Day Return

YTD Return

1-Year Return

3-Year Return

5-Year Return

Note: Industry performance is calculated based on the previous closing price of all industry constituents

Largest Companies in This Industry

Name | Last Price | 1Y Target Est. | Market Weight | Market Cap | Day Change % | YTD Return | Avg. Analyst Rating |

|---|---|---|---|---|---|---|---|

| 18.84 | 22.97 | 34.10% | Buy | ||||

| 105.56 | 131.25 | 16.04% | Buy | ||||

| 14.85 | 17.86 | 9.13% | Buy | ||||

| 10.96 | 14.25 | 8.69% | Buy | ||||

| 15.97 | 19.90 | 8.53% | Buy | ||||

| 10.23 | 10.95 | 5.29% | Hold | ||||

| 8.85 | 10.19 | 4.76% | Buy | ||||

| 14.34 | 15.83 | 4.38% | Hold | ||||

| 13.94 | 15.93 | 3.74% | Buy | ||||

| 6.00 | 7.58 | 2.52% | Hold |

Investing in the REIT - Hotel & Motel Industry

Start Investing in REIT - Hotel & Motel Through These Companies

Top Performing Companies

Name | Last Price | 1Y Target Est. | YTD Return |

|---|---|---|---|

| 15.97 | 19.90 | ||

| 13.94 | 15.93 | ||

| 18.84 | 22.97 | ||

| 105.56 | 131.25 | ||

| 10.23 | 10.95 |

High Growth Companies

Name | Last Price | Growth Estimate | YTD Return |

|---|---|---|---|

| 6.00 | |||

| 13.94 | |||

| 15.97 | |||

| 8.85 | |||

| 14.85 |

REIT - Hotel & Motel Research

Discover the Latest Analyst and Technical Research for This Industry

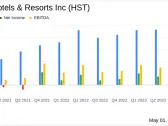

Analyst Report: Park Hotels & Resorts Inc.

Park Hotels & Resorts owns upper-upscale and luxury hotels with 23,428 rooms across 39 hotels in the United States. Park also has interests through joint ventures in another 2,665 rooms in four U.S. hotels. Park was spun out of narrow-moat Hilton Worldwide Holdings at the start of 2017, so most of the company's hotels are still under Hilton brands. The company has sold all its international hotels and many of its lower-quality U.S. hotels to focus on high-quality assets in domestic gateway markets.

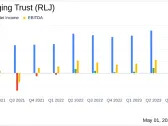

RatingPrice TargetAnalyst Report: Pebblebrook Hotel Trust

Pebblebrook Hotel Trust currently owns upper-upscale and luxury hotels with 11,924 rooms across 46 hotels in the United States. Pebblebrook acquired LaSalle Hotel Properties, which owned 10,451 rooms across 41 US hotels, in December 2018, though management has sold many of those hotels over the past few years. Pebblebrook's portfolio consists mostly of independent hotels with no brand affiliations, though the combined company does own and operate some hotels under Marriott, Starwood, InterContinental, Hilton, and Hyatt brands.

RatingPrice TargetDRH: What does Argus have to say about DRH?

DIAMONDROCK HOSPITALITY CO has an Investment Rating of BUY; a target price of $10.000000; an Industry Subrating of Low; a Management Subrating of High; a Safety Subrating of Medium; a Financial Strength Subrating of Medium; a Growth Subrating of Medium; and a Value Subrating of High.

RatingPrice TargetINN: What does Argus have to say about INN?

SUMMIT HOTEL PROPERTIES INC has an Investment Rating of HOLD; a target price of $7.000000; an Industry Subrating of Low; a Management Subrating of High; a Safety Subrating of Medium; a Financial Strength Subrating of Medium; a Growth Subrating of Medium; and a Value Subrating of Medium.

RatingPrice Target