Funko, Inc. (FNKO)

NasdaqGS - NasdaqGS Real Time Price. Currency in USD

Add to watchlist

At close: 04:00PM EDT

After hours:

| Previous Close | 6.18 |

| Open | 6.12 |

| Bid | 6.17 x 200 |

| Ask | 6.24 x 200 |

| Day's Range | 5.92 - 6.24 |

| 52 Week Range | 5.27 - 13.42 |

| Volume | |

| Avg. Volume | 486,498 |

| Market Cap | 329.561M |

| Beta (5Y Monthly) | 1.07 |

| PE Ratio (TTM) | N/A |

| EPS (TTM) | N/A |

| Earnings Date | N/A |

| Forward Dividend & Yield | N/A (N/A) |

| Ex-Dividend Date | N/A |

| 1y Target Est | N/A |

- Simply Wall St.

Is Funko, Inc. (NASDAQ:FNKO) Trading At A 50% Discount?

Key Insights The projected fair value for Funko is US$13.70 based on 2 Stage Free Cash Flow to Equity Funko's US$6.86...

- Insider Monkey

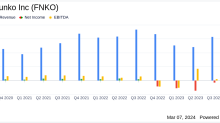

Funko, Inc. (NASDAQ:FNKO) Q4 2023 Earnings Call Transcript

Funko, Inc. (NASDAQ:FNKO) Q4 2023 Earnings Call Transcript March 7, 2024 Funko, Inc. isn’t one of the 30 most popular stocks among hedge funds at the end of the third quarter (see the details here). Operator: Good afternoon and welcome to Funko’s 2023 Fourth Quarter Financial Results Conference Call. At this time, all participants are […]

- GuruFocus.com

Funko Inc (FNKO) Navigates Challenging Year with Strategic Cost Reductions and Operational ...

Funko Inc (FNKO) Reports Q4 and Full-Year 2023 Results, Outlines 2024 Outlook