Hollysys Automation Technologies Ltd. (HOLI)

After hours:

| Previous Close | 23.65 |

| Open | 23.55 |

| Bid | 23.57 x 100 |

| Ask | 23.64 x 200 |

| Day's Range | 23.49 - 23.97 |

| 52 Week Range | 15.13 - 27.26 |

| Volume | |

| Avg. Volume | 446,203 |

| Market Cap | 1.467B |

| Beta (5Y Monthly) | 0.55 |

| PE Ratio (TTM) | 17.63 |

| EPS (TTM) | N/A |

| Earnings Date | N/A |

| Forward Dividend & Yield | N/A (N/A) |

| Ex-Dividend Date | Apr 01, 2022 |

| 1y Target Est | N/A |

- GuruFocus.com

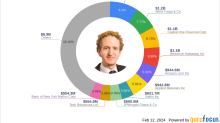

Chris Davis Adjusts Position in Hollysys Automation Technologies Ltd

On December 31, 2023, Davis Advisors, under the leadership of portfolio manager Chris Davis (Trades, Portfolio), made a notable adjustment to its investment in Hollysys Automation Technologies Ltd (NASDAQ:HOLI). Following the trade, Davis Advisors holds a total of 5,248,240 shares in Hollysys, representing an 8.50% ownership stake in the company and accounting for 0.87% of the firm's portfolio. Davis Advisors is a prominent investment management firm overseeing assets worth over $60 billion.

- Reuters

REFILE-UPDATE 1-Hollysys shareholders approve merger with Ascendent Capital affiliates

The U.S. listed Chinese automation control system provider said last year it had agreed that Ascendent Capital, which already owns a 13.7% stake in the company, will acquire the outstanding Hollysys shares at $26.5 each in a deal valued around $1.66 billion. Superior Technologies Mergersub Limited, which is affiliated with Ascendent Capital, will merge into Hollysys, and Hollysys will become a wholly owned unit of Superior Technologies Holding Limited, another Ascendent affiliate, according to a Hollysys statement.

- Reuters

UPDATE 1-Dazheng-led consortium sets out financing for Hollysys bid

A consortium led by China's Dazheng Group Acquisition has set out financing for its $29.50-per-share bid for Hollysys Automation Technologies as it battles a rival offer from Hong Kong-based private equity firm Ascendent Capital. In a statement on Saturday, the Dazheng consortium - which also includes TFI Asset Management - said it had secured a debt commitment letter for $1.5 billion from an unnamed China headquartered bank's Hong Kong branch. It had also secured equity commitments totaling $800 million from Dazheng Group and TFI Asset Management, it said.