PPL Stock: Analysts’ Recommendations

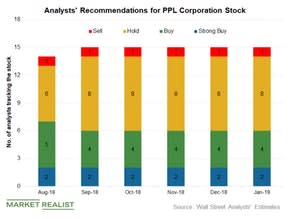

Why PPL Stock Looks Attractive Compared to Its Peers (Continued from Prior Part) ## Analysts’ recommendations Wall Street analysts have given PPL (PPL) stock a median target price of $31.6, which implies an estimated upside of almost 13% for the next 12 months. Currently, PPL is trading at $28.0. Among the 15 analysts tracking PPL surveyed by Reuters, eight recommended a “hold,” two recommended a “strong buy,” four recommended a “buy,” and one recommended a “sell.” The following chart shows how analysts’ views on PPL stock have changed in the last six months. ## Peers’ target prices Consolidated Edison (ED) stock has a median target price of $78.9—compared to its current market price of $75.3, which indicates an upside potential of ~5% going forward. Among the 17 analysts tracking Consolidated Edison, one recommended a “strong buy,” ten recommended a “hold,” five recommended a “sell,” and one recommended a “strong sell” as of January 4. Among the 15 analysts tracking Xcel Energy (XEL), two recommended a “strong buy,” two recommended a “buy,” and 11 recommended a “hold.” The median target price of $51.5 implies an ~7% upside potential compared to its current price of $48.0. PPL appears to be an attractive opportunity given the total return potential, handsome yield, and estimated upside. Read Do You Own Analysts’ Favorite Utility Stocks? to learn more. Browse this series on Market Realist: * Part 1 - PPL Stock Looks Attractive Compared to Its Peers * Part 2 - What Do PPL’s Chart Indicators and Short Interest Suggest? * Part 3 - What PPL’s Implied Volatility Trends Indicate

Yahoo Finance

Yahoo Finance