AngloGold Ashanti plc (AU)

| Previous Close | 23.71 |

| Open | 23.24 |

| Bid | 0.00 x 800 |

| Ask | 0.00 x 900 |

| Day's Range | 23.19 - 23.81 |

| 52 Week Range | 14.91 - 30.27 |

| Volume | |

| Avg. Volume | 2,277,216 |

| Market Cap | 9.933B |

| Beta (5Y Monthly) | N/A |

| PE Ratio (TTM) | 236.65 |

| EPS (TTM) | 0.10 |

| Earnings Date | Feb 22, 2024 - Mar 01, 2024 |

| Forward Dividend & Yield | 0.38 (1.60%) |

| Ex-Dividend Date | Mar 14, 2024 |

| 1y Target Est | 22.50 |

GlobeNewswire

GlobeNewswireG2 Goldfields Provides Exploration Update

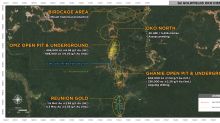

TORONTO, April 15, 2024 (GLOBE NEWSWIRE) -- G2 Goldfields Inc. (“G2” or the “Company”) (TSX: GTWO; OTCQX: GUYGF) is pleased to provide an update on the ongoing exploration program at the Company’s 27,719 acre OKO-AREMU gold project. G2 recently announced an updated Mineral Resource Estimate (“MRE”) for the OKO-Aremu Project comprised of 922,000 ounces of gold (“Indicated”) and 1,099,000 ounces of gold (“Inferred”) [see press release dated April 03, 2024]. The entirety of the reported gold resour

Business Wire

Business WireAngloGold Ashanti: Notice of 2024 Annual General Meeting

LONDON & DENVER & JOHANNESBURG, April 15, 2024--Today, AngloGold Ashanti plc ("the Company", "AGA" or "AngloGold Ashanti") posted its Notice of 2024 Annual General Meeting (the "Notice"), which can be viewed and downloaded from www.reports.anglogoldashanti.com. The Company’s 2024 Annual General Meeting (the "AGM") is scheduled to be held on Tuesday 28 May 2024 at 9:00 a.m. Mountain Standard Time (which is 4:00 p.m. British Summer Time and 5:00 p.m. South African Standard Time) at 6363 S Fiddlers

Business Wire

Business WireAngloGold Ashanti Publishes Its 2023 UK Annual and Other Reports

LONDON & DENVER & JOHANNESBURG, April 10, 2024--AngloGold Ashanti plc ("AngloGold Ashanti", "AGA" or the "Company") announces that it has today, Wednesday, 10 April 2024, published the following reports for the financial year ended 31 December 2023: