Enel SpA (ENEL.MI)

| Previous Close | 6.09 |

| Open | 6.11 |

| Bid | 6.07 x 0 |

| Ask | 6.07 x 0 |

| Day's Range | 6.05 - 6.11 |

| 52 Week Range | 5.47 - 6.82 |

| Volume | |

| Avg. Volume | 25,717,022 |

| Market Cap | 61.944B |

| Beta (5Y Monthly) | 0.95 |

| PE Ratio (TTM) | 16.85 |

| EPS (TTM) | 0.36 |

| Earnings Date | May 09, 2024 |

| Forward Dividend & Yield | 0.43 (7.06%) |

| Ex-Dividend Date | Jul 22, 2024 |

| 1y Target Est | 7.50 |

Bloomberg

BloombergEnel Forced to Raise Coupons on $11 Billion of ESG Bonds

(Bloomberg) -- Enel SpA will raise the coupons it pays investors on several so-called sustainability-linked bonds, after the Italian energy company triggered a penalty by missing its greenhouse-gas emissions targets.Most Read from BloombergTaylor Swift Is Proof That How We Critique Music Is BrokenTech Giants Roar as Tesla Spikes in Late Hours: Markets WrapTesla Stock in ‘No Man’s Land’ After 43% Rout Ahead of EarningsBiden’s New Chopper Is Demoted After Scorching White House LawnRay Dalio’s Famo

Insider Monkey

Insider Monkey11 Best Italian Stocks To Invest In 2024

In this piece, we will take a look at the 11 best Italian stocks to invest in 2024. If you want to skip our overview of the Italian economy and all the latest news, then you can take a look at the 5 Best Italian Stocks To Invest In 2024. The global economy, and particularly […]

GuruFocus.com

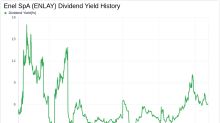

GuruFocus.comEnel SpA's Dividend Analysis

Enel SpA (ENLAY) recently announced a dividend of $0.23 per share, payable on 2024-02-14, with the ex-dividend date set for 2024-01-22. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Enel SpA's dividend performance and assess its sustainability.