Allianz SE (ALIZF)

| Previous Close | 277.50 |

| Open | 277.25 |

| Bid | 0.00 x 0 |

| Ask | 0.00 x 0 |

| Day's Range | 277.50 - 277.50 |

| 52 Week Range | 211.45 - 302.50 |

| Volume | |

| Avg. Volume | 306 |

| Market Cap | 109.422B |

| Beta (5Y Monthly) | 1.09 |

| PE Ratio (TTM) | 12.33 |

| EPS (TTM) | 22.51 |

| Earnings Date | N/A |

| Forward Dividend & Yield | 15.01 (5.41%) |

| Ex-Dividend Date | May 09, 2024 |

| 1y Target Est | N/A |

Simply Wall St.

Simply Wall St.Is Allianz SE's (ETR:ALV) Recent Stock Performance Influenced By Its Financials In Any Way?

Allianz's (ETR:ALV) stock up by 6.0% over the past three months. Given that stock prices are usually aligned with a...

Bloomberg

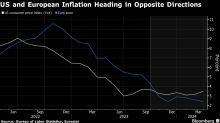

BloombergIt’s Time for the ECB to Diverge From Fed, Stournaras Says

(Bloomberg) -- The European Central Bank shouldn’t be afraid to shift its “overly prudent” stance on interest rates away from that of the Federal Reserve, according to Governing Council member Yannis Stournaras.Most Read from BloombergIsrael Bracing for Unprecedented Direct Iran Attack in DaysApple Plans to Overhaul Entire Mac Line With AI-Focused M4 ChipsRussian Attacks on Ukraine Stoke Fears Army Near Breaking PointUS Sees Imminent Missile Strike on Israel by Iran, ProxiesVietnam Tycoon Lan Se

Bloomberg

BloombergToo Many ECB Cuts Risk Spooking Markets, Allianz Chief Economist Says

(Bloomberg) -- The European Central Bank risks a backlash from investors if its interest-rate policy strays too far from that of its US counterpart, according to Allianz Chief Economist Ludovic Subran.Most Read from BloombergUS Sees Imminent Missile Strike on Israel by Iran, ProxiesVietnam Tycoon Lan Sentenced to Death Over $12 Billion FraudUS Slams Strikes on Russia Oil Refineries as Risk to Oil MarketsRussia Destroys Largest Power Plant in Ukraine’s Kyiv RegionChinese Cement Maker Halted After