Wynn Resorts (NASDAQ:WYNN) Beats Q1 Sales Targets

Luxury hotels and casino operator Wynn Resorts (NASDAQ:WYNN) reported Q1 CY2024 results topping analysts' expectations , with revenue up 30.9% year on year to $1.86 billion. It made a non-GAAP profit of $1.59 per share, improving from its profit of $0.29 per share in the same quarter last year.

Is now the time to buy Wynn Resorts? Find out in our full research report.

Wynn Resorts (WYNN) Q1 CY2024 Highlights:

Revenue: $1.86 billion vs analyst estimates of $1.80 billion (3.5% beat)

EPS (non-GAAP): $1.59 vs analyst estimates of $1.39 (14.6% beat)

Gross Margin (GAAP): 44.5%, down from 64.3% in the same quarter last year

Market Capitalization: $10.97 billion

"The strong momentum we experienced in our business throughout 2023 continued to build during the first quarter with Adjusted Property EBITDAR reaching a new all-time record. The investments we have made in our properties, our team and our unique programming continue to extend our leadership position in each of our markets," said Craig Billings, CEO of Wynn Resorts, Limited.

Founded by the former Mirage Resorts CEO, Wynn Resorts (NASDAQ:WYNN) is a global developer and operator of high-end hotels and casinos, known for its luxurious properties and premium guest services.

Casino Operator

Casino operators enjoy limited competition because gambling is a highly regulated industry. These companies can also enjoy healthy margins and profits. Have you ever heard the phrase ‘the house always wins’? Regulation cuts both ways, however, and casinos may face stroke-of-the-pen risk that suddenly limits what they can or can't do and where they can do it. Furthermore, digitization is changing the game, pun intended. Whether it’s online poker or sports betting on your smartphone, innovation is forcing these players to adapt to changing consumer preferences, such as being able to wager anywhere on demand.

Sales Growth

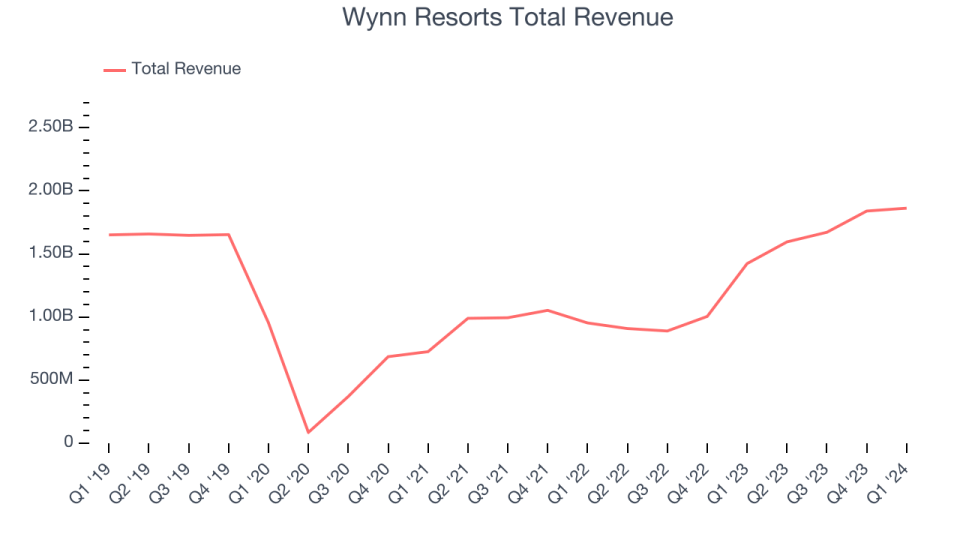

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. Wynn Resorts's revenue was flat over the last five years.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Wynn Resorts's annualized revenue growth of 32.2% over the last two years is above its five-year trend, suggesting some bright spots.

We can better understand the company's revenue dynamics by analyzing its three most important segments: Casino, Hotel, and Dining and Entertainment, which are 60.2%, 17.6%, and 14.3% of revenue. Over the last two years, Wynn Resorts's revenues in all three segments increased.Casino revenue (Poker, slots) averaged year-on-year growth of 61.6% while Hotel (food, beverage, Wynn Interactive) and Dining and Entertainment (overnight bookings) averaged 35.8% and 13.8%.

This quarter, Wynn Resorts reported wonderful year-on-year revenue growth of 30.9%, and its $1.86 billion of revenue exceeded Wall Street's estimates by 3.5%. Looking ahead, Wall Street expects sales to grow 3.6% over the next 12 months, a deceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

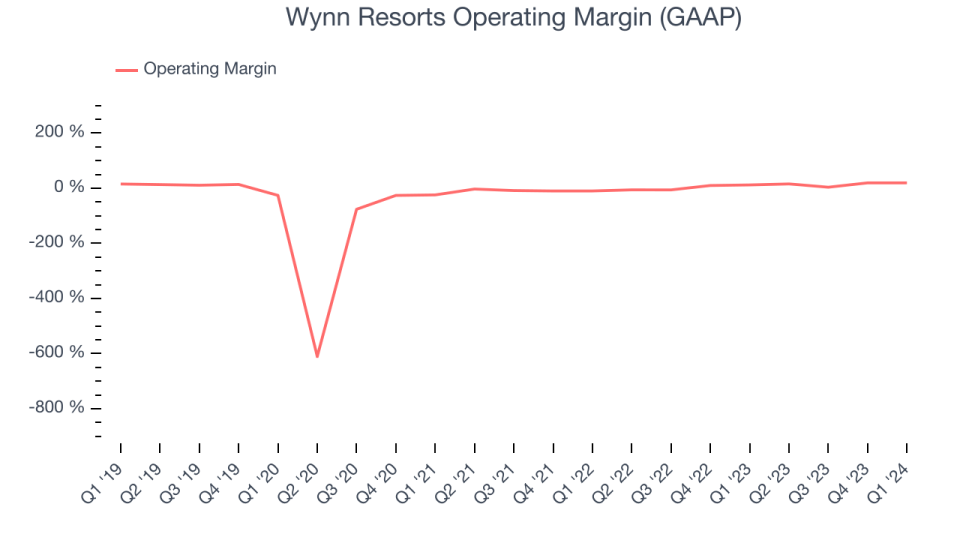

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Wynn Resorts has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 10.7%, higher than the broader consumer discretionary sector.

In Q1, Wynn Resorts generated an operating profit margin of 19.5%, up 7.6 percentage points year on year.

Over the next 12 months, Wall Street expects Wynn Resorts to become more profitable. Analysts are expecting the company’s LTM operating margin of 14.8% to rise to 18.1%.

Key Takeaways from Wynn Resorts's Q1 Results

It was good to see Wynn Resorts beat analysts' revenue and EPS expectations this quarter, although Hotel revenue unfortunately missed. Overall, we think this was still a solid quarter that should please shareholders. The stock is up 2.5% after reporting and currently trades at $99.67 per share.

Wynn Resorts may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance