Rio Tinto Group (RIO)

After hours:

| Previous Close | 66.77 |

| Open | 65.37 |

| Bid | 0.00 x 800 |

| Ask | 0.00 x 800 |

| Day's Range | 64.85 - 65.86 |

| 52 Week Range | 58.27 - 75.09 |

| Volume | |

| Avg. Volume | 3,041,312 |

| Market Cap | 109.462B |

| Beta (5Y Monthly) | 0.65 |

| PE Ratio (TTM) | 10.66 |

| EPS (TTM) | N/A |

| Earnings Date | N/A |

| Forward Dividend & Yield | 4.35 (6.62%) |

| Ex-Dividend Date | Mar 07, 2024 |

| 1y Target Est | N/A |

- Bloomberg

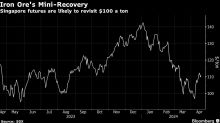

Iron Ore Seen Revisiting $100 as China’s Housing Woes Worsen

(Bloomberg) -- Iron ore is likely to revisit $100 a ton by the end of the year before falling further to $85 in 2025 as China’s housing market collapse worsens, according to Capital Economics Ltd.Most Read from BloombergDubai Grinds to Standstill as Cloud Seeding Worsens FloodingWhat If Fed Rate Hikes Are Actually Sparking US Economic Boom?China Tells Iran Cooperation Will Last After Attack on IsraelPowell Signals Rate-Cut Delay After Run of Inflation SurprisesUS Yields Spike as Hawkish Powell P

- Reuters

Rio Tinto aims to keep Resolution's copper in US, executive says

Rio Tinto aims to keep all of the copper from its Resolution mine inside the United States should the long-delayed and controversial project win regulatory approval, a senior executive said on Tuesday. The Arizona mine would, if developed, over its life produce more than 40 billion pounds (18.1 million metric tons) of copper and supply more than a quarter of U.S. demand, but it is strongly opposed by some Native Americans given concerns the project could destroy a site of religious and cultural import. That has placed Resolution at the center of a simmering debate about where best to secure copper and other critical minerals for the clean energy transition.

- Bloomberg

Rio Tinto Copper Boss Says Building Mines Is Better Than Buying

(Bloomberg) -- Rio Tinto Group’s copper head says he sees much more value in building mines rather than buying existing assets — comments that may disappoint industry observers anticipating another spate of mining dealmaking.Most Read from BloombergDubai Grinds to Standstill as Cloud Seeding Worsens FloodingWhat If Fed Rate Hikes Are Actually Sparking US Economic Boom?China Tells Iran Cooperation Will Last After Attack on IsraelPowell Signals Rate-Cut Delay After Run of Inflation SurprisesUS Yie