Dividend Royalty: 5 Fabulous Stocks to Buy Now for Decades of Passive Income

Written by Kay Ng at The Motley Fool Canada

When putting together this list of fabulous stocks for the goal of decades of passive income, here are some of the key criteria they must have. The dividend stocks must offer safe dividends. Since the goal is to generate meaningful passive income, these stocks must, as a group, offer a “high” dividend yield. They also trade at discounted if not fair valuations.

Without further ado, here are five fabulous dividend stocks you can consider buying now for long-term passive income.

Fortis stock

Fortis (TSX:FTS) has one of the longest dividend growth streaks – 50 consecutive years to be exact! As a regulated and diversified utility, it earns highly stable earnings that are resilient even through recessions. Additionally, it maintains a sustainable payout ratio of 74% of adjusted earnings this year.

At $54 per share, the stock trades at a 10% discount from its long-term normal price-to-earnings ratio (P/E), as the stock is weighed down by higher interest rates since 2022, leading to slower growth. This provides a decent opportunity to get an initial dividend yield of close to 4.4%. For your reference, its 3-, 5-, and 10-year dividend growth rates are 5.7%, 5.8%, and 6.3%, respectively.

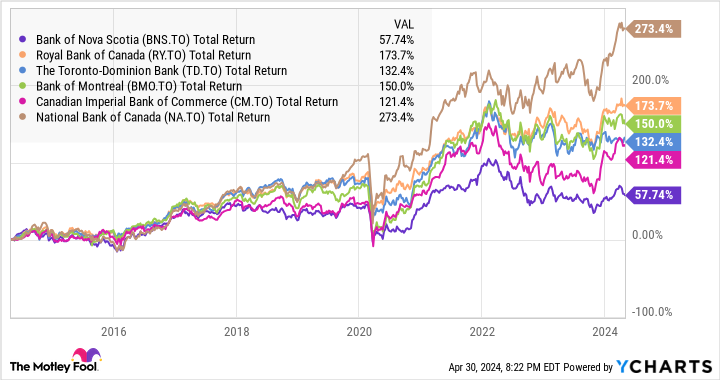

Big 6 Canadian Bank Stock 10-Year Total Return Level data by YCharts

Bank of Nova Scotia

Bank of Nova Scotia (TSX:BNS) has been the worst-performing big Canadian bank stock over the last decade, as shown in the graph above. Although the bank’s international strategy could lead to higher long-term growth, it has also exposed it to greater risk. For example, developing markets tend to have higher percentages of bad loans during harsh economic times.

That said, the bank’s core Canadian operations remain resilient. Its earnings are also more than enough to cover its dividend. At $63 per share, it trades at a low P/E of 9.6 and offers a rich dividend yield of 6.7%. This dividend is supported by a payout ratio of 65% of adjusted earnings this year.

Manulife

For a long time, Manulife (TSX:MFC) stock traded at a deep discount to its peers. After letting go of some legacy assets, the market finally showed some sign of lifting the life and health insurance stock’s valuation. Still, at $32 per share, it trades at nine times earnings, a 16% discount from the multiple of Sun Life’s peers. It’s anyone’s guess if it will fully fill that valuation gap.

However, it’s clear that Manulife is capable of paying its growing dividend, which offers a yield of 5%. For your reference, MFC’s 3-, 5-, and 10-year dividend growth rates are 9.2%, 9.9%, and 10.9%, respectively.

RioCan REIT

RioCan REIT (TSX:REI.UN) has been put in the penalty box since the rising interest rate cycle began in 2022. Investors also remain wary of the fact that it cut its cash distribution by a third in January 2021.

Several factors indicate it could be a good passive income stock. First, the retail real estate investment trust (REIT) has been increasing its cash distribution since 2022. Its funds-from-operations payout ratio is estimated to be sustainable at 72% this year. Second, its balance sheet is solid, and it’s awarded an investment-grade S&P credit rating of BBB. Third, it offers a nice yield of 6.3%, paid out as monthly cash distributions. So, it could be a nice holding in a Tax-Free Savings Account (TFSA).

Alimentation Couche-Tard

All names mentioned so far offer decent dividend yields. So, I thought it would be more balanced to offer a low-yield but faster-growing dividend stock as the last (but not least) idea: Alimentation Couche-Tard (TSX:ATD).

The global convenience store consolidator is a defensive name to own. You’ll know what I mean by looking at its long-term stock price chart. The recent drop of over 12% from its 52-week high appears to be good buy-the-dip opportunity. It has increased its dividend by at least 25% per year over the last 3, 5, and 10 years. Over the next few years, it should continue double-digit dividend growth.

Essentially, these five are buy-and-hold names in which investors can aim to accumulate shares, especially on meaningful pullbacks, and hold for long-term passive income. Investing the same amount in each stock today offers an average yield of almost 4.7%.

The post Dividend Royalty: 5 Fabulous Stocks to Buy Now for Decades of Passive Income appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Alimentation Couche-Tard?

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for a decade, Motley Fool Stock Advisor Canada, is beating the TSX by 32 percentage points.*

They just revealed what they believe are the 10 best Starter Stocks for investors to buy right now… and Alimentation Couche-Tard made the list -- but there are 9 other stocks you may be overlooking.

Get Our 10 Starter Stocks Today * Returns as of 3/20/24

More reading

Can You Guess the 10 Most Popular Canadian Stocks? (If You Own Them, You Might Be Losing Out.)

How to Build a Bulletproof Monthly Passive-Income Portfolio in 2024 With Just $25,000

Fool contributor Kay Ng has positions in Alimentation Couche-Tard, Bank of Nova Scotia, Fortis, and RioCan Real Estate Investment Trust. The Motley Fool has positions in and recommends Alimentation Couche-Tard. The Motley Fool recommends Bank of Nova Scotia and Fortis. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance