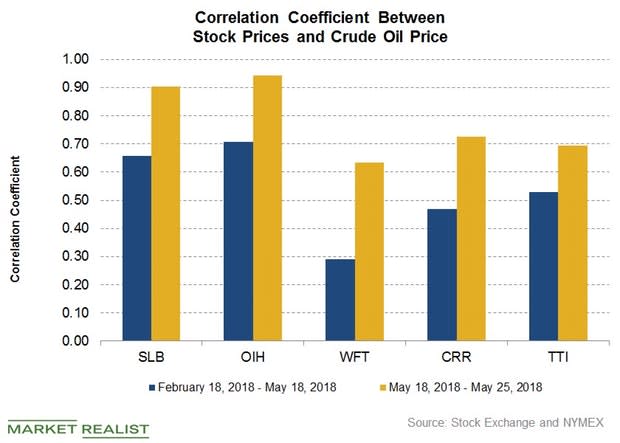

Schlumberger’s (SLB) correlation with crude oil’s price from May 18 to May 25 was 0.90, meaning that it was strong. This strong positive correlation implies that the stock closely tracked crude oil’s movements. Schlumberger’s correlation with the VanEck Vectors Oil Services ETF (OIH) in the same week was 0.93.

Yahoo Finance

Yahoo Finance