Koninklijke Vopak N.V. (VOPKF)

Other OTC - Other OTC Delayed Price. Currency in USD

Add to watchlist

As of 10:40AM EDT. Market open.

| Previous Close | 39.30 |

| Open | 39.25 |

| Bid | 0.00 x 0 |

| Ask | 0.00 x 0 |

| Day's Range | 39.30 - 39.30 |

| 52 Week Range | 30.95 - 39.73 |

| Volume | |

| Avg. Volume | 1,045 |

| Market Cap | 4.918B |

| Beta (5Y Monthly) | 0.58 |

| PE Ratio (TTM) | 10.10 |

| EPS (TTM) | N/A |

| Earnings Date | N/A |

| Forward Dividend & Yield | 1.61 (4.10%) |

| Ex-Dividend Date | Apr 26, 2024 |

| 1y Target Est | N/A |

- GuruFocus.com

Koninklijke Vopak NV's Dividend Analysis

Koninklijke Vopak NV (VOPKY) recently announced a dividend of $1.63 per share, payable on 2024-05-17, with the ex-dividend date set for 2024-04-26. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Koninklijke Vopak NV's dividend performance and assess its sustainability.

- Simply Wall St.

Koninklijke Vopak N.V.'s (AMS:VPK) Intrinsic Value Is Potentially 64% Above Its Share Price

Key Insights Koninklijke Vopak's estimated fair value is €60.47 based on 2 Stage Free Cash Flow to Equity Koninklijke...

- Simply Wall St.

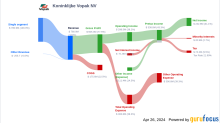

Koninklijke Vopak Full Year 2023 Earnings: EPS Misses Expectations

Koninklijke Vopak ( AMS:VPK ) Full Year 2023 Results Key Financial Results Revenue: €1.52b (up 9.7% from FY 2022). Net...