Takeda Pharmaceutical Company Limited (TAK)

NYSE - NYSE Delayed Price. Currency in USD

Add to watchlist

At close: 04:00PM EDT

After hours:

| Previous Close | 13.37 |

| Open | 13.21 |

| Bid | 12.80 x 1400 |

| Ask | 13.25 x 3100 |

| Day's Range | 13.17 - 13.30 |

| 52 Week Range | 12.77 - 16.58 |

| Volume | |

| Avg. Volume | 1,667,975 |

| Market Cap | 41.579B |

| Beta (5Y Monthly) | 0.54 |

| PE Ratio (TTM) | 45.69 |

| EPS (TTM) | N/A |

| Earnings Date | N/A |

| Forward Dividend & Yield | 0.64 (4.77%) |

| Ex-Dividend Date | Sept 28, 2023 |

| 1y Target Est | N/A |

- Investor's Business Daily

Catalyst's New CEO Has Big Ideas For The Small Biotech

Richard Daly has watched Catalyst Pharmaceuticals transform. Now, as the company's new CEO, he has some metamorphic ideas of his own.

- GuruFocus.com

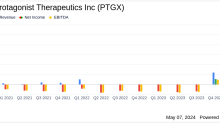

Protagonist Therapeutics Inc (PTGX) Surpasses Q1 Revenue Estimates with Strategic Collaborations

Comprehensive Analysis of Q1 2024 Earnings and Strategic Developments

- Zacks

Down -6.19% in 4 Weeks, Here's Why Takeda Pharmaceutical Co. (TAK) Looks Ripe for a Turnaround

Takeda Pharmaceutical Co. (TAK) is technically in oversold territory now, so the heavy selling pressure might have exhausted. This along with strong agreement among Wall Street analysts in raising earnings estimates could lead to a trend reversal for the stock.