Nedbank Group Limited (NDBKF)

| Previous Close | 10.64 |

| Open | 10.64 |

| Bid | N/A x N/A |

| Ask | N/A x N/A |

| Day's Range | 10.64 - 10.64 |

| 52 Week Range | 9.55 - 13.40 |

| Volume | |

| Avg. Volume | 122 |

| Market Cap | 5.287B |

| Beta (5Y Monthly) | 1.09 |

| PE Ratio (TTM) | 6.53 |

| EPS (TTM) | 1.63 |

| Earnings Date | N/A |

| Forward Dividend & Yield | 1.08 (10.19%) |

| Ex-Dividend Date | Apr 10, 2024 |

| 1y Target Est | N/A |

GuruFocus.com

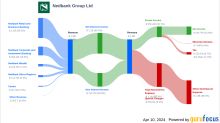

GuruFocus.comNedbank Group Ltd's Dividend Analysis

Nedbank Group Ltd (NDBKY) recently announced a dividend of $0.55 per share, payable on 2024-04-25, with the ex-dividend date set for 2024-04-11. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's delve into Nedbank Group Ltd's dividend performance and assess its sustainability.

Reuters

ReutersS.Africa's Nedbank warns of sticky bad loans, 2025 targets at risk

JOHANNESBURG (Reuters) -South Africa's Nedbank Group, amongst the top five lenders in the country, warned on Tuesday that its bad loans would stay elevated for the rest of the year and it could miss its 2025 financial targets. But its shares were up 2.5% in early trading as profit for the six months ended June 30 jumped 11% and CEO Mike Brown projected a drop in bad loans from the first half. "Someone who has got an entry-level home, an entry-level car, they've now had to absorb the 350 basis points interest rate increases over the last 12 months," Brown said, referring to the segment of people most under pressure.